Just shy of a year ago, the KCR team wrote A Penchant for Pain: A Search for Big Returns in Small Packages. The piece made a table-pounding case to invest in the extraordinarily cheap, high-quality and small names that had come to dominate our Microcap Model Portfolio. Since publication our Micro Model Portfolio has held its own despite the Russell Micro benchmark collapsing.

Since the start of 2025, the Russell Micro Index has plummeted -19%. Our response? Keep pounding the table on cheap, high-quality stocks in the space with significant growth potential, deleveraging and self-help.

Get our insights direct to your inbox: SUBSCRIBE

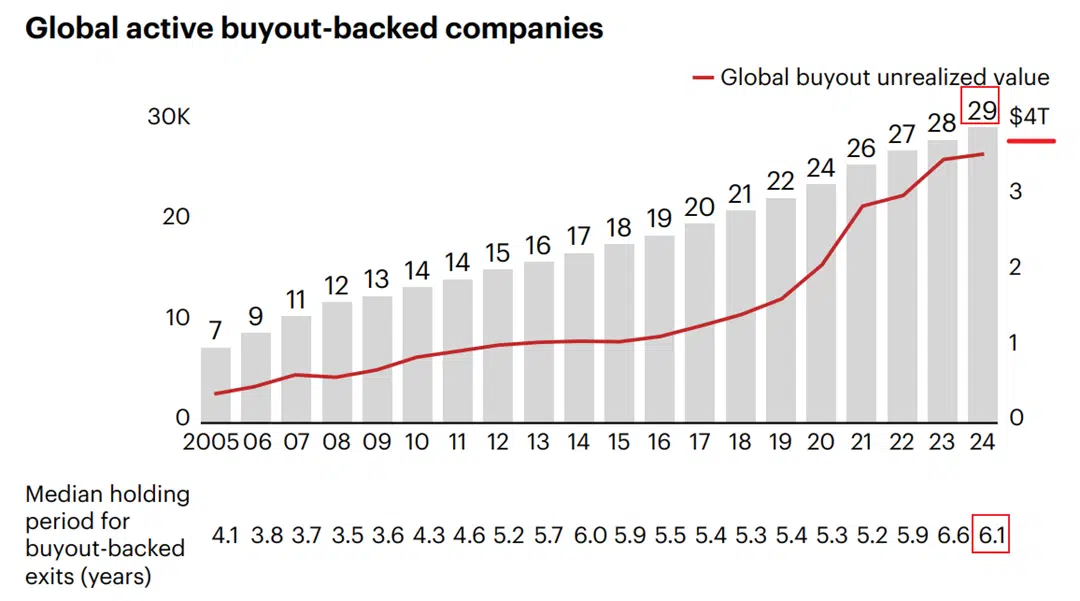

Recent reports from McKinsey, Bain and Pitchbook on the current status of Private Equity seem to make the case for our Microcap model’s holdings all the more compelling. Our brutally abbreviated summary of what these reports show is as follows:

- Private Equity sponsors continue to talk of an “IPO Drought” – which is a nonsensical fiction

- There is always a clearing price for any given asset – we believe “IPO Drought” should be rewritten as:

“Private Equity managers, who now hold a record 29,000 companies in their portfolios, cannot get cash back to investors like they normally do because they have valued their holding companies at prices that the public markets simply will not pay”

-Do our readers believe this is a credible re-write? Let us know if you disagree as we are open minded.

- The chart below, from Bain, shows that not only are there 29,000 companies valued at ~$4 trillion dollars waiting for an exit, but the median age they have been sitting in a portfolio is now 6.1 years

- We believe this is particularly noteworthy considering current listed markets are more expensive than at the peak of the dot.com bubble.

- As the pieces linked above explain, the recent wave of cash returned from private equity sponsors to investors has largely been funded by NAV loans and private to private sales

- We can think of nothing that better embodies this than our Microcap Model Portfolio’s holding in the digital wallet and transaction company, Paysafe (PSFE) which we recently wrote-up

- Summarily: after private equity firms paid far too much for PSFE in 2017, they sold as much as they could via a SPAC in the speculative froth of 2021 at a $9bn valuation, post that listing the stock plunged -90% with private equity sponsors Blackstone and CVC still holding ~40% of the shares outstanding

In KCR’s view, select listed microcap stocks offer investors the potential to buy companies that are similar to those held by many PE sponsors…but at a potentially large discount to PE. Even better, these companies can be bought without paying the high management, performance, and operating costs that characterize many of these vehicles. Incredibly, the one “negative” is that the positions in our Micro Model are liquid. So, the price moves around. If your measure of success is compounding capital at above benchmark rates over long horizons, we think there is a veritable arbitrage between private equity and cheap, high quality, listed microcaps.

Today we will continue this new tradition by advocating for a microcap stock favored by our models.

United Natural Foods, Inc. (UNFI) is the leading distributor of healthier food options in the United States and is the largest publicly traded wholesale distributor of organic and natural food options across North America. At its core, UNFI is a complex, single-industry logistics company. The more efficiently UNFI runs its network, including managing its capital expenditures and freight and other operating costs, while keeping its grocery store customers satisfied with the quality and frequency of its deliveries, the more successful it will be.

Why We are Bullish on UNFI:

- UNFI is one of only three primary organic/natural food wholesale food distributors – a powerful oligopoly

- Sourcing food from 11,000 unique suppliers, UNFI is one of the largest bulk purchasers of organically grown food in North America giving it significant negotiating power as a buyer

- One of its private peers is valued at a significant premium to UNFI despite comparable sales and profits suggesting investors in UNFI are getting a discount and liquidity vs. an illiquid peer

- From 2019 – 2023 grocery sales have increased nearly 38% despite a -1.6% decline in unit volumes due to strong pricing

- Despite a challenging macro headwind, consumers are showing a continued preference for healthier organic food, with the category experiencing unit volume growth in 40% of categories and overall revenue growth in-line with the broader categories

- The company’s management has put forth a clean and credible approach to cost optimization with the potential to generate outsized returns for patient investors

- Specifically: every quarter point, 0.25%, reduction in operating costs relative to sales generates ~$75ml in incremental cash flow – worth $8 per share if we hold the stock’s current, depressed, multiple constant

- Bond investors already see what we do: specifically, UNFI’s bonds have repriced from 75% of par to just above par since April 2024 – shifting yield to maturity down from 16% to just 6.58%

- One of the chief advantages of investing in UNFI stock is the ability to identify the key driver of the company’s future profitability and cash flows. Specifically: whether, and to what degree, the company will be able to control its operating costs.

- If management can control costs (at which it has been very successful in its last 3 reported quarters), UNFI’s profits and cash flows can increase rapidly.

- Another appealing feature of UNFI is the company’s discounted valuation of just 6.5x EV/EBITDA; more than a 50% discount to the S&P 500 Index

- We believe management’s cost optimization plan and capital discipline may significantly reduce the volatility of returns allowing the company to benefit from a re-rating

- The sensitivity of UNFI’s share price to what we believe is a merited revaluation of its EV/EBITDA ratio is another powerful potential driver of returns: for each 0.5x improvement in this multiple, UNFI’s EV would increase by about $280 million equivalent to a $5 boost in its stock price.

- If the company can cut operating costs by the aforementioned 0.25% and get a half point increase in multiple, investors could see a re-rating in excess of $13 per share, or ~50% upside.

What is the Bear Case?

Sales to Whole Foods Market comprised 23% of UNFI’s sales in FY 2024, making UNFI quite dependent on one customer. However, Whole Foods has been a UNFI customer for 20 years. This long history does not preclude the possibility that Whole Foods could at some point consider changing wholesale suppliers, but the strong and lengthy relationship between the two parties suggests the odds of such an action may be low.

Summary

Founded in 1976 and headquartered in Rhode Island, United Natural Foods, Inc. (UNFI) is the leading distributor of healthier food options in the United States [1] and is the largest publicly traded wholesale distributor of organic and natural food options across North America. At its core, UNFI is a complex, single-industry logistics company. The more efficiently UNFI runs its network, including managing its capital expenditures and freight and other operating costs, while keeping its grocery store customers satisfied with the quality and frequency of its deliveries, the more successful and profitable it will be.

More specifically, UNFI offers 250,000 products, including grocery and general merchandise, perishables, frozen foods, and other products, to more than 30,000 locations, primarily chain and independent grocery stores. On the cost side, UNFI is one of the largest bulk purchasers of organically grown products in North America, affording it substantial pricing power over companies which produce healthy foods and beverages. UNFI purchases the products that it resells from around 11,000 unique suppliers. Importantly, the company should be insulated from tariffs and geopolitical instability.

UNFI’s grocery customers span all 50 U.S. states and ten Canadian provinces. Not surprisingly, the company operates a substantial number of distribution centers and warehouses to ensure the timely delivery of its products to customers. In total, it runs 55 such facilities with 31.2 million square feet of warehouse space (about 13.3 million square feet owned and 17.9 million leased). [2]

The Wholesale Grocery Business is Very Competitive

Many companies compete in the $270+ billion wholesale food distribution business [3], including Sysco Corporation (SYY), a Fortune 500 company and the world’s largest broadline food distributor. In the organic/natural products segment of this industry (about a $90 billion market growing at a low single-digit annual percentage rate), UNFI is one of the three main national players. The other two are the private companies C&S Wholesale Grocers and KeHe Distributors. C&S Wholesale Grocers, one of the largest private companies in the U.S., has annual revenue of around $34 billion, making it roughly the same size as UNFI. Interestingly, C&S was valued at $4.8 billion in February 2024, according to the Bloomberg Wealth Index. UNFI’s current enterprise value (EV) is $3.7 billion, comprised of $1.7 billion of stock market value and $2.0 billion of net debt. KeHe’s estimated sales are much smaller, perhaps $7.5 billion. [4]

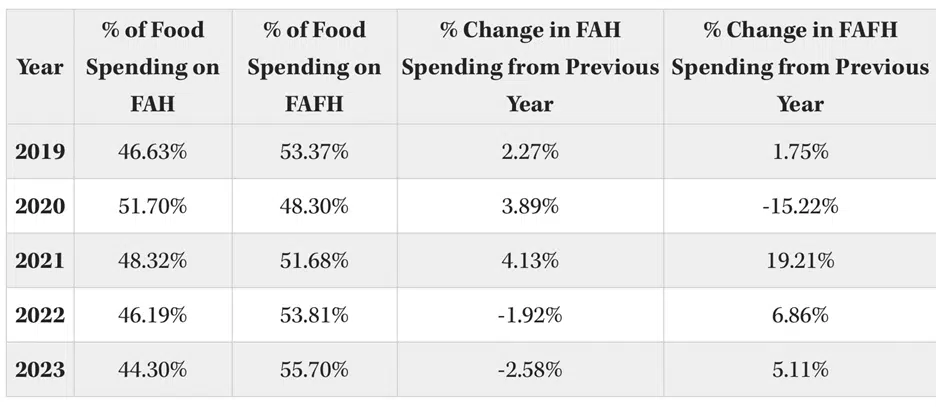

UNFI faces the same broad challenge that all suppliers of grocery store food products do: Americans spend more of their food budgets at restaurants and on restaurant takeout/delivery ($1.5 trillion in aggregate in 2023) than at home ($1.1 trillion in 2023). During the peak COVID year of 2020, U.S. consumers spent more on food at home (FAH) than food away from home (FAFH), but that relationship switched back in FAFH’s favor in 2021 and moved even more in that direction in 2022 and 2023. In both years, dollars spent on FAH declined sequentially, while FAFH spending rose. Data on FAFH spending is not yet available for 2024, but overall restaurant sales were likely flat versus 2023.

How Much are Americans Spending on Food at Home Versus Food Away from Home?

Total Eating and Drinking Place Sales (billions of current dollars)

Note that while dollar sales at grocery stores increased about 38% over the 2019-2023 period, more than all of that gain stemmed from rising prices (inflation). Unit sales actually declined by about 1.6% over that period. [5]

Customers’ Interest in Organic Products Remains Robust

Sales of certified organic products were $69.7 billion in 2023, an all-time high, and up 3.4% from 2022, according to the Organic Trade Association (OTA). Organic food sales made up more than 90% of this total. Sales of organic food products grew at about the same rate as overall food sales in 2023, meaning that even in the face of significant food inflation and economic challenges, consumers still chose to buy premium-priced organic products. Sales of organic products soared 12% in 2020 during the height of stay-at-home requirements during the pandemic. Just as in the case of conventional grocery products, the growth rate in sales of organic products slowed after that due to both supply chain issues and high inflation rates.

Total U.S. Organic Sales and Growth, 2014 – 2028E, in millions of dollars

Unit sales increased in 2023 for more than 40% of the organic products tracked by the OTA. Milk and cream sales are a good example of the growth in organic product sales. Overall milk and cream sales rose about 5% to $4.2 billion in 2023, while the organic dairy alternative category grew almost 14% to a total market of about $700 million. [6]

UNFI Stock Has Had its Shares of Ups and Downs …

After its IPO in 1996, UNFI’s stock generally performed well over most of the next two decades, particularly from the Great Financial Crisis market bottom in March 2009 until early 2015, a period over which the shares more than quintupled. Steady growth in consumer demand for natural foods, especially from its key customer, Whole Foods Market, drove double-digit annual percentage revenue increases during much of this period.

This consistent uptrend in UNFI’s stock price abruptly reversed — a decline of about 60% from early 2015 through early 2016 — when Albertsons, the second largest grocery store chain in North America, announced it would terminate its delivery contract with UNFI in September 2015, ten months before the original agreement was set to expire. UNFI had won Albertsons’ business four years earlier. UNFI’s annual revenue from Albertson’s in 2012-2015 was in the neighborhood of $400 million, or about 5% of its consolidated revenue. [7] (As an aside, the massive correction in UNFI’s stock price about ten years ago seems inconsistent with the moderate amount of Albertson revenue recorded by UNFI at that time.)

Likely in response to the significant correction in its share price, UNFI’s management team at the time (only the chief human resources officer still holds the same position now) acquired SUPERVALUE, a large U.S. grocery wholesaler and retailer, in the fall of 2018 for $2.9 billion, including assumed debt. [8] UNFI funded the equity portion of the takeover with debt. However, integrating the SUPERVALUE acquisition proved more challenging than management had assumed, and investors grew increasingly concerned about the amount of debt that UNFI added to its balance sheet. In turn, UNFI’s stock price fell from about $32 when the takeover deal was announced before bottoming at around $9 in March 2020, the time of the COVID stock market lows.

UNFI shares were a standout performer during the bull market fueled by enormous U.S. government liquidity injections from March 2020 through March 2023; indeed, UNFI stock traded in the low $40’s in the first two months of calendar 2023. However, UNFI’s profitability began to erode throughout 2023. UNFI’s adjusted EBITDA fell 19% and 56% in the quarters ended late April 2023 and late July 2023, respectively, primarily due to a decrease in inflation-driven procurement gains (selling a product to a grocer at a higher than usual mark-up compared with the price paid to a supplier) and elevated shrink in its business (a polite word for theft or fraud). In turn, the stock roundtripped to a low of $9 in late April 2024.

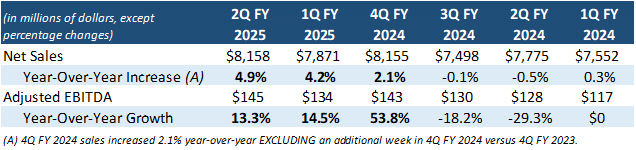

… But UNFI’s Prospects Have Decidedly Brightened

UNFI stock has tripled off its April 2024 lows, with much of that gain achieved over the last four months. A strategic plan which the company introduced in 2024 that: 1) emphasizes the optimization of its logistics network and reductions in both operating costs and future capital expenditures and looks to be quite achievable, and 2) UNFI is effectively executing is a key reason for the stock’s strong overall performance in 2024. Another is the solid top-line growth the company has achieved over the last 2+ quarters. UNFI’s revenue increased 2.1% year-over-year in the quarter ended August 3, 2024, and 4.2% year-over-year in the three months ended November 2, 2024, and 4.9% in the quarter ended February 1, 2025. This follows essentially zero year-over-year revenue growth over the previous three quarters. Furthermore, UNFI’s adjusted EBITDA increased 13%, 15% and 54% on a year-over-year basis in the last three reported quarters, respectively.

