Out with the Old In with the New: What Chat GPT Means for You

Definitions and Generally Accepted Interpretations: 1. Something new is replacing something that is old or out of date , 2. Life improves by replacing old things with new things. 3. To discard older, legacy technologies or ideas, with new and improved technologies or ideas Out With Old In With New: Good for You The history books are quite clear on the matter: over the long arc of human history, life has improved. Generally speaking “out with old, in with new” has helped human beings live longer, healthier and safer lives. As recently as 1900, average life expectancy in the US was barely 48 years. By 2020 the number had jumped to 79 years. Progress.

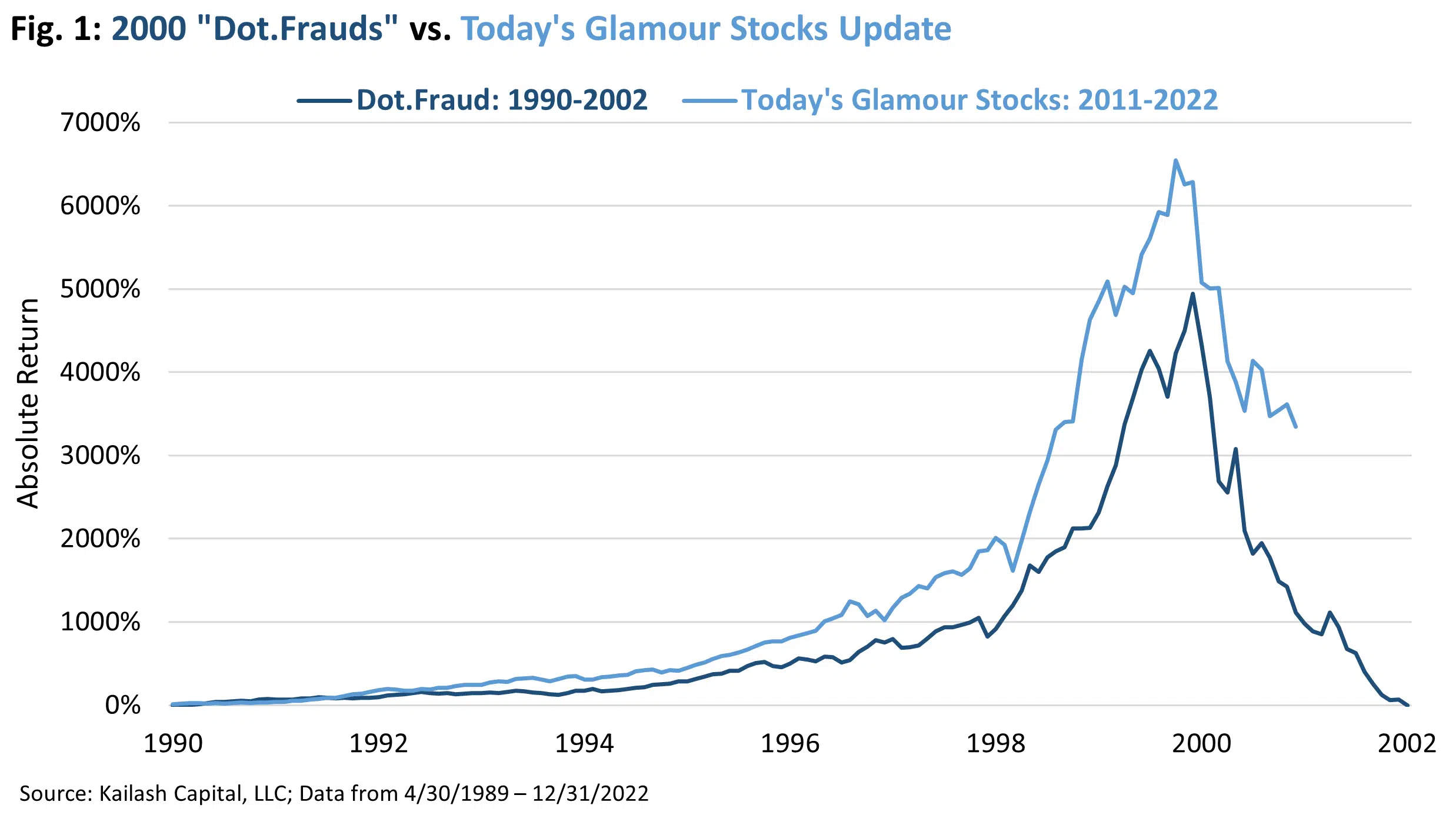

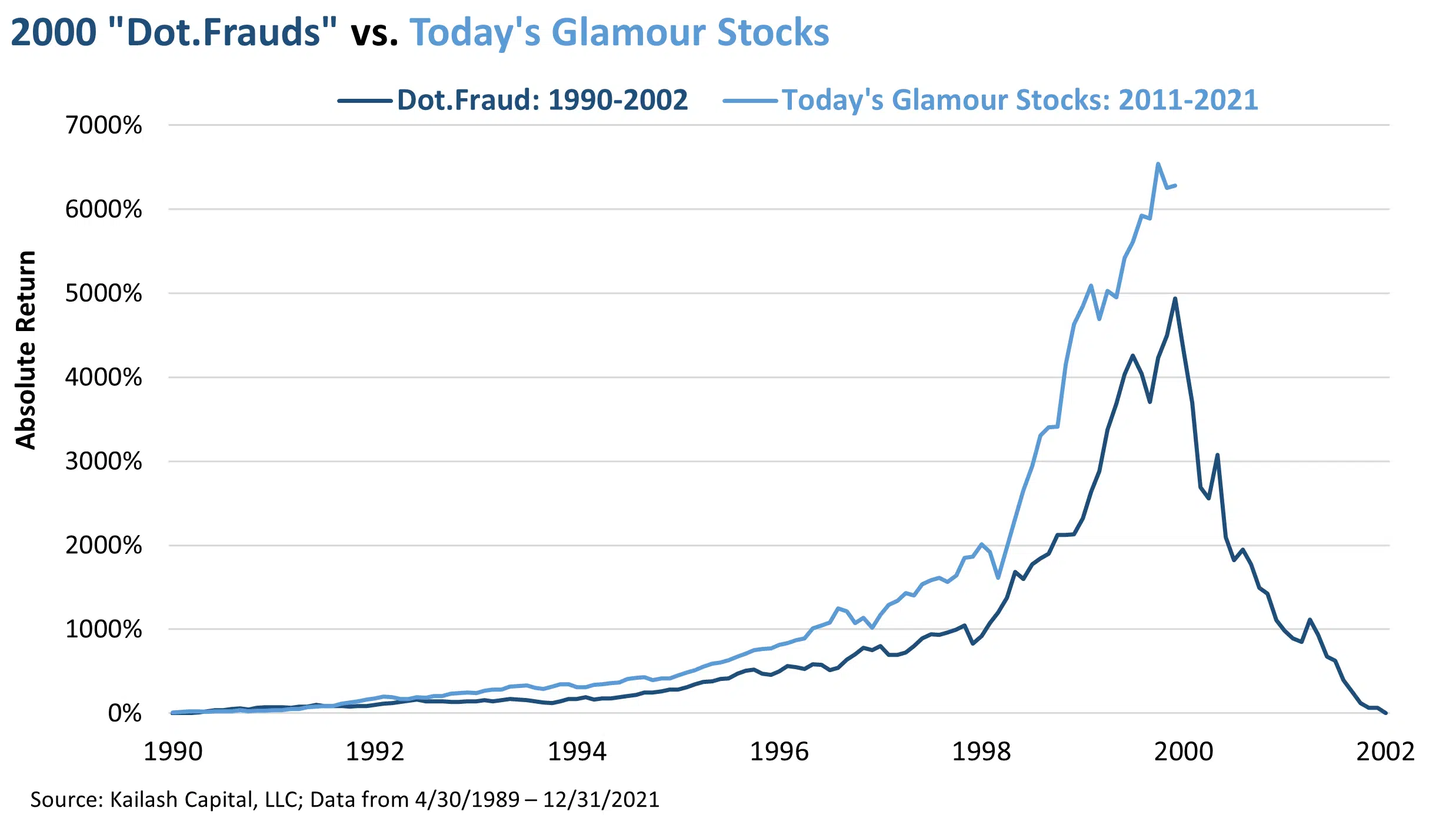

Market Froth Abates: Lessons from a Historical Speculation

KCR is not surprised at the amount of Wall Street shills claiming they can predict the Federal Reserve Chairman’s next moves. Equally unsurprising is the market’s overwhelming interest in how market conditions might shift based on a leveling off or outright reduction in interest rates. The thinking goes like this: the stock market bubble that drove low-quality stocks to unsustainable levels could come roaring back to life if only the Fed would...

KCR Equity’s Best Charts from 2022: All Charts Updated!

We recently posted a year end piece summarizing KCR’s work from 2022. There were so many blistering charts that we broke the recap into two parts. The first, Short Term Stock Speculators Beat a Hasty Retreat, and A Basic Industries Boom & the Return of the Real Economy as the follow-up. When we posted our 2022 year-in-review we highlighted the charts as they were...

The DAV

As anyone with a wallet and an email inbox can attest, we live in an age of unprecedented crowding in the philanthropy and charitable giving space. Americans donated $485 Billion in 2021, and with charitable organizations jockeying for the biggest slice of that pie, many folks seek out the organizations that are delivering the most benefit. This is why we want to take a moment to highlight the charity Disabled American Veterans (DAV).

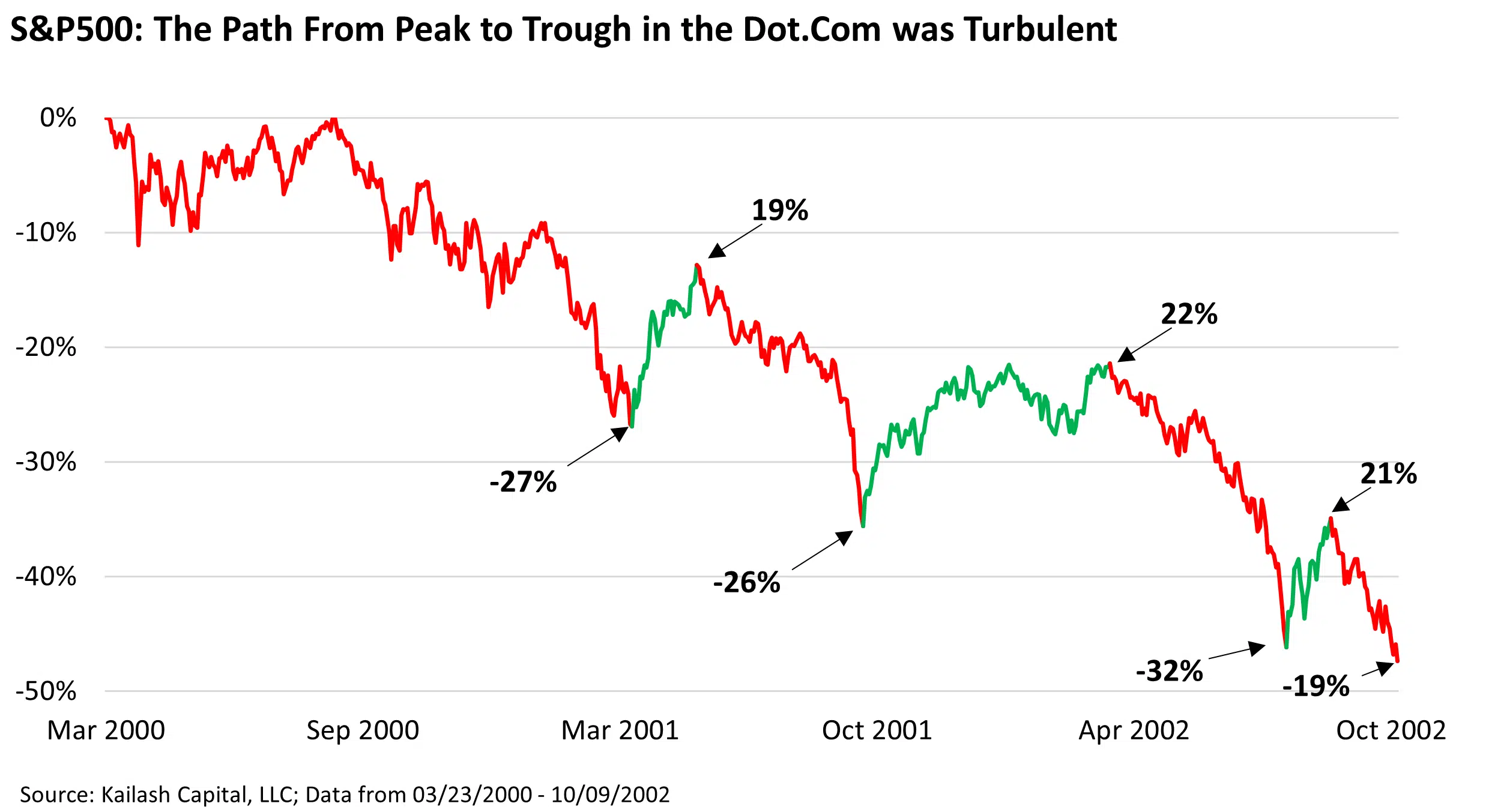

ARKK vs. QQQ in the Dot.Com Bust

2020 was a brutal year for KCR. US bonds rose to offensive levels, offering investors a 0.50% yield, while equities soared to valuations above the dot.com peak. Our evidence-based investment process is driven by historical data, algebra, and common sense. By the end of 2020, there was nothing less common than common sense. Basic math's were tossed out the window and replaced by empirically impossible narratives spouted by promotional fund managers and...

A Basic Industries Boom & the Return of the Real Economy

Last week’s piece Short Term Stock Speculators Beat a Hasty Retreat, walked through the blizzard of work we did on the continued collapse of speculatively priced stocks in 2022.Today, we present the best charts on the bullish material we highlighted last year.

Short Term Stock Speculators Beat a Hasty Retreat 2022 Year in Review: Part I

At the end of last year, we posted a piece reviewing our research from 2021. We explained that after a brutal 2020 where we were bombarded by skeptics, ‘21 had been a terrific year for KCR and we expected more in ‘22 based on the data. Thankfully, fortune favors the patient, disciplined, and empirically inclined.

Cash Flow to Stockholders is Defined As: Misleading?

How the Crypto-FTX-Fraud Could be Masking Epic Capital MisallocationAccounting Tools states that cash flow to stockholders is the amount of money a firm pays its equity owners. They explain that “Investors routinely compare the cash flow to stockholders to the total amount of cash flow generated by a business…”

The Kindness of Strangers

We think it is worthwhile to ask: what do we lose when we close ourselves to interactions with people in our everyday lives?

The Mining Investment Boom Nobody Believes

Market Prices Suggest the Movement to a Green Grid Will Fail - Quick piece on some of the market’s cheapest and most unpopular stocks.

Small Cap Investing Strategies, Large Caps & Active Management

The Role of Critical Minerals in Clean Energy Transitions

Have Policy-Makers Given Investors a Secular Growth Story for Cyclical Stocks? Our research is empirically based and tends towards places that are uncomfortable and out-of-favor. In 2020, as investors gorged on crypto, loss-making tech and growth stocks of dubious merit..