Income Investing: Staples & IT – How Dividend Investing May Halt the Speculative Quest for Quick Gains

Introduction: This paper builds on our recent work highlighting that many of the market’s highest quality firms are trading at discounts to the broad market. The exhibits that follow ...

High Quality and Income Stocks at Low Prices

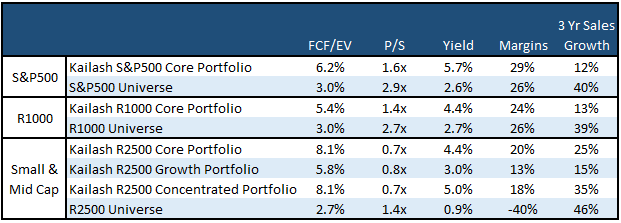

High Quality & Income at Low Prices: Index mania has sent money into ever larger and more expensive companies The slides below show that our S&P 500, Russell 1000 and Russell 2500 model portfolios all now trade at half ...

Safety & Income Investing vs. Index Investing

As documented in our recent research on high quality midcap investing, growth investing and value investing firms , the mania for index investing has left many of the market’s highest quality and most profitable firms trading at discounts to ...

Value Investing Jobs: Easy to Say, Not Easy to Do

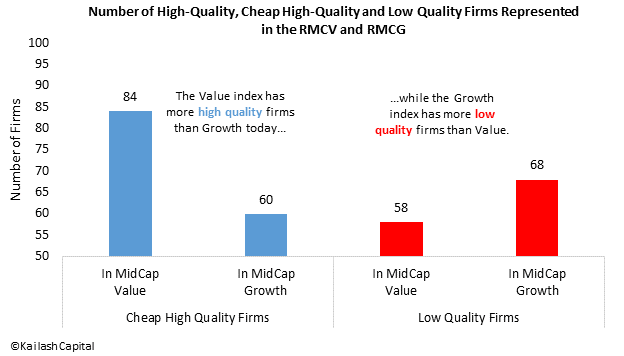

Based on research from our last paper, the chart below shows there is abundant quality available at reasonable prices – a scenario reminiscent of the internet bubble: The first two bars in the chart below show there are many ...

Is This Where You Want to be Investing Today?

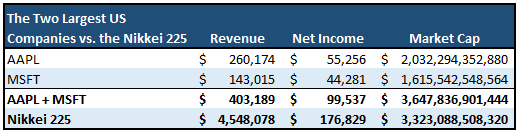

Apple, Amazon, Microsoft, Facebook & Google: Did you know that these FIVE companies are over 20% of the SP500 Index? Did you realize that the stock prices of these firms have risen much faster than sales growth? As their ...

High-Quality Midcap Value: The Case for Common Sense

Introduction: This paper makes the case that today is as compelling a time to buy the highest quality Midcap firms trading at below-market prices as it was at the peak ...

Index Funds the Most Crowded Trade?

In our last paper “The Collision of Arithmetic & Over-Optimism", Kailash presented a compelling chart demonstrating that investor obsession with the 25 largest growth firms had driven them to record valuations. The chart below shows that the odds of ...

The Collision of Arithmetic & Over-Optimism – Why Today’s Larger Cap Growth is More Precarious than the Nifty Fifty

Introduction: This paper seeks to discredit the “quality & growth at any price” thesis underpinning many of the market’s leading growth firms. Kailash intends to review and provide evidence ...

IPO Stocks are the New Staples – History & Current Data Suggest that is as Silly as it Sounds

Introduction: Price Action Does Not Always Reflect Value Financial Pornography: 1999 & Today Conclusions & Exhibits Introduction: Price Action Does Not Always Reflect Value A recent Barron’s article cited ...

Is It Any Wonder Berkshire is Shopping in Japan?

In our September 4th paper, IPO Stocks are the New Staples – History and Current Data Suggest that is as Silly as it Sounds, we submit historical evidence that Tesla’s $400bn market cap, despite having just 1.4% US market ...

Growth Stock Mania and the Risk of Timing Markets

The Hazards of being In the Grip of a Growth Mania The Resurrection of Value Post a Period of Manic Growth Conclusion & Exhibit The Hazards of being In ...

This Time is Different – The Death of Valuation

Introduction: An Old Story The Rich (expensive growth) Get Richer…and Poorer Conclusions & Exhibit Introduction: An Old Story A recent article from Bloomberg counted a leading quant from one ...