United Natural Foods, Inc. — Selected Financial Statistics

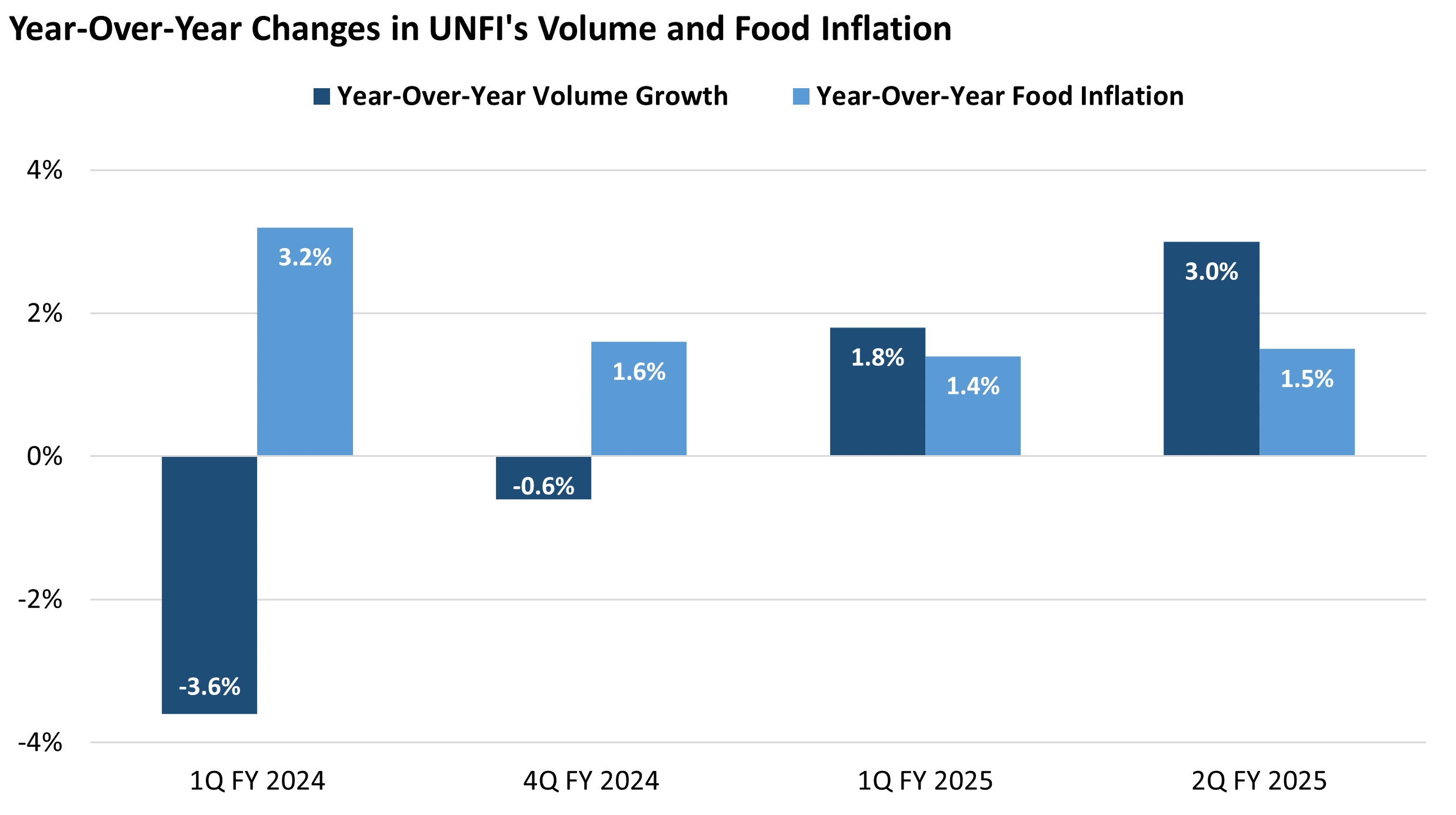

Even more interesting, UNFI’s unit sales volumes began to turn higher in the latter part of the quarter ended August 3, 2024. Moreover, the company’s unit volumes increased nearly 2% in the quarter ended November 2, 2024, and this growth accelerated to 3.0% in the quarter ended February 1, 2025 (2Q FY 2025). Encouragingly, management reports that UNFI has continued to experience strong volume sales growth over the first few weeks of 3Q FY 2025. [9]

United Natural Foods, Inc.’s Volumes Have Increased Sharply Over the Last Two Quarters

Note: 2Q FY 2025 ended on February 1, 2025.

Sources: United Natural Foods, Inc. 1st Quarter Fiscal 2025 presentation slides, December 10, 2024; and United Natural Foods, Inc. 2Q FY 2025 earnings call transcript, March 11, 2025.

Notably, UNFI’s volume growth in the key natural/organic category was considerably stronger in 2Q FY 2025 than the overall 3.0% volume growth it realized in the quarter, while conventional volume growth was about flat. [10] Importantly, UNFI’s unit volume trends are outpacing the wholesale grocery supply industry. [11]

UNFI’s focus on achievable cost cuts in a business with moderate revenue growth should allow the company to post consistent earnings and cash flow increases over at least the medium term and avoid the unpleasant — and unwanted — ups and downs it has experienced over the past decade. Some of the tangible reductions in UNFI’s costs include:

- UNFI’s goal is to cut $150 million from its $4 billion of annual operating expenses within three years. [12] In greater detail, UNFI’s operating expenses were $1.031 billion in 2Q FY 2025, up slightly from $1.015 billion in 1Q FY 2025 and $1.010 billion in 2Q FY 2024. Crucially, UNFI’s 2Q FY 2025 operating expenses represented 12.64% of revenue, down from 12.99% in 2Q FY 2024. The comparison