- Introduction, Quantifying the Issue

- The Case for Cash Alone

- The Benefits of Borrowing

- Conclusion: Sanity Check

“All this cash is dammed up at these companies, we are the catalyst to enable them to do something with it.” –Carl Icahn, “Icahn Unleashed.” Forbes, April 15, 2013.

Introduction, Quantifying the Issue

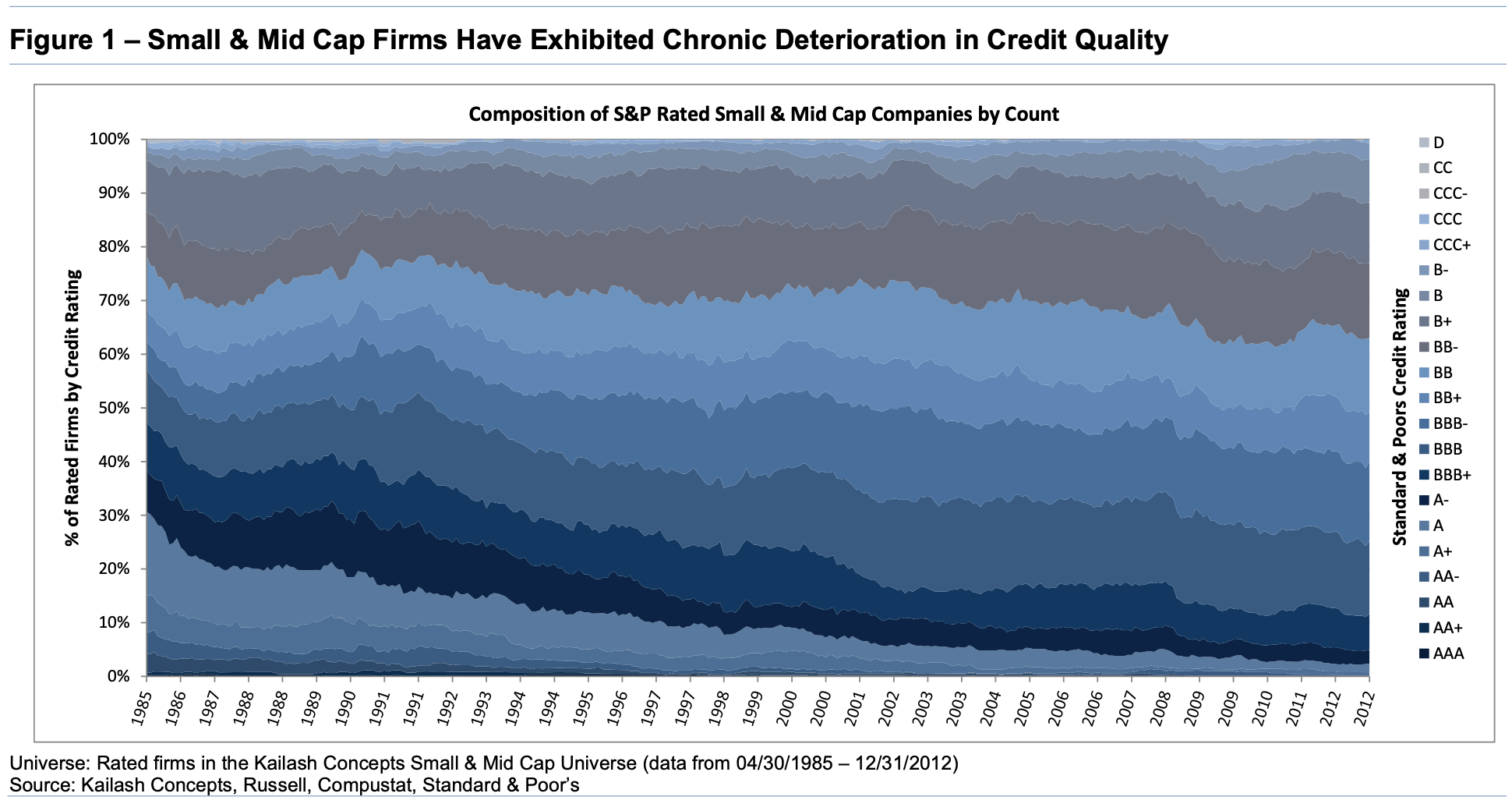

In Activism Lite, Parts I and II, our work explored the powerful role debt reduction can play in equity returns for more indebted companies. Among our thoughts in those papers, we posited that the idea might make even more sense going forward due to the nearly uninterrupted 20-year decline in issuer credit quality despite record low interest rates.

Get our White Papers direct to your inbox: SUBSCRIBE

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “Kailash Capital Research, LLC ”) shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of Kailash Capital Research, LLC . In preparing the information, data, analyses, and opinions presented herein, Kailash Capital Research, LLC has obtained data, statistics, and information from sources it believes to be reliable. Kailash Capital Research, LLC , however, does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. Kailash Capital Research, LLC and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction. © 2021 Kailash Capital Research, LLC – All rights reserved.

Nothing herein shall limit or restrict the right of affiliates of Kailash Capital Research, LLC to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of Kailash Capital Research, LLC from buying, selling or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of Kailash Capital Research, LLC may at any time have, acquire, increase, decrease or dispose of the securities or other investments referenced in this publication. Kailash Capital Research, LLC shall have no obligation to recommend securities or investments in this publication as result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

April 16, 2013 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

April 16, 2013

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin