How High ROIC Firms Could Cause the Next Crisis For Index Funds

KCR was founded in 2010. A couple money managers looking to do something different. Honest. Unconflicted. Our asset allocation models were clear: high quality US large-cap blue chip stocks had almost never been cheaper relative to developed and emerging markets. US stocks looked like a free lunch to us in 2010. Simple.

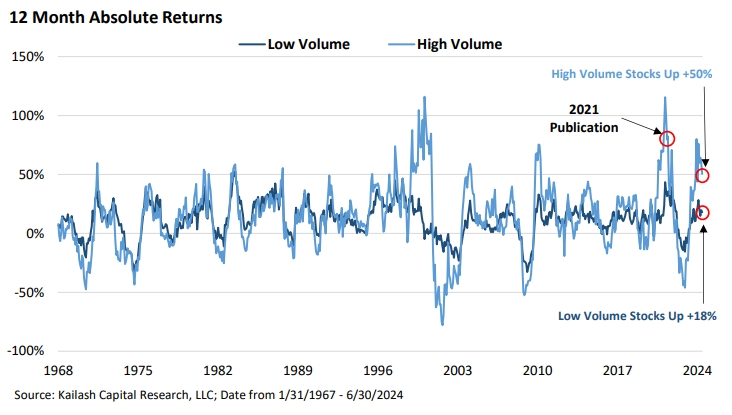

Speculative Trading Returns with a Vengeance

KCR is fond of highlighting the models where our methodologies are suffering. We do this as we think it shows intellectual honesty and highlights outsized opportunities to come. This piece is different. In our July 2021 missive The Low Value in High Volume, we focused on stocks with the lowest and highest volume.

Is MasterBrand Inc. (MBC) a Long Term Buy?

Founded nearly 70 years ago, MBC is the largest manufacturer of residential cabinets in North America. MBC is known for high quality products and innovative designs. Its business is closely tied to home improvement, repair and remodel (R&R), and new home construction activity in the United States and Canada.

Owens Corning (OC): A Bull Case for a Real Economy Stock

A global leader in the manufacturing of building and construction materials, Owens Corning (OC) sells its products in 30 countries. OC’s legacy business is divided into three segments: Roofing (~40% of sales), Insulation (~37% of sales), and Fiberglass Composites (~23% of sales).

The Case for Cardinal Health, Inc. (CAH)

Cardinal Health, Inc. (CAH) is primarily a pharmaceutical wholesaler that distributes the medicines drug manufacturers produce to pharmacies. CAH also manufactures and distributes CAH-branded medical, surgical, and laboratory products in the U.S. and Canada.

ARIS Water Solutions, Inc. (ARIS)

ARIS is a uniquely positioned company: its water handling and recycling services seem likely to be in tremendous demand for the foreseeable future. In simple terms, the fracking process produces rapidly increasing quantities of water that must be disposed of or recycled.

OSG Ship Holding Group, Inc. (OSG)

Overseas Shipholding Group, Inc. (OSG) operates a fleet of vessels that transport crude oil, petroleum, and transportation fuels primarily in the U.S. Flag trade. OSG operates a fleet of 21 vessels (13 owned and eight chartered) with aggregate carrying capacity of ~1.5 million deadweight tons (dwt). One dwt is 2,240 pounds.

A Penchant for Pain: A Search for Big Returns in Small Packages

The research in this newsletter is not designed for those looking to feel comfortable in large crowds. Our ranking tools and model portfolios pay various levels of respect to the momentum anomaly. “Momentum anomaly” is merely an academically vetted term for performance chasing.

Apple, Coke, Tesla, WorldCom & Warren Buffett: What Can We Learn?

April. Busy month. Let’s use numbers and history to make a powerful point with simple pictures. The cranberry bars show Apple’s price to sales (P/S) ratio by year. You can see AAPL’s valuation ballooned from 3x sales in 2014 to 7x sales today. The navy-blue bars show Apple's market cap from 2014 through today.

“Number Go Up” & The Ouroboros-Like Asset Inflation of the Post GFC Era

“Number Go Up” [is] one of the many memes that sprang up during a previous crypto surge, representing a similar vibe as “to the moon” or “hodl” – the idea that the faithful would keep buying in the belief that prices would continue to climb. … For active managers, the pressure is getting more intense by the day to ride the upward momentum across tech-powered indexes like the S&P 500 and Nasdaq 100 …

A Quixotic Crusade for Common Sense?

Yet after the world’s most valuable chipmaker smashed expectations with its blowout report Wednesday, the AI party is one nobody can afford to miss. Short interest is nearly nonexistent among tech behemoths. … For active managers, the pressure is getting more intense by the day to ride the upward momentum across tech-powered indexes like the S&P 500 and Nasdaq 100 …

KCR’s Dividend Portfolio: An Evidence Based Approach

Shortly after the trough of the Great Financial Crisis, this newsletter observed that Wall Street was selling “dividend investing” strategies to coax investors back into equities. In pieces ranging from The Dividend Deception to Rushing About: The Thirst for Yield, we pilloried what we felt were often deceptive marketing pitches that led investors into history’s biggest bubble in dividend stocks.