of operating costs as a percentage of revenue was similarly constructive in 1Q FY 2025 compared with 1Q FY 2024 (12.90% versus 13.55%) and in 4Q FY 2024 compared with 4Q FY 2023 (13.18% versus 13.54%). [13] The implementation of Lean Six Sigma principles has been a key impetus to this improving cost picture. These principles were implemented in nine of UNFI’s distribution centers in 2Q FY 2025, up from two in 1Q FY 2025, and productivity has increased in the low- to mid-single digit percentage ranges in these locations. In addition, three distribution centers have been closed over the last six months, further optimizing UNFI’s distribution network. [14]

While these percentage differences are small, their impacts could be enormous. Consider the following logic: UNFI’s revenue in FY 2025 should be around $31 billion. For each reduction in operating costs equivalent to 0.25% of revenue, the annual savings and incremental positive cash flow would be around $75 million. At UNFI’s current EV-to-adjusted EBITDA valuation of about 7x, this implies that a permanent reduction of $75 million in costs could increase UNFI’s EV by around $500 million. This would in turn boost UNFI’s equity value, or stock market capitalization, by around $8 per share. $500ml divided by about ~60ml shares outstanding.

- Over the last few quarters, UNFI has reduced its shrink to pre-COVID levels. In FY 2023, shrink represented about 0.55% of the company’s wholesale sales (or about $150 million). In FY 2024, UNFI’s shrink shrank (pun intended) to 0.30% of UNFI’s wholesale sales (or about $90 million). [15] Furthermore, the company’s shrink loss in 2Q FY 2025 was its second lowest quarterly level in the last ten quarters. [16]

- UNFI has cut its employee count by around 4% in a year — from 29,455 in late July 2023 to 28,333 in early August 2024. [17]

- UNFI’s sales per employee was 6% higher in 1Q FY 2025 versus 1Q FY 2024. [18]

UNFI’s Decision to Charge a Fixed 2.5% Fee to its Suppliers

Effective May 1, 2024, UNFI began charging a fixed 2.5% fee to all its suppliers. As part of its Simplified Supplier Approach (SSA), this fee consolidates a number of individual fees, including compliance, distribution efficiency, and warehouse slotting charges. [19] We think the imposition of this fixed fee may have lifted UNFI’s revenue and adjusted EBITDA slightly in the quarters ended August 3, 2024, and November 2, 2024, but the magnitude of the increases was probably modest. As UNFI’s CEO Sandy Douglas said in December 2024, “The benefit to UNFI is we make slightly higher fees on the bigger suppliers, approximately the same on the medium. And then we still keep fees low, but it’s 1 fee, not 15 to 20.” [20]

Bond Market Confirms the Progress UNFI Has Made

Interestingly, the bond investors have likewise become much more optimistic about UNFI’s prospects. In late April 2024, UNFI’s bonds due in October 2028 — which carry a coupon of 6.75% and $500 million of which are outstanding — were trading at around 75% of par, a price consistent with a yield to maturity of 16% to 17%. Today, these bonds are priced at about 100.5% of par, equivalent to a YTM of just 6.58%.

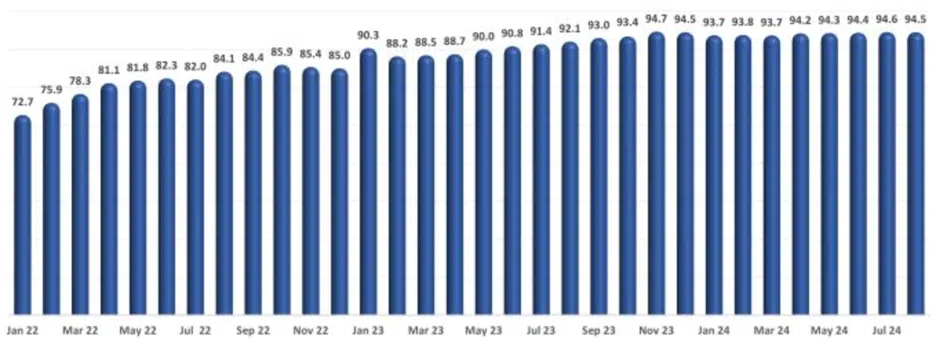

United Natural Foods, Inc. – Price as a Percentage of Par for 6.75% Bond Due October 15, 2028

Financial Results

As noted earlier, UNFI’s sales increased noticeably over the last three reported quarters, breaking a string of essentially flat revenue growth over the previous three quarters ending April 27, 2024. Indeed, the recent strong sales growth prompted management on March 11, 2025, to raise its FY 2025 (twelve months ending in early August 2025) revenue estimate to $31.3 to $31.7 billion, up $700 million at the midpoint from its previous estimate. UNFI’s gross profit margin has remained in the low to mid 13% range for the last ten quarters (including 13.1% in 2Q FY 2025, 13.2% in 1Q FY 2025 and 13.7% in 4Q FY 2024), and we would expect this range to hold through at least the medium term.

Sources: Last six earnings releases of United Natural Foods, Inc.

Particularly noteworthy is the impact that impressive revenue growth and cost controls had on UNFI’s cash flows in 2Q FY 2025. The company’s adjusted EBITDA and free cash flow during the period improved to $145 million and $193 million from $128 million and $116 million, YoY respectively. (UNFI’s business is highly seasonal; cash flows are negative in the first fiscal quarter of its year, and positive in the three subsequent quarters.)

Over the 53 weeks ended February 1, 2025, UNFI’s operating cash flow and adjusted EBITDA totaled $453 million and $552 million, respectively, and the company projects these cash flow measures to reach more than $450 million and $550 to $580 million, respectively, in FY 2025. UNFI’s free cash flow is estimated to follow a similar pattern: it was positive $154 million over the 53 weeks ended February 1, 2025, and should be more than positive $150 million in FY 2025.

Customer Concentration and Tariff Impact Risks Both Seem Small

Sales to Whole Foods comprised 23% of UNFI’s sales in its most recent fiscal year, [21] making UNFI quite dependent on one customer. However, Whole Foods has been a UNFI customer for 20 years. [22] Furthermore, in May 2024, UNFI signed an amended distribution agreement with the Amazon-owned grocer which runs through May 20, 2032. [23] Of course, this long history does not preclude the possibility that Whole Foods could at some point consider changing wholesale suppliers (as Albertsons did ten years ago), but the strong and lengthy relationship between Whole Foods and UNFI suggests the odds of such an action are fairly small.

Tariff concerns, perhaps the biggest worry for many industries across the U.S., seem modest for UNFI. Mexico, clearly a country in the tariff crosshairs of the Trump Administration, is the leading importer of organic foods into the U.S., but that amounted to only $110 million in 2023, according to Tendata, a Shanghai, China-headquartered digital international trade service. Peru, Colombia, and Honduras — all countries with low profiles in terms of tariff discussions — are the numbers two through four importers of organic foods into the U.S., comprising just $90 million, $70 million, and $70 million, respectively in 2023. [24]

Investment Summary and Valuation

One of the chief positives of investing in UNFI stock is the ability to identify the key driver of the company’s future profitability and cash flows. In UNFI’s case, this variable is whether, and to what degree, the company will be able to control its operating expenses in the near and medium terms. For most companies, a host of variables impact future cash flows and investor perception of value, often making the decision to invest quite complex. Furthermore, UNFI is unlikely to be significantly impacted by the global trade war being waged by the Trump Administration since the company relatively few products from foreign countries.

As UNFI showed in its 4Q FY 2024 through 2Q FY 2025 financial results, if management can control costs, UNFI’s profits and cash flows can increase rapidly. Of course, an increase in revenue, especially growth in unit volumes, which UNFI enjoyed in its last two reported quarters, can add even more to earnings and cash flow growth. Given UNFI’s large revenue and operating cost bases and its relatively small amount of shares outstanding, even a modest reduction in operating costs can have an outsized impact on UNFI’s cash generating ability and value. More specifically, just a 25 basis point permanent reduction in its operating costs as a percentage of revenue could result in incremental annual operating cash flow and free cash flow of around $75 million, which in turn could prompt an ~$8 upward reset in its share price.

Based on the $565 million midpoint of UNFI’s adjusted EBITDA guidance for FY 2025, UNFI trades at an EV-to-forward adjusted EBITDA multiple of just 6.5x, or more than a 50% discount to the S&P 500. Generally speaking, the stock market assigns low cash flow multiples to companies with limited or uncertain growth prospects or to businesses which generate negative free cash flow.

UNFI fits neither of these categories. Investors are currently penalizing UNFI’s stock because the overall grocery wholesale delivery business is set to grow at a low single digit percentage rate for the foreseeable future, which in turn presumably implies a low EV-to-EBITDA valuation is merited. We generally acknowledge the first aspect of this claim (notwithstanding UNFI’s strong realized unit volume growth over the last seven months or so), but not its conclusion — at least not for UNFI. As noted above, the growth in UNFI’s future cash flows is quite sensitive to its ability to control costs, which is management’s chief focus. Just a small reduction in its operating costs as a percentage of revenue can have significant financial implications; witness the 13% to 54% range of year-over-year increases in adjusted EBITDA in UNFI’s three most recently reported quarters — quarters in which the company was able to cut operating costs as a percentage of revenues by relatively small amounts (0.35%, 0.65% and 0.36%, respectively). In our view, investors are underestimating management’s ability to cut operating costs further which would make UNFI’s future EBITDA growth more predictable and make UNFI shares much more valuable.

The sensitivity of UNFI’s share price to what we believe is a merited revaluation of its EV-to-EBITDA ratio is likewise significant. For each 0.5x improvement in this multiple, UNFI’s EV and stock market capitalization would each increase by about $280 million (0.5 times FY2025E adjusted EBITDA of $565 million). If one divides this potential increment by UNFI’s 60.5 million shares outstanding, this calculation implies that a modest 0.5x increase in UNFI’s EV-to-EBITDA multiple translates into about a $5 boost in its stock price.

KCR What’s In Your Portfolio?TM

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2023 Kailash Capital Research, LLC – All rights reserved.

April 17, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

April 17, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin