The Cardinal Sin of Artificial Intelligence & Finance

We recently wrote a bullish piece on Cardinal Health (CAH). The work caught the attention of an investing legend who founded and ran one of the most successful money managers we know. His view? Cardinal Health was a low-quality company and deserved to be cheap. KCR takes the “other side” of investors like him with great caution.

Nvidia: A Quick Example of Excessive Extrapolation

Last week we wrote a piece citing work done by some of the greats in behavioral finance – Benartzi, Tversky and Kahneman. Our work suggested that the recent wall of stock-based compensation could create unprecedented risk for employees. Millions of individuals often refuse to diversify their stock comp due to well-understood behavioral errors. Most recently,

Excessive Extrapolation & Stock Based Compensation

The researchers and portfolio managers who write KCR’s newsletter do their best to follow the data. We use sophisticated analytical tools to identify areas where we see significant market inefficiencies. Yet history does not repeat; it rhymes, which means we get things wrong. We write about that, too. Most recently,

KCR Micro Model Explained

In our last missive, A Penchant for Pain, we highlighted that our Microcap Model Portfolio was lagging the Russell 2000 – one of its two principal benchmarks. We went on to note that some of our most timely highlights have been when we draw our readers’ attention to our worst performing products. Evidence based and systematic, we have been fortunate to see every period of pain followed, eventually, by outsized prosperity.

KCR’s Top Charts of 2023 Updated

Every year since the launch of our website, we have posted a piece reviewing KCR’s work from the prior year. Today’s post continues that tradition. We would like to thank our rapidly growing list of readers for their support, engagement, and thoughtful kindness. KCR has updated all the charts below through December 31, 2023.

Monopoly Money: Big Business, Barbie & the Benefits of Diversification

“Small, independent, decentralized business of the kind that built up our country, of the kind that made our country great, first, is fast disappearing, and second, is being made dependent upon monster concentration.” “I think that we are approaching a point where

The Solvency Debate Continues: A Quick Tour of the Financially Fragile

In August of 2021, we published Junk Stocks Funded by Junk Bonds, which noted that high-yield spreads had hit record lows. Our view was that record low-spreads on record-low nominal yields were a recipe for ruin. Using the Fed’s definition of financial fragility, we highlighted a group of equities that scored poorly on the Fed’s durability test and ranked poorly in our models.

How to Value Tech Companies Everyone Loves?

“Disturbing research warns AI may be the ‘Great Filter’ that wipes out human civilization” -The Independent “…artificial general intelligence or AGI is AI’s ‘big brass ring’ and will become a trillion-dollar industry by the 2030s…it will also do good in the world.” -Business Insider “What is certain is that creating [artificial general intelligence] AGI is the explicit aim of the leading AI companies, and they are moving towards it far more swiftly than anyone expected...

Rank Speculation Returns: A Crisis of Concentration

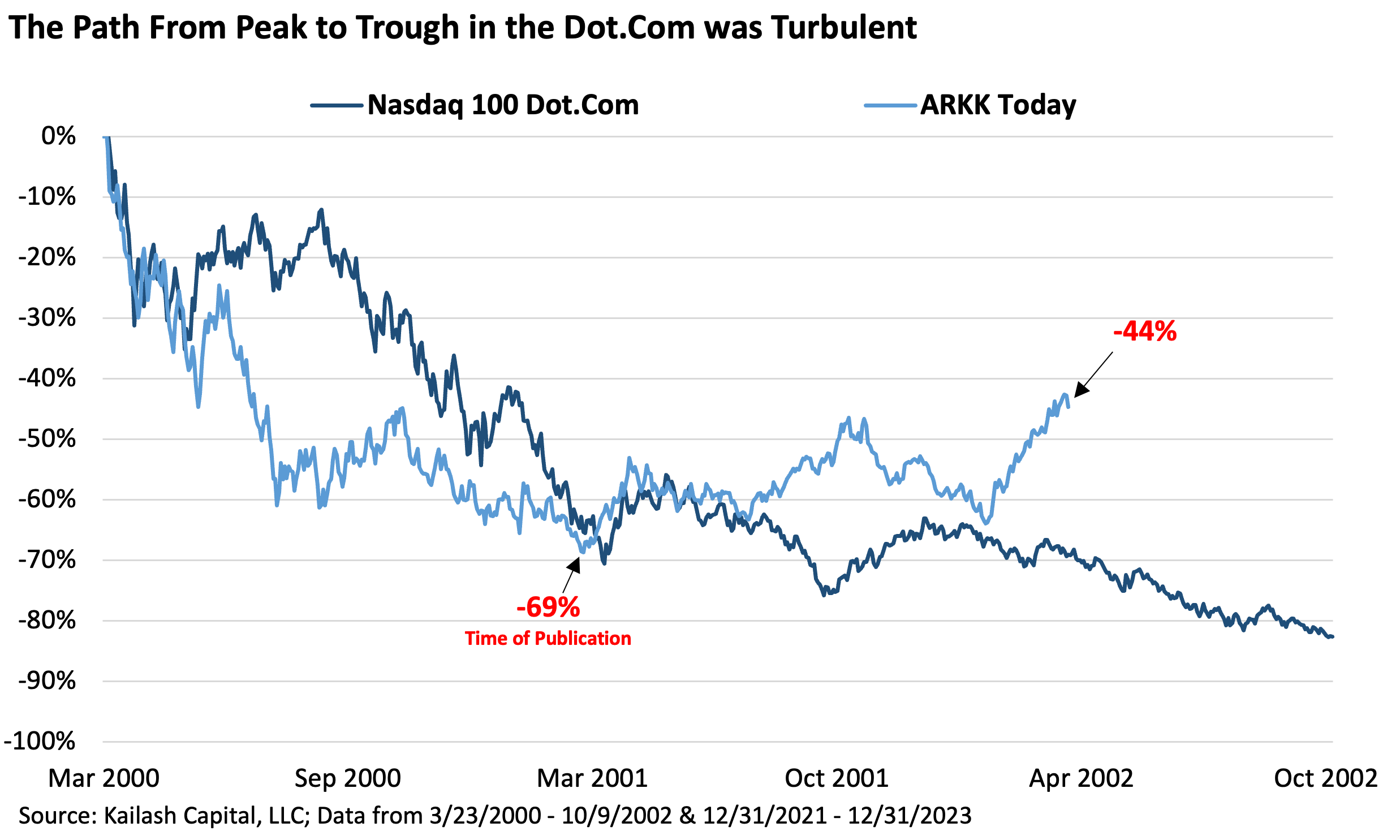

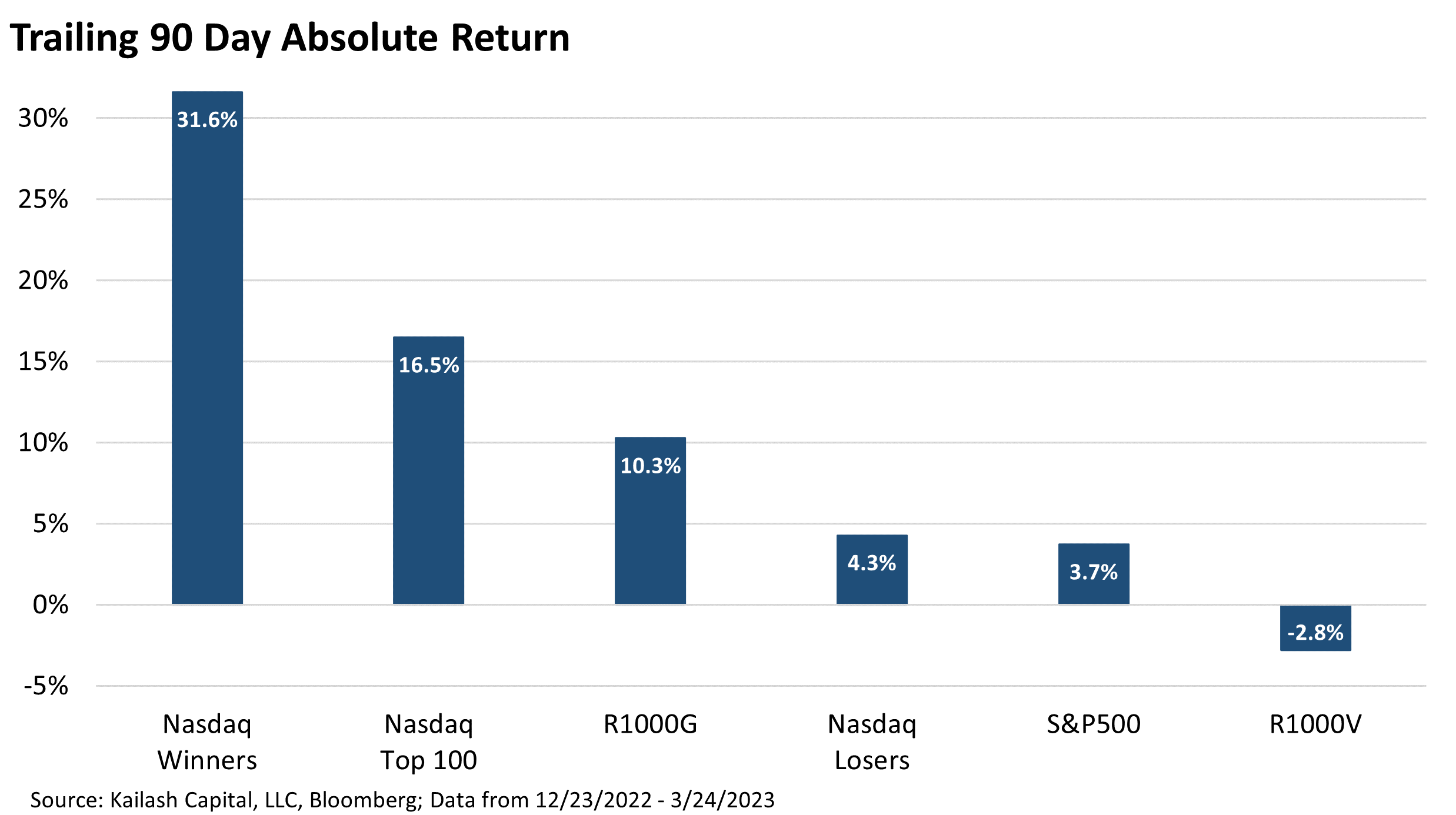

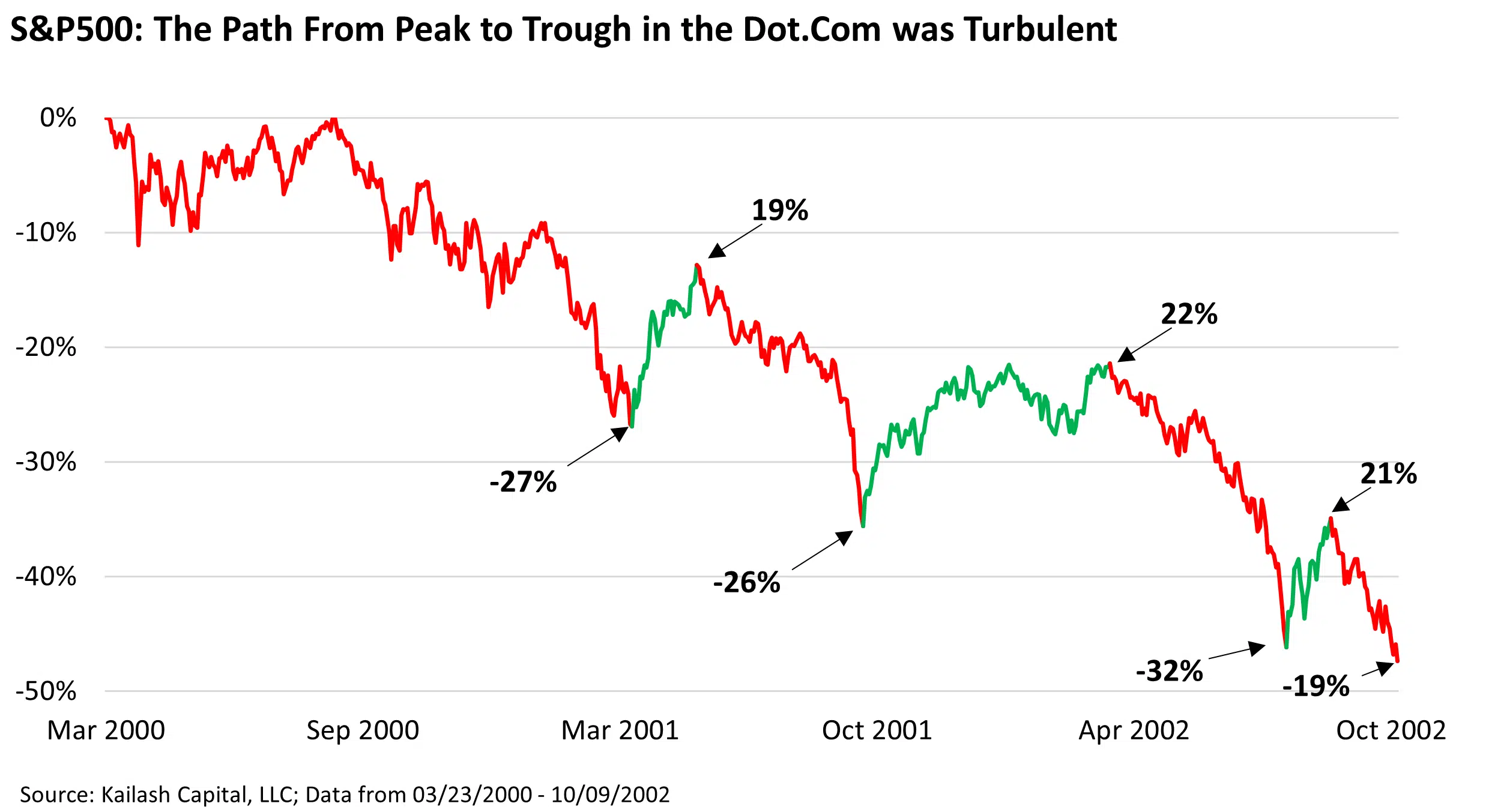

At the start of the year, KCR penned ARKK vs. QQQ in the Dot.Com Bust and Specious vs. Spurious Correlation. The point of both papers was to warn readers that after speculative peaks, stock prices drop swiftly but then rally violently. Post-bubble price patterns were impossible to predict but precise in their message: speculative counter-rallies among the “fallen generals” of speculative cycles were the rule, not the exception...

Common Stocks and Uncommon Profits

In 1958 Philip A. Fisher published Common Stocks and Uncommon Profits in the hope of giving investors a systematic process to follow when seeking out great companies. Widely respected and admired, the book creates a process for an investing philosophy focused on growth. Our team shares some variant of Buffett’s quip that Berkshire Hathaway is “85% Graham and 15% Fisher.” 85% of Buffett’s investment process comes from...

Specious vs Spurious Correlation

Spurious vs. Specious: The Merriam-Webster dictionary tells us that despite both terms featuring deceptive or deceitful in their respective definitions, there is a surprising difference between “specious” and “spurious.” Spurious, of “spurious correlation” fame, is explained as outwardly similar or corresponding to something without having genuine qualities. Specious adds an element of appeal or allure.

ARKK vs. QQQ in the Dot.Com Bust

2020 was a brutal year for KCR. US bonds rose to offensive levels, offering investors a 0.50% yield, while equities soared to valuations above the dot.com peak. Our evidence-based investment process is driven by historical data, algebra, and common sense. By the end of 2020, there was nothing less common than common sense. Basic math's were tossed out the window and replaced by empirically impossible narratives spouted by promotional fund managers and...