Trading Strategies to Preserve & Grow Wealth

Drawdowns: “If you buy things you don’t need, you will soon sell things you need.” -Buffett Our first newsletter of 2021 suggested it might be a great time to ...

Is Warren Buffett’s Berkshire Hathaway Energy an Example of ESG Excellence?

These are days of high-hopes and higher stock prices. As documented in two of our recent Charts For The Curious (“CFTC”), history suggests a very dim view on the ...

Sun Microsystems, The Greatest Quote & The Rise of the Reckless

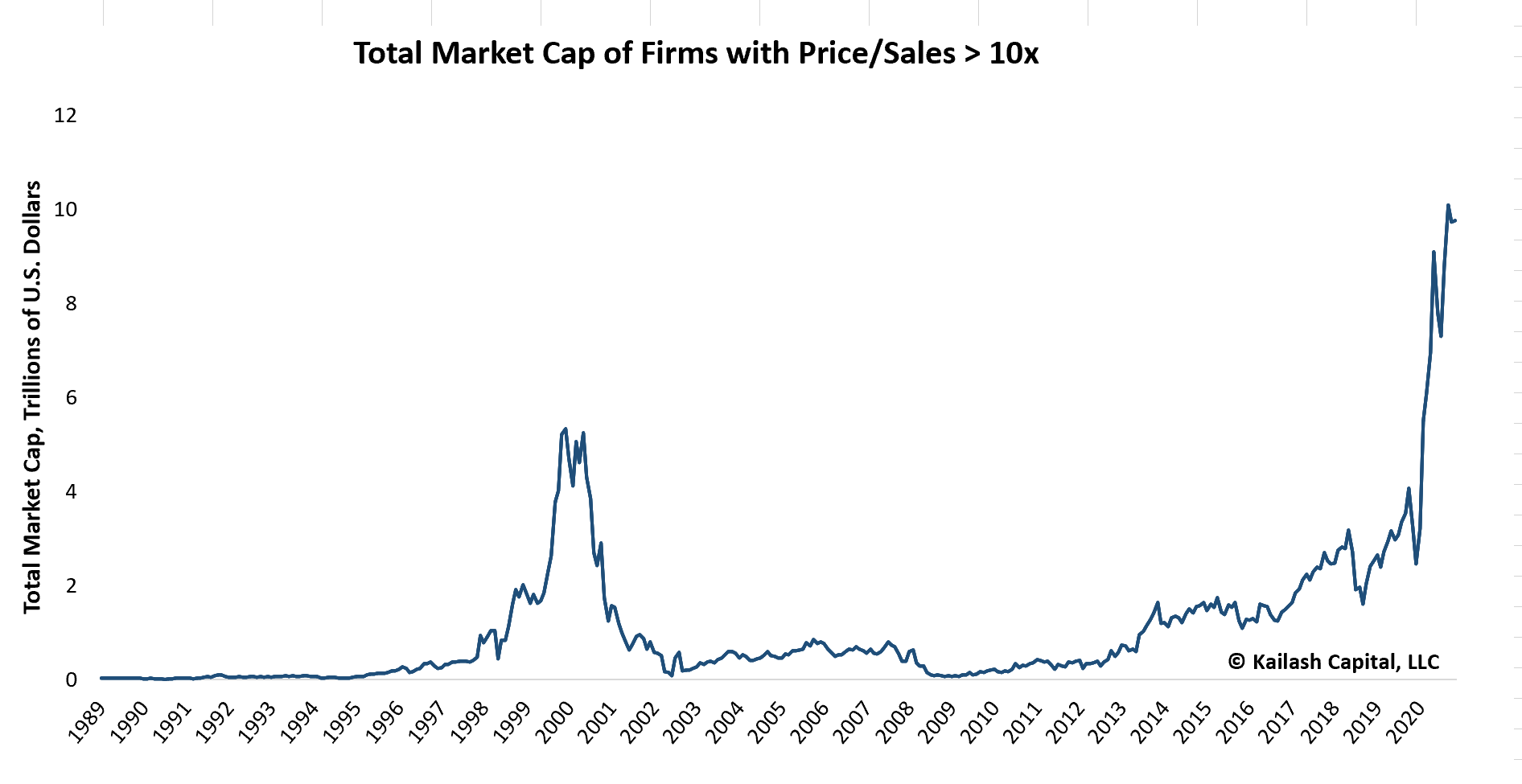

Sun Microsystems Inc: A Lifetime Lesson in Valuation Market cap of firms trading > 10x price to sales is now +$10 trillion Investors who paid 10x P/S to buy ...

How to Learn About Investing in Stocks: Rule #1

KCR believes bear market strategies today suggest a speculative mania similar to the internet bubble. “Rule #1: Never Lose Money, Rule #2: Never Forget Rule ...

Fast Growing Stocks & Profiting from Patience: Bullish America, Bullish Berkshire & Bearish the Index

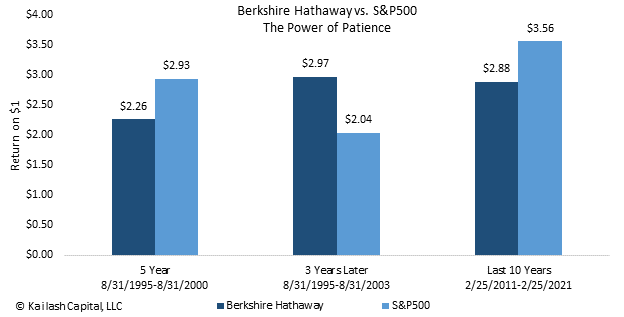

Similar to the peak of 2000, people are wondering if Buffett & Munger have lost their touch? As documented by CNBC, Berkshire has underperformed the S&P 500 Index by ...

Buy or Sell Tesla Stock? A Quick Answer to a Behavioral Question

Should You Sell Tesla Stock & The High Cost of “Anchoring” Anchoring, or the act of placing too much emphasis on an arbitrary number is a well understood human ...

Warren Buffett’s Market Cap to GDP

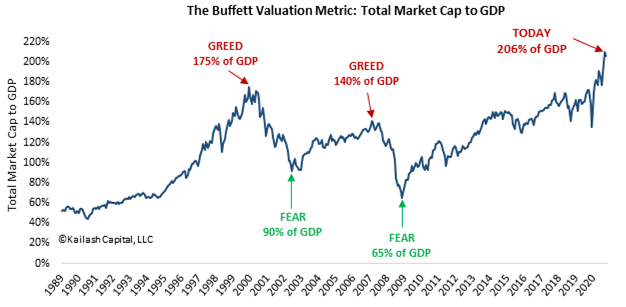

"Be FEARFUL when others are GREEDY" –Warren Buffett: The chart below is Buffett’s favorite broad market valuation tool – Market Cap/GDP – a Kailash topic discussed here When stocks ...

Negative Cash Flow & The Problem with Paying High Prices for Systematic Dilution

Broken Business Models Our recent paper on Small Caps, The Low Price of High Quality, identified the market’s highest quality firms trading at reasonable valuations That work also documented ...

The Low Cost of High Quality: Russell 2000

Introduction: This paper employs similar analytical structures to those used in our...

An Investment Strategy for High Quality Firms

If you are saving for retirement, have some investment goals and are looking to buy stocks we believe this chart is for you. Our last two newsletters documented the ...

What Is Value Investing?

A Primer for Novices: A Prelude to Our Series on the Best Value Investing BooksInefficient Markets: The Largest Market Cap Companies Can Often be MispricedThis paper will explain some of ...

What You Need Has Never Been Cheaper vs. What You Want

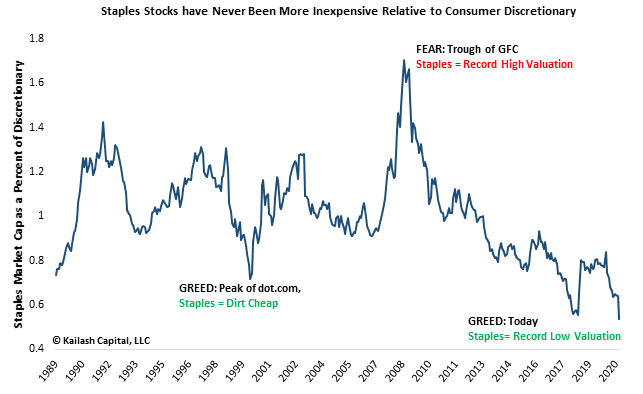

What You Need Has Never Been Cheaper vs. What You Want: The chart below shows the ratio of Consumer Staples to Consumer Discretionary stocks is now LOWER than at ...