What Is Value Investing?

A Primer for Novices: A Prelude to Our Series on the Best Value Investing BooksInefficient Markets: The Largest Market Cap Companies Can Often be MispricedThis paper will explain some of ...

What You Need Has Never Been Cheaper vs. What You Want

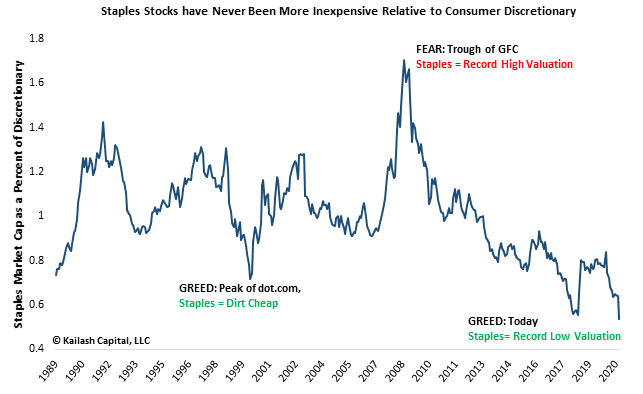

What You Need Has Never Been Cheaper vs. What You Want: The chart below shows the ratio of Consumer Staples to Consumer Discretionary stocks is now LOWER than at ...

The Case for Buying What You Know and Need – Staples and the Power of the Prosaic

Introduction: This paper adds to our recent research making the case that today is one of the most compelling times in history to adopt a simple dividend and income ...

Investing in Staples Made Simple

The Supremacy of Staples: A Triumph of the Mundane: The market is awash in stories about the wonders of day trading (h/t Ramp Capital tweet) egging the inexperienced to ...

Multiple Expansion and Stock Performance: A Tale of Two Markets

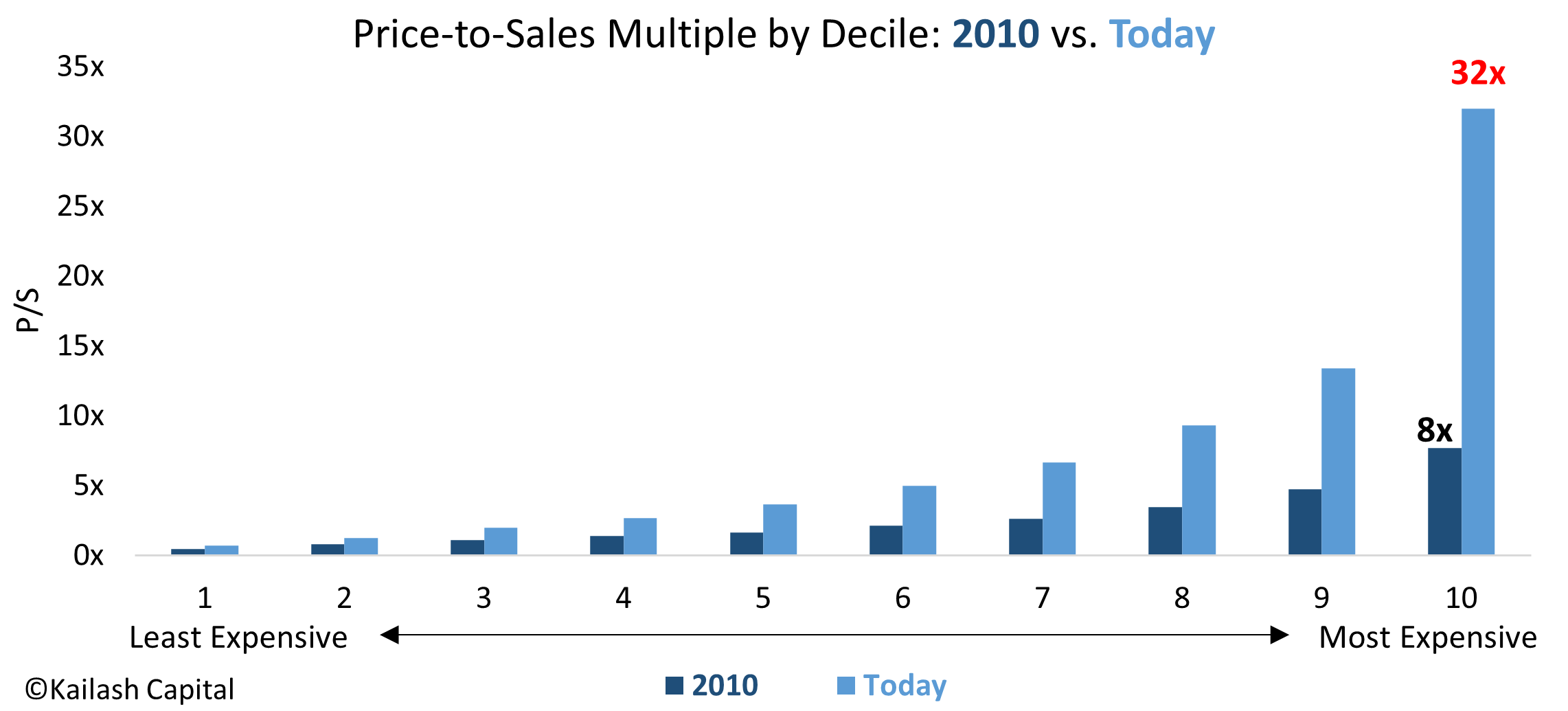

Multiple Expansion: A Tale of Two Markets The NAVY BLUE BARS show the price-to-sales ratio of stocks in 2010 by decile, from least to most expensive The LIGHT BLUE ...

Performance of Loss Making Stocks

Losing Money is No Way to Make Money: In our recent papers on quality investing and income investing, Kailash is pounding the table advocating investors avoid the IPO/Tech mania ...

Income Investing: Staples & IT – How Dividend Investing May Halt the Speculative Quest for Quick Gains

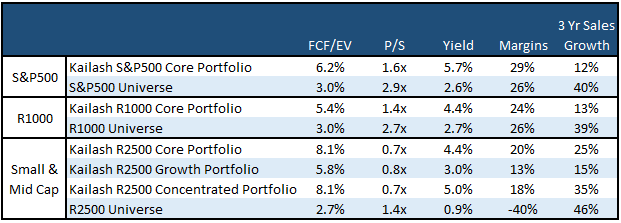

Introduction: This paper builds on our recent work highlighting that many of the market’s highest quality firms are trading at discounts to the broad market. The exhibits that follow ...

High Quality and Income Stocks at Low Prices

High Quality & Income at Low Prices: Index mania has sent money into ever larger and more expensive companies The slides below show that our S&P 500, Russell 1000 ...

Safety & Income Investing vs. Index Investing

As documented in our recent research on high quality midcap investing, growth investing and value investing firms , the mania for index investing has left many of the market’s ...

Value Investing Jobs: Easy to Say, Not Easy to Do

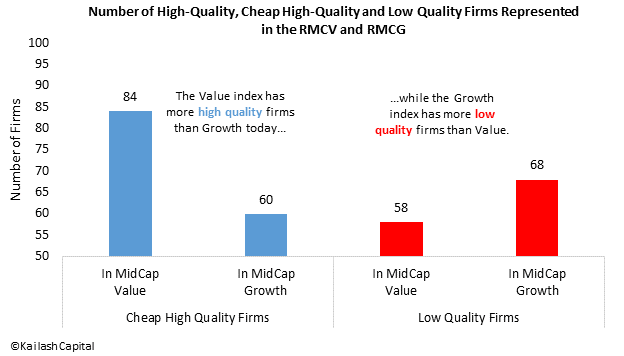

Based on research from our last paper, the chart below shows there is abundant quality available at reasonable prices – a scenario reminiscent of the internet bubble: The first ...

Is This Where You Want to be Investing Today?

Apple, Amazon, Microsoft, Facebook & Google: Did you know that these FIVE companies are over 20% of the SP500 Index? Did you realize that the stock prices of these ...

High-Quality Midcap Value: The Case for Common Sense

Introduction: This paper makes the case that today is as compelling a time to buy the highest quality Midcap firms trading at below-market prices as it was at the peak ...