Ralph Lauren Corporation (RL) is a global leader in the design, marketing, and distribution of apparel and accessories that span the mid-range to luxury segments. RL’s products are sold through a variety of distribution channels under well-known brand names such as Polo Ralph Lauren and the Ralph Lauren Collection.

Get our insights direct to your inbox: SUBSCRIBE

Why RL’s Recent Strong Returns May Have Much Farther to Run

• RL has reported impressive financial results for the last five quarters.

• Comparable store revenues over the most recent twelve months increased 6%.

• Over the last few years, RL has implemented a three-pronged business strategy which includes:

- product elevation (which essentially means higher prices).

- personalized and targeted promotion, and

- disciplined inventory management.

- These practices boosted gross margins to 67.2% up from 64.9% in FY 2023.

• RL’s rising sales and improving gross margins translated led to impressive EPS gains and a significant increase in free cash flow.

EPS Growth:

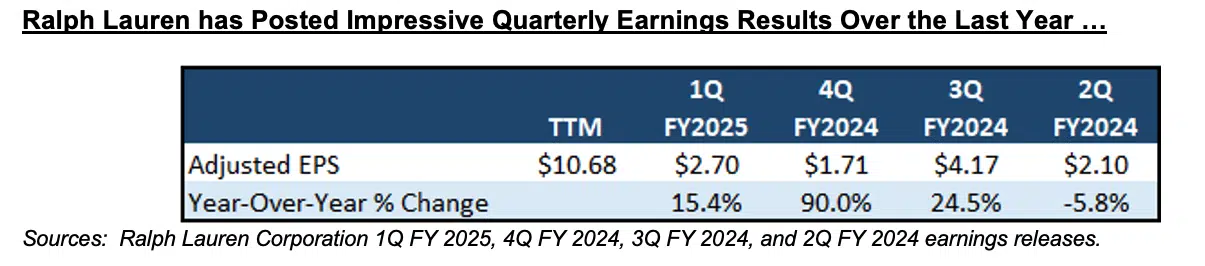

• In four of the last five quarters, RL posted a year-over-year EPS increase of >15%.[1]

• RL’s EPS for the twelve months ended June 2024 was $10.68, up nearly 30% from $8.34 in FY 2023.

• If RL can close the gap in gross margins with competitors, these strong results may continue.

Potent Free Cash Flow & Disciplined Capital Allocation:

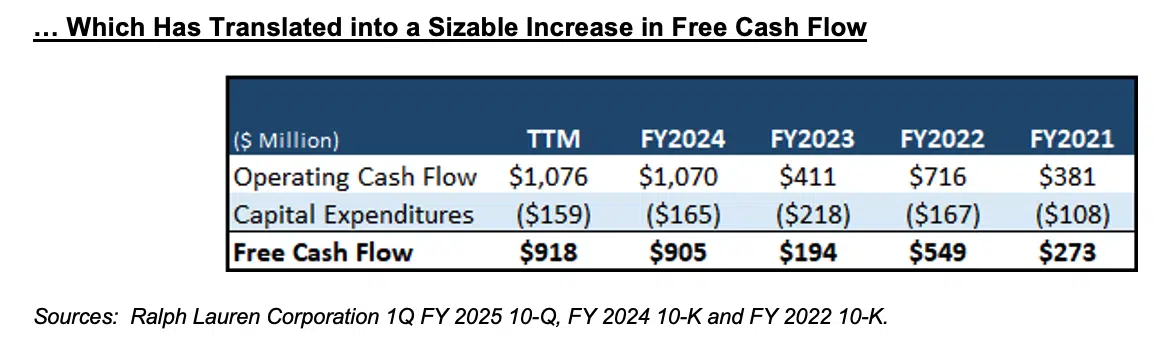

• The company generated over $900ml in FCF over the last four quarters.

• The company has < $1bn in net debt, and an Enterprise Value of only $11.5bn, equal to an 8% FCF Yield

• RL has consistently repurchased shares at these discounted valuations, wiping out nearly 6% of the shares outstanding in the last year alone.

What Could Go Wrong: Uncertain Luxury Trends May Signal Trouble

• More than almost any other luxury retailer, RL has relied upon price increases, not volume increases, as the key to realization of its revenue targets.

• Indeed, average unit retail prices in its direct-to-consumer business have increased 80% in aggregate over the four-year period FY 2021 through FY 2024.

• In the current environment where even higher income customers appear to be more cautious regarding their purchasing decisions, a heavy reliance on price increases may be a higher risk strategy than it was several quarters ago.

• U.S. consumer spending on brands that are under-indexed to higher income consumers, such as Ralph Lauren, was down 8% year-over-year in 2Q 2024, and 6% in 1Q 2024.

• Spending on the over-indexed brands was down as well in 2Q 2024: negative 5% year-over-year.[2]

In this post, we will do our best to offer some details behind our bullish view on RL.

Summary

Ralph Lauren Corporation (RL) has reported better than expected financial results throughout 2023 and 2024. The company’s sales, gross margins, and EPS[3]

have increased notably over the last five quarters. RL’s stock has jumped nearly 50% over the last year and has outperformed the S&P 500 (+24%) over this period.[4]

RL has so far avoided the 2024 sales shortfalls — and accompanying stock price corrections — reported by other makers of personal luxury items such as LVMH, Burberry, and Capri Holdings. We would note that the sales environment for luxury items continues to weaken in the U.S. and across the globe.

Why we are bullish in three bullets:

1. It is possible that RL’s knowledge of its customers’ product interests and tastes may allow the company to avoid a future sales disappointment.

2. Investors’ macro concerns about the health of the personal luxury goods industry has weighed on the company’s valuation.

3. We believe at an 8% FCF Yield and 13.5x forward earnings, investors have priced in a fairly negative future for a global leader like RL.

Company Description

RL is a global leader in the design, marketing, and distribution of apparel and accessories that span the mid-range to luxury segments. RL’s products are sold through a variety of distribution channels (retail, wholesale, and licensing) under well-known brand names such as Polo Ralph Lauren and the Ralph Lauren Collection. Notably, RL was the Official Parade Outfitter for the U.S. Olympic Team at the recent Summer Olympic Games in Paris.

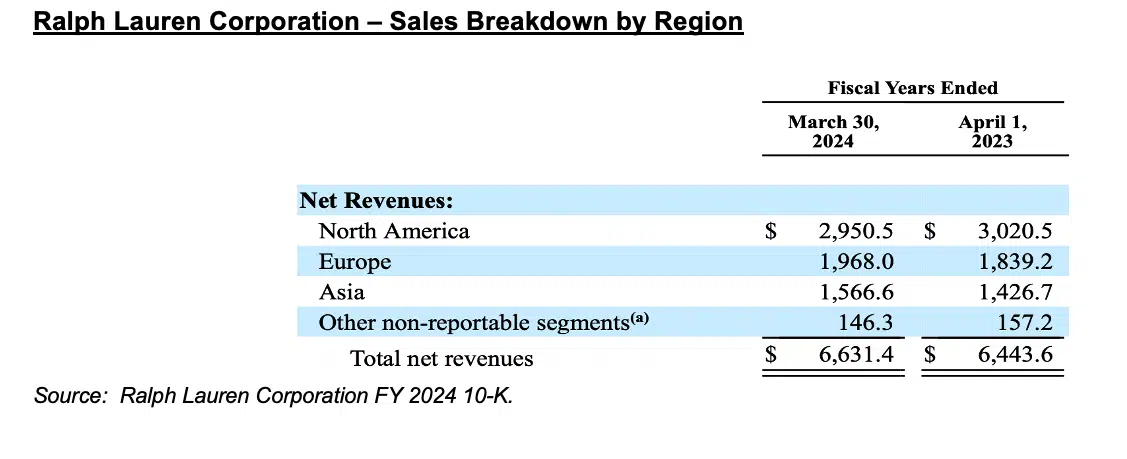

RL’s business is well diversified by geography. Sales are split between North America (44%), Europe (30%), and Asia (24%). Importantly, China represents only about 6% of the company’s revenue, measurably smaller than many other luxury retailers.[5]

This relatively small weighting is a positive given the slowdown in luxury spending in the world’s most populous nation.

Impressive Financial Results Over the Last Five Quarters

RL has reported impressive financial results for the last five quarters. RL’s 2025 fiscal year is the twelve months ending in late March 2025. Comparable store sales growth has been positive in each of the last five quarters, and comparable store revenues over the twelve months ended June 29, 2024 increased about 7%.[6]

Over the last few years, RL has implemented a three-pronged business strategy which includes product elevation (which essentially means higher prices), personalized and targeted promotion, and disciplined inventory management. These practices, particularly the company’s focus on increasing unit prices, have boosted RL’s gross margin. Indeed, its adjusted gross margin reached 67.2% for the most recently reported twelve months, up from 66.8% in FY 2024 (twelve months ended March 30, 2024), and 64.9% in FY 2023.[7]

Not surprisingly, RL’s rising sales, combined with 200+ basis points in gross margin improvement over the last five quarters, have translated into impressive EPS gains and a significant increase in free cash flow. More specifically, in four of the last five quarters, RL posted a year-over-year adjusted EPS increase of at least 15%. Furthermore, the company’s adjusted EPS for the twelve months ended June 2024 was $10.68, up nearly 30% from $8.34 in FY 2023 (twelve months ended April 1, 2023).[8]

RL’s free cash flow generation has increased at an even faster rate. Over the most recent twelve months, the company has generated free cash flow of $918 million ($14.82 per RL share), up from $194 million in FY 2023, and $549 million in FY 2022.

More than almost any other luxury retailer, RL has relied upon price increases, not volume increases, as the key to realization of its revenue targets. Indeed, average unit retail (AUR) prices in its direct-to-consumer (DTC) business have increased 80% in aggregate over the four-year period FY 2021 through FY 2024. The AUR price rose a further 6% year-over-year in 1Q FY 2025. Wedbush analysts calculate that RL has raised its DTC AUR prices for a remarkable 29 consecutive quarters – a testament to the strength of their brands, in our view.[9] RL plans to continue raising its prices as it seeks to elevate the cachet of its brands.[10]

Ralph Lauren Corporation has Implemented an Aggressive Pricing Strategy

We understand that this recent strength may also be one of the stock’s biggest risks but feel the valuation is already baking in a good deal of bad news on this front. We discuss this in more detail on the following pages.

How a Slowing Luxury Market Could Undermine Recent Pricing Trends

The luxury sector enjoyed a surge in spending during the COVID-19 pandemic as affluent customers diverted funds from travel to high-end goods. As travel options for the well-off are now fully open, luxury goods makers are transitioning to a more normalized business environment where the tailwinds that characterized much of the pandemic period are not always present. Those luxury goods market tailwinds seem to have changed to at least

mild headwinds. Growth is slowing in some sectors, and business has turned down in others. In turn, investors are now being forced to reassess long-held beliefs that luxury brands are insulated from any economic downturn.

For example, LVMH, the world’s most valuable fashion company, reported just a 1% increase in organic revenue in its key Fashion & Leather Goods segment in the first half of 2024 compared with a 20% increase in the year ago period.[11] A slowdown in China was a key reason for the weaker than expected results. Rising outbound tourism by Chinese is pulling consumers away from domestic spending, as is a phenomenon dubbed “luxury shame” where consumers are increasingly hesitant to splurge on high-end items. (A similar attitude prevailed in the U.S. during the 2008-2009 financial crisis.)[12] Furthermore, Bloomberg reports that luxury return rates in China have risen to around 50% this year, well above the luxury industry average of 30%.[13]

Another example: Capri Holdings’ Michael Kors brand sales plunged 14% to $657 million in the quarter ended June 29, 2024. Michael Kors’ sales fell in all markets: revenue in the Americas, EMEA, and Asia fell 10%, 11%, and 23%, respectively.[14]

RL has (so far) avoided the sharp downturns experienced by other luxury brands, but the company is not immune to the pressures being felt in many corners of the luxury market.

Yet these negative headwinds have hardly gone unnoticed. Based on the company’s FCF yield, the company is now cheaper than ~90% of stocks in our Large Cap Universe.[15] If we were alone in observing these headwinds and the stock was trading at a premium, we would be far more concerned. Instead, the stock appears to be pricing in quite a bit of this bad news.

Luxury Market Spending Data Trends Continue to Weaken

The market for personal luxury goods grew in 2023, reaching 362 billion euros on a global basis last year, up 4% from 2022, and up nearly 30% from 2019, the last full year before the pandemic.[16]

However, sales growth softened quarter by quarter as 2023 progressed.

Equally concerning, spending by U.S. high-income shoppers, defined by Consumer Edge as individuals with annual income of more than $150,000, dropped by 5% in 2Q 2024. Spending by such affluent shoppers in the just-completed quarter is at its lowest point since 2Q 2020. Could this be an inflection point?

Higher-income shoppers are still spending on luxury brands, but the decline in overall spending by such customers has scared investors.[17]

Consumer Edge is a consumer-focused data analysis firm which tracks 100+ million U.S. credit and debit card payment accounts.

The luxury spending slowdown continued in July 2024. According to a study based on data from 10 million credit card holders by Citi Research, U.S. consumers spent 11% less on luxury goods in July 2024 versus July 2023. This marked a significant deterioration from a 7% year-over-decline in June 2024. Sales of leather goods and ready-to-wear apparel were especially weak luxury segments in July 2024, declining 19% and 15%, respectively, versus the year-ago period.[18]

Lauren Family Controls 84% of the Voting Power & 35% of the Shares Outstanding

Through its ownership of Class A and Class B shares, Ralph Lauren and the Lauren family control about 84% of the voting power of RL stock. Notably, the family owns all 21.9 million Class B shares outstanding. Holders of Class B shares are entitled to ten votes per share, while Class A holders have one vote per share. As of August 1, 2024, 40.1 million Class A shares were outstanding.[19]

The KCR team believes this is an interesting dynamic. The family has been relentless in repurchasing from the Class A owners. Based on shares outstanding, the Class A shares are worth roughly $6.9bn of the company’s $10.7bn market cap, with the remainder in the Class B shares owned by the family.

This has the potential to supercharge the impact of the firm’s commitment to returning capital via share repurchases. Why? Well the family, which already owns $3.8bn of the company, must believe this is the most efficient method of returning capital to themselves in terms of EPS, dividends, and stock price.

For context, over the last 12 months the company’s ~$600ml in repurchases equals nearly 10% of the float. Over that same period, RL paid out nearly $200ml in dividends. So these repurchases suggest to the KCR team that the family is happy seeing their share of those future dividends and earnings rise and the repurchases also have an outsized impact on the float.

For our friends in the Small & Midcap world we would also note that these same macro fears appear to be creating bargains in midcap brands.

Specifically, our SMID model ranks

• Tapestry, Inc. (key brands: Coach, Kate Spade, Stuart Weitzman) as the number 2 pick in our ranks this month.

• Our model also sees solid value in PVH Corp. (key brands: Tommy Hilfiger and Calvin Klein) which ranks 98 out of ~1,600 stocks.

• In contrast, our model sees a much dimmer outlook for Capri Holdings Ltd, (ticker CPRI, key brands: Versace, Jimmy Choo, Michael Kors), which ranks 745.

We have provided the one-page tear sheets for each of these three SMID stocks below. Please reach out if you would like to learn more!

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2023 Kailash Capital Research, LLC – All rights reserved.

September 26, 2024 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

September 26, 2024

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin