The Riskiest Stocks Right Now?

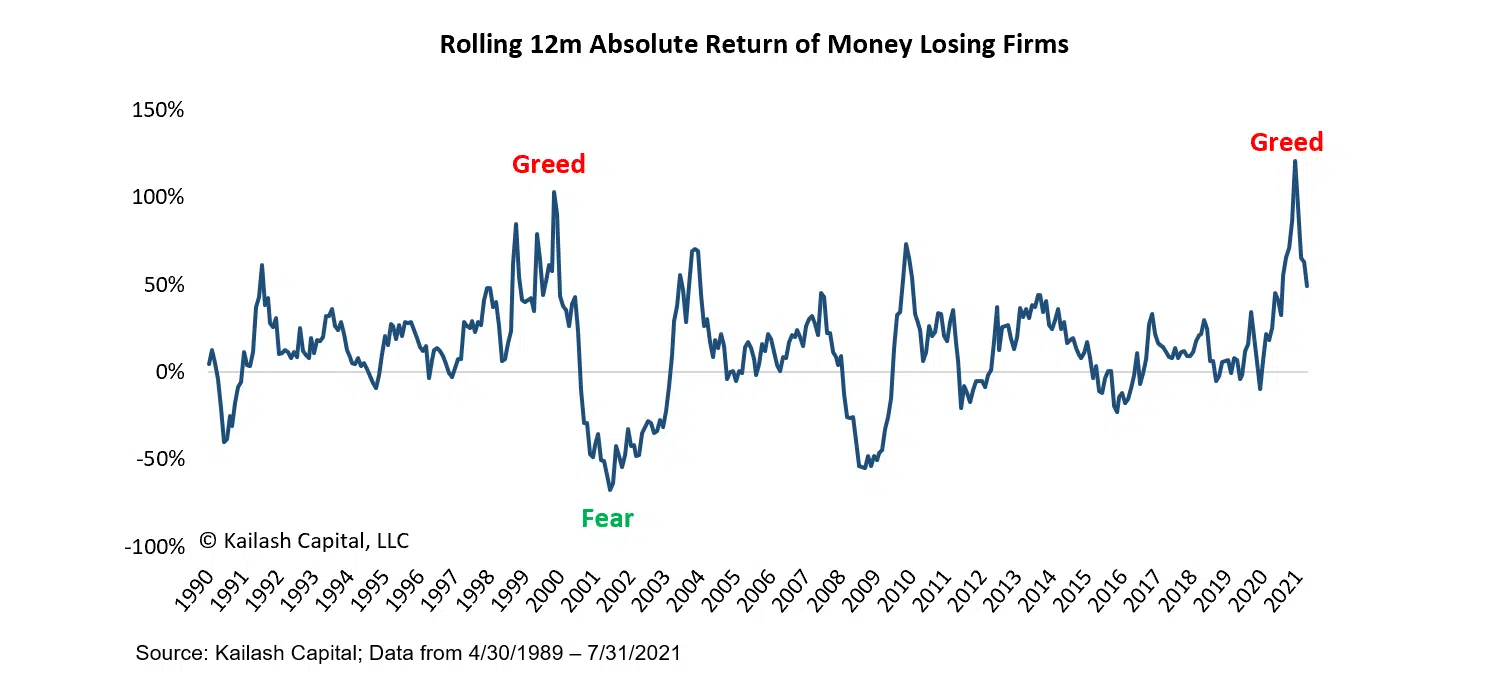

- The chart below shows that money-losing firms recently generated a 120% return

- When people double their money buying risky stocks, it is just another sign of the euphoria documented by legends like Galbraith, whose work we review here

- A post by consultant Marquette Associates discussed the impact of peak earnings on the stock market

- They suggest that active managers that have struggled to keep up with a “sentiment-driven” market could benefit from company-specific fundamentals starting to drive returns

- Our empirical research highlights possible stocks to buy for long term investors in reasonably priced firms with healthy businesses and strong balance sheets

Get our insights direct to your inbox: SUBSCRIBE

Looking at the chart below, KCR agrees with the esteemed consultant: while the returns to novel loss-making stocks are still elevated, they do indeed appear to be rolling over.

Considering the trillions of market cap sitting in loss-makers we highlighted in our chart here, the implications could be dire for speculators. As Wall Street has replaced the concept of “growth stocks” with firms sporting high revenue growth in the absence of profits, investors have become infatuated with the world of high-risk high-reward stocks. We believe there has been too much emphasis on the possibility for “high rewards” without much attention to the “high risks” being taken.

Risky Stocks to Invest In – The Case for Caution

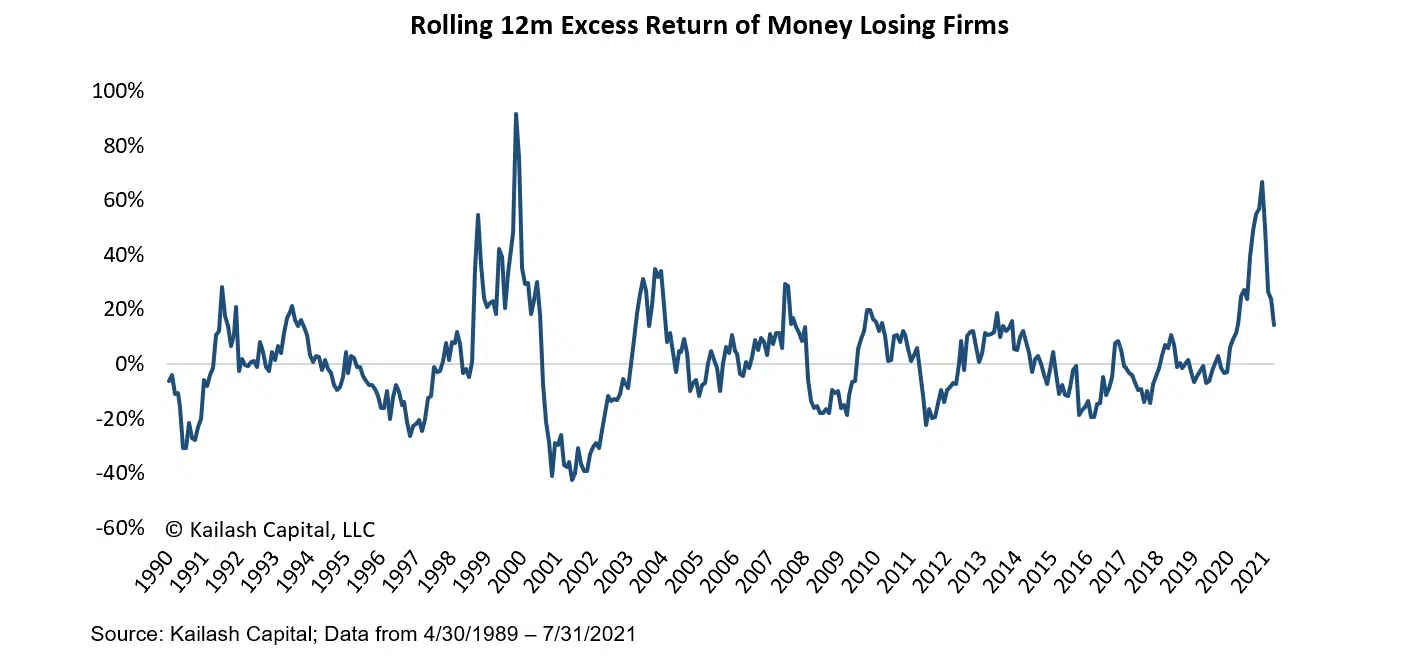

The chart below is similar to the one above. The difference is the chart below shows the relative returns of the loss-making firms. So the 12 month return of the loss-makers minus the 12 month return of the S&P 500 index.

The effect is the same. The extraordinary absolute returns generated by the loss-makers have been equally unusual on a relative basis. Looking at the volatility of these lines we would emphasize that the entry points for these risky stock picks looks particularly unappealing to us based on history.

Believers that history informs the future, the message strikes us as abundantly clear: this will end badly for these firms, in our view. The chart below is the same as the first chart in the missive. The only difference is we have added the losses incurred by investors who bought into the pool of loss-making firms at the prior peak in 2000.

An investment at the peak of the dot.com bubble led to an 80% loss of investor capital in just over a year. We have picked up the habit of noting the agonizing implications of geometric returns.

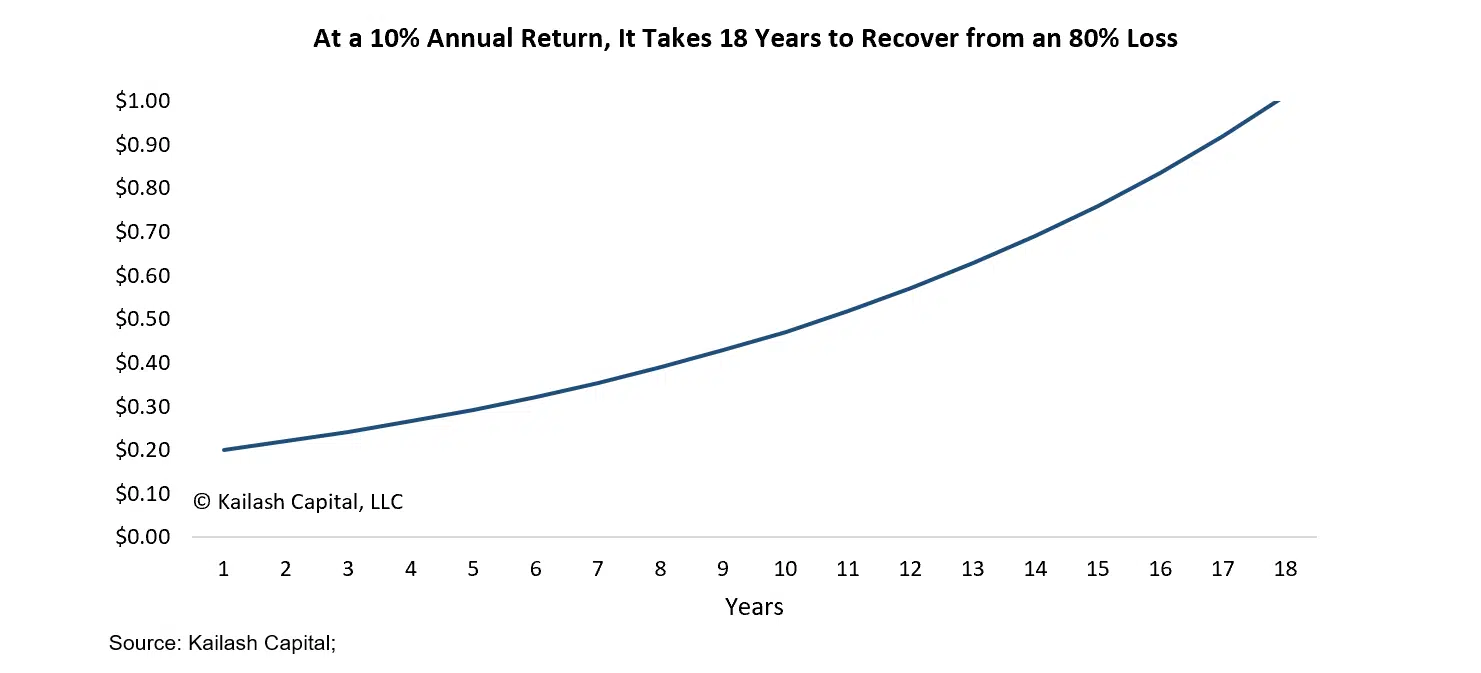

We do not mean to be pedantic. We believe many investors have forgotten the true nature of risk. In this case, our team offers the gentle reminder that no matter how novel and exciting the stock, if it is exorbitantly priced and makes no money it could be a great way to end up owning a penny stock! If the future were to follow the dot.com precedent, $1 invested in these types of stocks would turn into ~$0.20.

Getting back to $1 from $0.20 requires a 400% return. As the chart below shows, at a 10% annual return, with no interruptions or drawdowns, it takes 18 years to breakeven on $1.[1]

Please click on the button below to see the full list of money losers. We have ranked the stocks from worst to best according to our proprietary US S&P 500 Universe ranking model. The closer a stock is to the top of that list the more caution we urge on investors and speculators.

Year to date, we feel the market has been engaged in a bit of a tug-of-war. Many analysts seem comfortable setting price targets based on Price-to-Imaginary Sales five and even ten years from now discounted back at low rates. We feel positions in the securities being recommended may generate serious losses. Like our piece on Seth Klarman’s legendary Margin of Safety book, this post and many others like it are, at their most basic, an attempt to inspire prudence in some.

KCR does not make forecasts. Instead, we use a robust empirical analysis of history to inform our readers of the odds based on current prices and historical data. In our view this is a market with myriad opportunities for those willing to swim against the herd and hew to the lessons of history.

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “Kailash Capital Research, LLC ”) shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of Kailash Capital Research, LLC . In preparing the information, data, analyses, and opinions presented herein, Kailash Capital Research, LLC has obtained data, statistics, and information from sources it believes to be reliable. Kailash Capital Research, LLC , however, does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. Kailash Capital Research, LLC and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction. © 2021 Kailash Capital Research, LLC – All rights reserved.

Nothing herein shall limit or restrict the right of affiliates of Kailash Capital Research, LLC to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of Kailash Capital Research, LLC from buying, selling or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of Kailash Capital Research, LLC may at any time have, acquire, increase, decrease or dispose of the securities or other investments referenced in this publication. Kailash Capital Research, LLC shall have no obligation to recommend securities or investments in this publication as result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

August 6, 2021 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

August 6, 2021

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin