In our September 4th paper, IPO Stocks are the New Staples – History and Current Data Suggest that is as Silly as it Sounds, we submit historical evidence that Tesla’s $400bn market cap, despite having just 1.4% US market share, may be the apogee of equity mispricings in the current bubble. From the close on August 24th to the high on September 1st Tesla’s market cap rose over $90bn or said another way “a Volkswagen” or “half-a-Toyota”. That’s a lot of market cap for a week of trading where the primary news is they are diluting owners with a $5bn stock issuance to fund operations. Kailash believes the day-to-day movements of many popular stocks are now totally decoupled from fundamentals and reality. Investors seem to have lost sight of what numbers mean.

We are in the phase of this bubble where you start to think “the 285 acres of land under the Imperial Palace in Japan was worth more than all the real estate in California in 1989” is the appropriate analogy.

Get our insights direct to your inbox: SUBSCRIBE

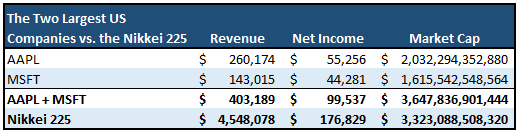

To show the extremity of today’s mania we would note that the market cap of AAPL and Microsoft is now over half a trillion dollars LARGER than the entire market cap of the Nikkei 225. Apple and Microsoft could be the best of the US mega-caps. But numbers like these are difficult to digest. Apple and Microsoft could buy…..Japan’s entire suite of blue-chip companies, pick up $4.5 trillion in revenues and triple profits. IS IT ANY WONDER BERKSHIRE IS SHOPPING IN JAPAN?

Get our White Papers direct to your inbox: SUBSCRIBE

Want more content? Subscribe now!

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “Kailash Capital Research, LLC ”) shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of Kailash Capital Research, LLC . In preparing the information, data, analyses, and opinions presented herein, Kailash Capital Research, LLC has obtained data, statistics, and information from sources it believes to be reliable. Kailash Capital Research, LLC , however, does not perform an audit or seeks independent verification of any of the data, statistics, and information it receives. Kailash Capital Research, LLC and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction. © 2021 Kailash Capital Research, LLC – All rights reserved.

Nothing herein shall limit or restrict the right of affiliates of Kailash Capital Research, LLC to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of Kailash Capital Research, LLC from buying, selling or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of Kailash Capital Research, LLC may at any time have, acquire, increase, decrease or dispose of the securities or other investments referenced in this publication. Kailash Capital Research, LLC shall have no obligation to recommend securities or investments in this publication as result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

September 15, 2020 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

September 15, 2020

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin