First things first: KCR is a nonpartisan publication. We have friends across the political spectrum. To a person, we are die-hard Americans who are grateful to be in this country. On to the issues at hand.

No matter who you voted for, we would guess that everyone can agree that Mr. Trump’s victory came in part from his commitment to do things differently. One of the areas he has been most clear on is his dedication to revoking the vast subsidies granted by the Inflation Reduction Act. President-Elect Trump has repeatedly highlighted how he views the $369 billion spending package as an inflationary misallocation of capital. He has promised to end the battery electric vehicle (“BEV”) mandate and, in the process, save American automakers.[1]

Get our insights direct to your inbox: SUBSCRIBE

That appears to have caught Mr. Musk’s attention and brought him, and his money, into President-Elect Trump’s camp. We admit that the $300+ million Mr. Musk spent in support of Trump’s candidacy is pocket lint for the world’s richest man. That number is less than one-tenth-of-one-percent of Musk’s $304bn net worth. 0.10%.[2]

Elon Musk falls into line, source: NY Post

There is no end to the amount of speculation about how Mr. Musk intends to use what he believes is his outsized influence on Trump to further his own interests. Fortune magazine wrote a basic summary for those interested.

Regardless of where you stand on the possible benefits of BEVs, we think most people would agree that Elon Musk is a brilliant promoter. With Tesla valued at over 10x price to sales and 150x earnings, Musk has created a funding vehicle that puts every other global automaker at an immense disadvantage. Maintaining that advantage has never been more important. Why?

Competition is coming. America’s immense subsidies for BEVs are not unique. China has also spent vast amounts of money subsidizing electric vehicles – and their subsidies have gone first to BYD and second…to Tesla.[3]. The difference is that unlike America where virtually all our subsidies have flowed to one company, China’s industrial policy has spawned 100s of ruthless competitors forcing them to close the quality and design gap with their Western counterparts.

The world just watched as the Chinese electric vehicle giant BYD displaced Tesla as the electric car leader. As EV Magazine recently reported “…BYD’s ascent was…due to its superior vertical integration and a broader range of models across different vehicle segments…[and]…is a testament to its comprehensive approach to EV manufacturing…” [4] Carscoops described BYD’s 1,000 horsepower Denza Z9 GT, priced at ~$50,000, as a vehicle “…to make your Porsche-owning neighbor cry into their overpriced latte.”

The Denza Z9 is not an anomaly. We doubt many of our readers have heard of Xpeng. The company offers a remarkable 540 horsepower SUV called the G9 with massage seats and a 22-speaker sound system for under €60,000.[5] And this is where things may get complicated between Mr. Musk and President-Elect Trump.

Chinese domestic automotive companies have already slashed Tesla’s local market share from 9% to just 6.5%.[6] So, Tesla is losing ground in China to Chinese BEV makers. Worse, over 50% of Tesla vehicles are made in China [7] which is becoming an export hub that has sent over 1 million cars into foreign markets. [8]

With the US already imposing 100% tariffs on Chinese BEVs [9], the EU has become a natural dumping ground for Chinese made electric cars. In response the EU increased tariffs on Chinese-built electric vehicles up to 45.3%.[10] So Tesla is under tremendous organic pressure from Chinese competitors that it must compete with both locally in China and in the export markets Tesla’s Chinese factory serves.

Now take all of that and layer in Trump’s policy promises to level the playing field for American workers and industry. His program promises to end China’s Most Favored Nation trade status, stop US companies from investing in China, and eliminate federal contracts for any company that outsources to China.[11]

While Tesla’s reliance on China for nearly 40% [12] of its battery supply is concerning, one could see how the heavy investments in China, cozy ties to Chinese censors [13], and the potential conflicts at SpaceX could exacerbate things further. Since the election, Tesla’s market cap has increased by nearly $400bn [14] – that’s akin to 10 Kimberly-Clarks appearing out of thin air. Please click here for our bullish take on Kimberly Clark.

Yet the KCR team suspects that while President Trump has acknowledged the importance of Musk’s money [15], he is far more likely to follow-through on his commitment to American workers. We doubt he will abandon the policy positions that got him elected for the pittance Musk gave.

So aside from possible risks to euphoric Tesla investors, why does all this matter to investors?

When government policies get to the size of the Inflation Reduction Act they influence investment outcomes. Indeed, one of our more provocative pieces, The Mining Boom Nobody Believes, cited the blind application of money to “green” policies as a source of unsustainable but very real demand.

KCR has been relentless in reminding readers that when it comes to policies around trade, labor, and antitrust, both Republicans and Democrats were promoting similar policies. The difference, in our highly imperfect view, is largely a function of methods and application. As if to make our point, JD Vance was very public in his support for anti-trust warrior Lina Khan.[16]

Our piece The Politics of Profits used data and myriad citations to make the case that Americans across the political spectrum were exhausted by the political enablers of the oligopolies that now dominate our economy. At the time we were highlighting the bipartisan support to end the forces that had decimated the middle class.

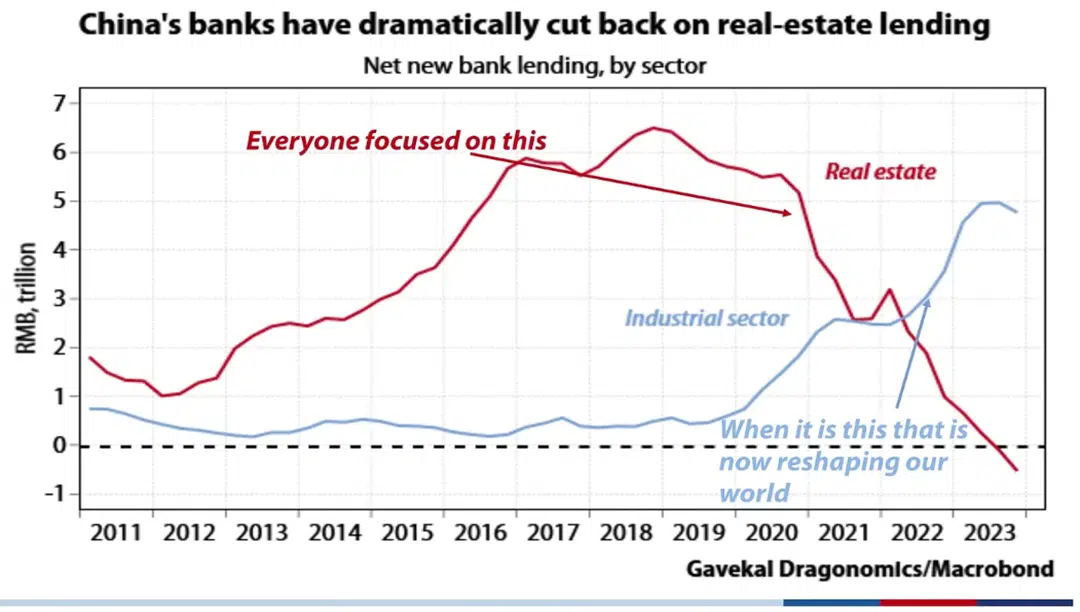

But now, we see bright warning lights that this is no longer just a political issue. China’s many industries have benefitted from not just US policies around outsourcing but tremendous domestic subsidies. And now they have arrived looking to compete with low labor costs, potent technology, and ruthless pricing. Your Weekend Reading recently featured the below chart from Gavekal and we think it paints a powerful picture.

With soaring trade tensions, we cannot help but wonder about the extraordinary valuations ascribed to America’s largest global companies. We first brought this up as pertains to Apple. In our piece Apple, Coke, Tesla, WorldCom & Warren Buffett we highlighted the remarkable progress by Chinese cell phone maker Huawei. Costing 60% less than comparable Apple peers and loaded with Chinese designed and made chips, Huawei went from nowhere to suddenly putting the iPhone’s “go to” status at risk with its Mate series of cell-phones.

If you read the last few pages and expect us to opine on what’s next for Tesla, Apple, Nvidia, Alphabet, and the select other global mega-caps that now dominate index funds, we are sorry to disappoint you.

Longtime readers of KCR know that we do not make forecasts. We merely put the current situation in historical context using data. From that data we believe we can achieve an investment advantage because over centuries the evidence is clear: human beings make the same mistakes again and again.

Look at the sheer number of variables in the preceding three pages. Billionaires. Politicians. Tax policies. Tariffs. Social discord. These impossible-to-predict variables are swirling in an increasingly violent vortex around the largest US companies which now trade at some of the most dangerous valuations seen in a century of data.

If that sounds like a pretty tough game to play: we agree.

The good news is you do not need to figure out any of these things. By moving down to Mid Cap, Small Cap, and Microcap stocks you will find an abundance of high-quality, inexpensive stocks, that are growing, and trade at enormous discounts to the megacap stocks that dominate headlines.

To the KCR team, avoiding the partisan rancor, focusing on mispriced fundamentals and buying stocks with a margin of safety seems immensely more palatable and profitable than trying to outguess speculators and index funds.

In the short term we recognize these less popular stocks may lag the broader indexes dominated by the likes of Tesla and Apple. But over the long-term, we think it is simply a matter of when not if these more modestly sized companies begin to trounce their overpriced megacap peers.

For those who have found our research pounding the table on the cheap, hiqh-quality Staples stocks or large-cap blue-chip dividend stocks too boring…..or our emphatic two-part series endorsing the incredible values we see in Microcap stocks too frightening, our next series will make the case for Midcap Stocks.

To see the top ranked stocks from our empirically driven, systematic, low-turnover methodologies, for Dividend Payers, Staples, Small Cap, and Micro Cap stocks please click on our Monthly Research.

Note to our readers: if you jumped into this piece hoping to see some sort of political bias, got all the way to the end and realized “these KCR people didn’t say one negative thing about either political party and actually made positive comments about Elon Musk” …well that is the point.

Our goal is to get people to think about where they have an investing edge. Not pontificate about politics and what they might mean for stocks.

Please find below a list of our Top 25 ranked Small & Mid Cap stocks.

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2023 Kailash Capital Research, LLC – All rights reserved.

November 21, 2024 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

November 21, 2024

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin