Note: the most important chart for tech investors today is on page three…and it is not complicated.

Our last white paper on tech, The Troubles of 2025 are on Full Display, demonstrated that:

- Technology’s share of total market cap has eclipsed the prior peak in the dot com bubble

- Technology’s bloated market cap has come, in no small part, from multiple expansion

- No matter if we use price to sales or free cash flow yields, US tech is deep in bubble territory

Get our insights direct to your inbox: SUBSCRIBE

Now. For the elephant in the room. Earnings. This is the argument for why “this time is different.”

Tech bulls will tell you that, unlike in the dot com bubble, today the biggest tech stocks are profitable. We agree.

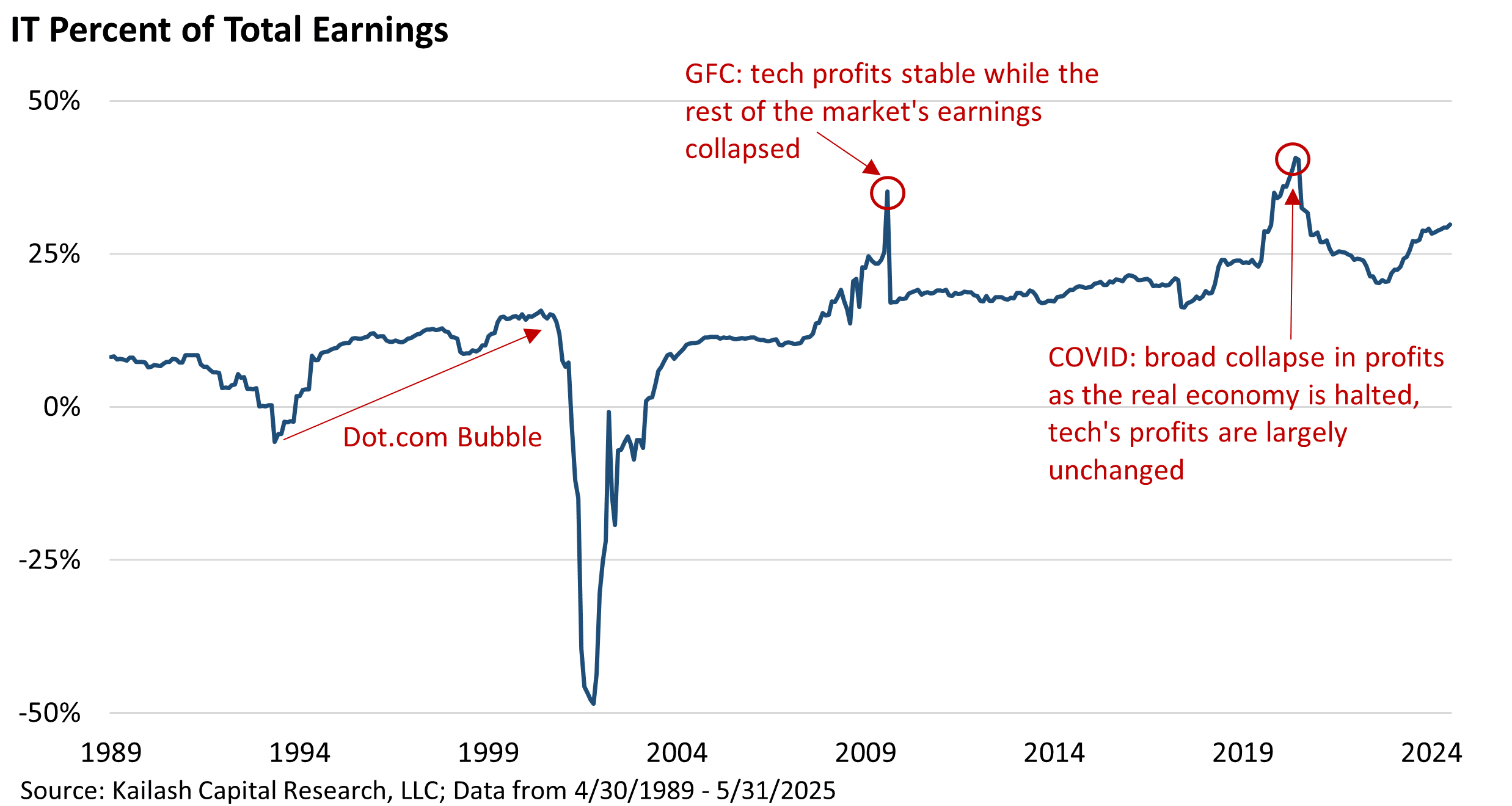

Let’s take a look at the data and see if we might convince you that faith in eternally high profit margins is a recipe for disaster. The chart below shows the Tech sector’s share of total corporate earnings.

While the share was relatively modest and stable through the early 2000s, it experienced a sharp collapse around the dot com bust and has since trended steadily upward. Tech now accounts for just over 30% of the market’s total earnings, reflecting a large increase in its contribution to aggregate corporate profitability

Continuing to look at the chart above, when the mortgage bubble imploded in 2008 it collapsed the profits of many other sectors in the economy, causing Technology’s share of total profits to spike sharply. We saw the same phenomenon during Covid.

In the post 2003 period then, technology has been an earnings fortress with profits seemingly impervious to exogenous shocks.

So, Technology stocks now represent 40% of the weight in the S&P 500 benchmark [2] and roughly a third of the total earnings in the US stock market. That sounds reasonable until you look at the dot com experience.

By the end of the dot com bubble, tech represented 16% of the market’s total profits, as seen on the prior page. Yet this profits boom was an illusion created by money-losing startups that purchased vast quantities of products from big tech companies.

The demand for technology equipment from loss-making startups created an illusion of robust and rising profits at the larger tech firms. In response, technology companies ramped spending on engineers, salespeople and advertising known as “SG&A”. The chart below shows that

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

July 3, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

July 3, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin