Diversifying with Dividends: Are Investors Ignoring a Free Lunch?

“One of our clients is a married couple with about $5 million in liquid assets. They are both 80 years old. 90% of their money is in equities. Most in US large cap index funds and then they own large single positions in Nvidia, Eli Lilly, and Tesla. The husband wants to be 100% in these things. The wife wants it all in CDs. Trying to walk them back from so much risk would seem easy but

The Great Growth Run & a Peek at Forsaken Dividend Stocks

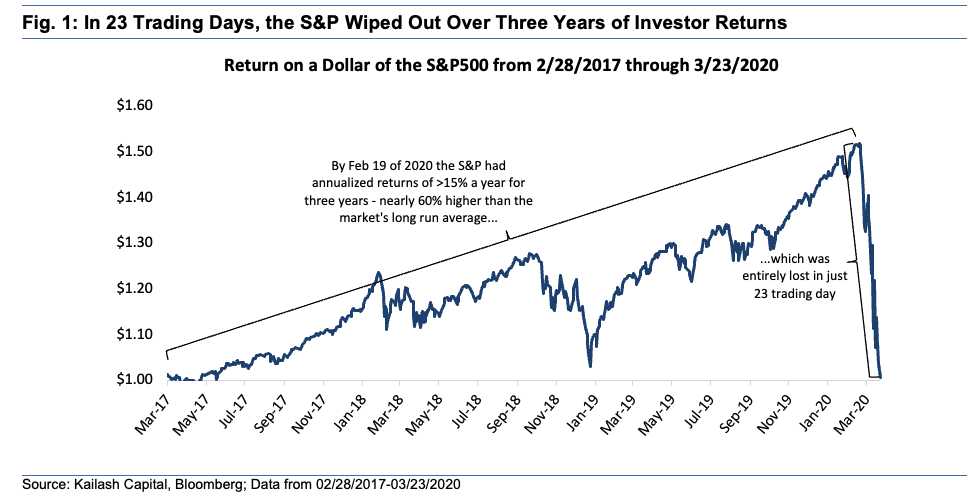

Researchers in behavioral finance have documented the following three items: • Human beings have a nasty habit of extrapolating trends • Even worse, the longer a trend has been going on, the more likely we are to extrapolate it…. • …. which is terrible because the longer a trend has gone on, the more likely it is to revert!

Everything AI: An Update on Machine Learning & Multiple Expansion

In our June piece External Obsolescence: Tech Investors’ Newest Nightmare, we explained how the consensus view on AI stocks might simply be misplaced confidence that had sent multiples soaring. We highlighted that investors had anointed Microsoft, Apple, Google, Nvidia, and Amazon as the “sure-fire” winners of all things AI.

The Anxiety Opportunity from FOMO Sufferers

FOMO includes both the perception of missing out, which triggers anxiety, and compulsive behaviors … it is closely related to the fear of social exclusion or ostracism, which existed long before social media. -Natalie Christine Dattilo, Ph.D, Harvard Medical School, 2023 Recall that the second line of defense of the efficient markets theory is that the irrational investors,

The Politics of Profits, Volatility Laundering & All-Alts are not Equal

In our piece, Economic Cycles and Mean Reversion, we demonstrated that corporate profit margins had risen to levels above the prior century's peak in 1929. We have updated the chart used in that piece. These margins have been and continue to be the fundamental bulwark on which any bull case for US equities rests.

The Refinancing Wall Looms Large: When Algebra & Optimism Collide

In our August piece, The Solvency Debate Continues, KCR updated our 2021 missive Junk Stocks Funded by Junk Bonds. We observed that 2023 had seen speculators return with a ferocious appetite for low-quality stocks. Our focus in that piece, and again today, will be on a group of companies that failed the Federal Reserve’s test for financial fragility as defined by interest coverage ratios (“ICRs”).

Equal Weight S&P 500 Indexes: A Panacea for Concentration Risk?

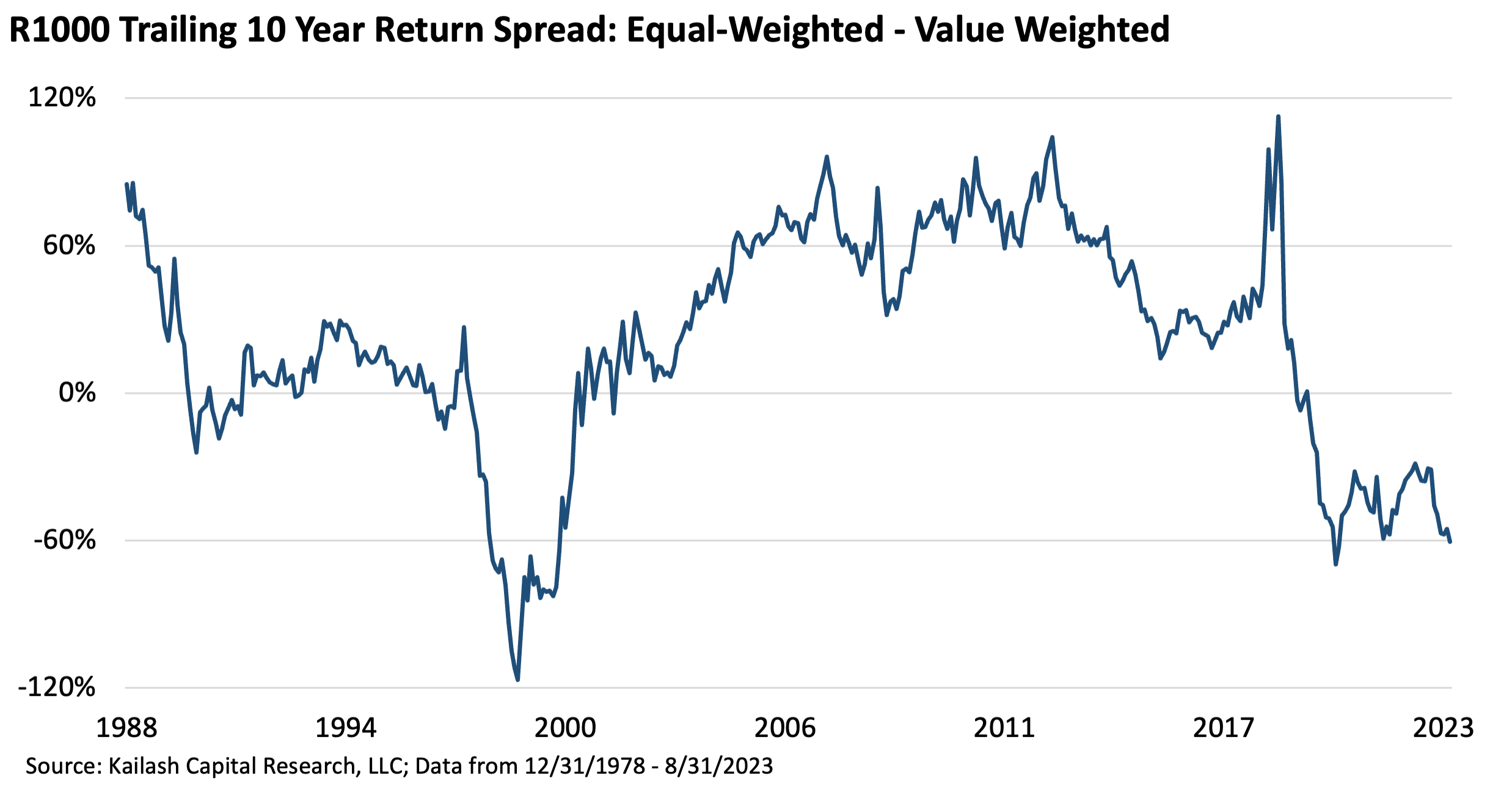

KCR has written a blizzard of material on the increasingly dire investment implications of market capitalization weighted index funds due to the outsized performance of large stocks that now sit at brutally high multiples. This is hardly a new topic for us. In 2014, as “smart beta” strategies became wildly popular, we penned Indexing Dilemmas, which laid out the following facts:

Stock Bubble Charts: YTD Update on the Echo-Bubble Driving Equities

Hello everyone. This is Matt from KCR. Today we will do what is effectively a tardy half-year update. The speed and tone will be quick and sharp as the year has been challenging for evidence-based investors like us. The summary is that the sharp speculative rally we have seen YTD

AI, Oil and Gas: Misadventures in Capital Allocation

Our recent pieces, How to Value Tech Companies and External Obsolescence: Tech Investors’ Newest Nightmare?, discussed how AI algorithms, big data, and machine learning could be undermining the moats of tech stocks that now sport multiples last seen during the dot.com mania. We noted that our empirically

Mega Cap Stocks: Making Money in Large Cap Growth

“Didn’t we just learn that pouring trillions of dollars into technologies with uncertain profit profiles we didn’t fully understand was a bad idea? Tech investors seem to be most aggressive when they have the least visibility on the IP and valuation provides them with no margin of safety.” -Zac M., KCR Subscriber...

Alternative Assets & the 60/40 Portfolio Crisis

This paper will demonstrate the following: 1. 60/40 Asset Allocation models have come under crushing stress over the last several months 2. Combined, popular alternatives like private equity, private credit & venture capital strategies are often merely leveraged, high-cost variants of “60/40” with lagged reporting, in our view

Earnings Quality and Stock Returns with Value as a Tailwind

In April last year, KCR penned What is Accounting Quality and Why it Matters. The work discussed the abysmal state of financial reporting and used our earnings quality score to demonstrate that high-quality firms trounced low-quality firms’ performance.