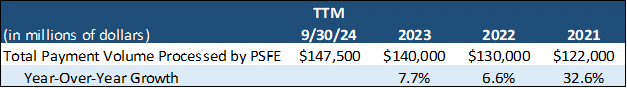

Paysafe Limited (PSFE) provides payment solutions, including credit and debit card processing, digital wallets, and real-time banking. The company serves 18 million active users in more than 120 countries who can interact with 250,000+ small and medium-sized businesses (SMBs). In so doing, PSFE processed more than $140 billion in digital commerce transactions in 2023, or nearly 3% of the $4.5 trillion aggregate size of the world’s digital commerce market.

Get our insights direct to your inbox: SUBSCRIBE

PSFE’s payments platform serves consumers and merchants in the entertainment industry, particularly in fast-growing iGaming (betting related to sports, e-sports, fantasy sports, poker, and other casino games). Notably, iGaming revenue in PSFE’s Merchant Services segment increased about 50% year-over-year in 3Q 2024. Furthermore, two of PSFE’s digital wallet brands, Skrill and Neteller, are rated by Fortis Media as the second and third best digital wallets in the iGaming industry.

Why We are Bullish on PSFE:

- After private equity owners monetized some of their 2017 investment in PSFE via a SPAC transaction in the spring of 2021, PSFE has collapsed, falling an incredible -90%.

- This painful experience caused investors to ignore the company’s subsequent impressive revenue and cash flow increases over the last seven quarters and positioning itself as an attractive takeover candidate.

- Despite nearly doubling since its bottom in May 2023, PSFE still looks deeply undervalued, in our view.

- In each of the full years 2021-2023, PSFE generated annual free cash flow of about $220 million, or $3.60/share. So, PSFE trades at a free cash flow yield of about 20% of equity or roughly 8% of EV.

- Considering the compelling fundamental backdrop of high growth, technological sophistication, and lower costs than legacy card services, PSFE looks to be an attractive acquisition candidate as it disrupts the oligopoly of Visa, Mastercard, and American Express.

- For context on what PSFE could be worth: Paysafe was bought for $4.7bn by two private equity firms in 2017 when its EBITDA was just $301 million vs. ~$500ml today. [1] This implies a takeout EV-to-adjusted EBITDA multiple of more than 15x.

- Today, PSFE generates two-thirds more adjusted EBITDA than it did in 2016, yet its EV is only $3.3 billion, or just 70% of the price that highly sophisticated investors paid for this payments platform enterprise eight years ago. So, what does that mean?

- At 15x EBITDA the equity would rise 4.6x. If the next takeout was done at only 10x EBITDA, the equity value would rise nearly 2.5x. We think somewhere in that range is reasonable. Here’s why:

- Considering the rapid growth in digital wallets and the benefits to merchants who cite credit card swipe fees as their number one pain point, we think it is worth noting that Visa and Mastercard trade at ~15x sales vs. PSFE trading at 0.7x.

What is the Bear Case?

Given the relentless growth in global digital commerce and the need for state-of-the-art payments providers such as PSFE to service that growth, the chief risk for PSFE is a worldwide economic slowdown where all commerce would slow, including iGaming. Even in such a scenario, PSFE’s low valuation and free cash flow generation ability could limit the downside in the stock.

Company Description

Paysafe Limited (PSFE) is a payments platform that serves consumers and merchants in the entertainment industry, particularly in fast-growing iGaming (betting related to sports, e-sports, fantasy sports, poker, and other casino games). Notably, iGaming revenue in PSFE’s Merchant Services segment increased about 50% year-over-year in 3Q 2024. [1] Furthermore, two of PSFE’s digital wallet brands, Skrill and Neteller, are rated by Fortis Media as the second and third best digital wallets in the iGaming industry. [2] PSFE serves about 1,500 operators across the global iGaming market.[3]

More broadly, PSFE provides payment solutions, including credit and debit card processing, digital wallets, and real-time banking. The company serves 18 million active users in more than 120 countries who can interact with 250,000+ small and medium-sized businesses (SMBs). In so doing, PSFE processed more than $140 billion in digital commerce transactions in 2023 [4], or nearly 3% of the $4.5 trillion aggregate size of the world’s digital commerce market last year. [5] One of PSFE’s competitive strengths in the payments platform industry is it processes credit card transactions for some higher-risk merchants, though PSFE has been pruning many of its riskiest clients in 2024. [6] PSFE charges smaller, newer retailers that it deems creditworthy, a $200 per month fee for this service. Most payment platforms do not accept high-risk merchants. [7]

Volumes Processed by Paysafe Limited, Year-By-Year Progression

Digital Wallets

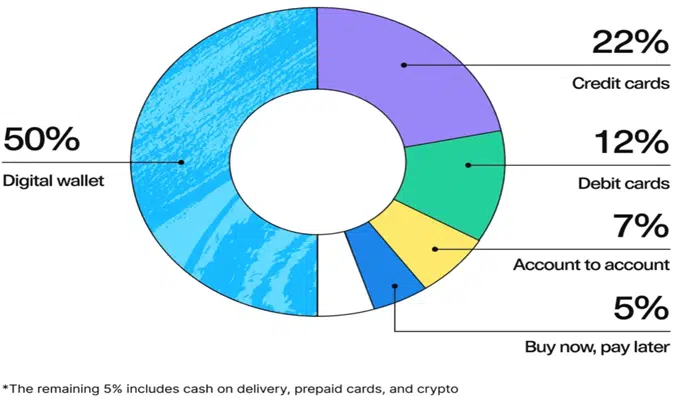

Digital wallets, or e-wallets, are online services that allow individuals to execute electronic transactions, typically payments. Such electronic payments, which are a convenient alternative to traditional payment methods, can be made via a computer or smartphone. Two key requirements for successful digital wallets are encryption technology and the assurance of secure and swift transactions. Consumers generally appreciate the convenience afforded by digital wallets to make contactless, one-click payments without the need to enter credit or debit card details. In addition, payments from digital wallets are accepted by businesses on a broad scale. This potent combination has translated into aggregate payments from digital wallets representing half of 2023 global e-commerce spending and about 30% of all 2023 global point of sale (POS) transaction value. [8]

Furthermore, consumers are increasingly using digital wallets to make purchases not just online, but also in the giant “in-store” economy. In 2024, about 28% of purchases at “brick and mortar” locations were made via digital wallets, up from 19% in 2019. In-store consumer-to-business spending accounts for about a $10 trillion annual market in the U.S. and Europe combined. [9] From an even wider perspective, digital wallets are evolving into comprehensive platforms which now include such features as the ability to integrate payments, identity, loyalty perks, and even health care. In other words, they are becoming a central aspect of many consumers’ lives. [10]

About seven million people worldwide are active users of PSFE’s digital wallet brands. Both the average number of transactions per active user and the average revenue per active user has trended higher over the last seven quarters.

Paysafe Limited’s Revenue Per User and the Number of Transactions Per User Continue to Grow

Why Payments Platforms Such as Paysafe Limited Will Continue to Grow and Take Market Share

PSFE’s business plan — and, to a great degree, its growth potential — may be summarized by the notion that an ever-increasing proportion of digital commerce around the world is outpacing the capabilities of: 1) traditional payment providers like the giant credit card companies Visa, Mastercard, and American Express; and 2) e-commerce providers such as Shopify or WooCommerce that bundle the front-end interface with the back-end infrastructure and data base. [11] Such well-known companies provide a comprehensive solution without requiring complex integrations between separate systems.

Both these categories of legacy providers are struggling to provide the flexibility and advanced features, including sophisticated risk management, that younger consumers demand. In contrast, PSFE’s payments platform and its digital wallet brands provide state-of-the-art features.

One statistic which is driving online merchants to consider accepting payments from sources other than credit cards is the high cost of processing such transactions. Indeed, U.S. merchants paid a staggering $100.8 billion in credit card swipe fees in 2023 to Visa and Mastercard alone. [12] To reinforce this point, a 2023 poll of merchants by Plaid, the giant data transfer network company based in San Francisco, shows that the cost of payments is by far merchants’ biggest “pain point.” Note especially than U.S. merchants footed these enormous credit card swipe fees even though digital wallets were used more than twice as frequently as credit cards in 2023 to pay for online transactions.

Merchants’ Biggest Pain Point Related to Payments

Source: “The future of e-commerce payments,” Plaid, by Danielle Antosz, August 7, 2024.

Separately, but a related point, the younger the consumer, the less she is inclined to utilize credit cards. Per a study by Ernst & Young, the professional services and accounting firm, only 39% of Gen Z (individuals born between 1997 and 2012) say they frequently use credit cards, a significant gap versus the 51% usage pattern of older consumers. Furthermore, many members of Gen Z (39%) also profess that even entering a four digit PIN is a bothersome extra step in completing a debit card transaction. [13] This behavioral difference is constructive for the continued growth of new payments platforms, such as PSFE’s digital wallets.

Paysafe Limited’s Operations

PSFE has two major segments:

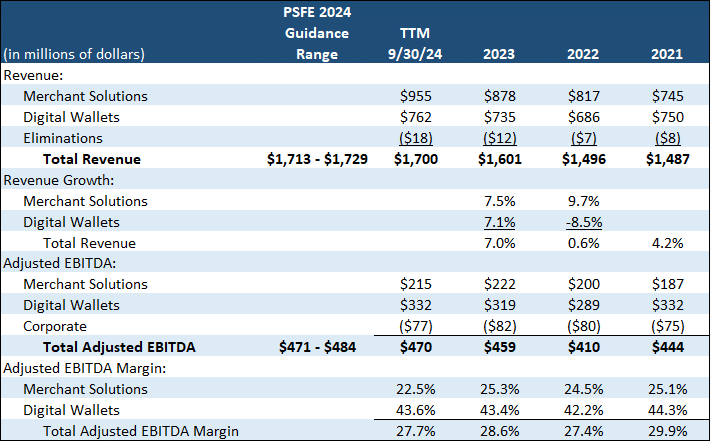

- Digital Wallets ($734 million of 2023 revenue, or 46% of the company’s overall sales; and $319 million of 2023 adjusted EBITDA, or 59% of the company’s 2023 total before corporate overhead). Users can transact in 14 languages and in 40 currencies to transfer funds with 250+ types of cardless methods. [14]

- Merchant Solutions ($867 million of 2023 revenue, or 54% of PSFE’s aggregate sales; and $222 million of 2023 adjusted EBITDA, or 41% of PSFE’s 2023 total before corporate overhead). This segment provides payment acceptance services allowing SMBs to receive payments in 40+ currencies in-store, online, or via mobile channels. E-commerce accounts for around 15% of Merchant Services’ revenue. [15]

Revenue and Adjusted EBITDA Details of Paysafe Limited’s Business Segments

Sources: Last four Paysafe Limited quarterly earnings releases and year-end 2022 and year-end 2021 earnings releases.

PSFE’s revenues are the transaction fees it assesses based on either a percentage of the transaction dollar volume or a fixed fee for each transaction, or a combination of the two. The fees are assessed when funds are loaded onto digital wallets, when these funds are used to make a transaction, and when PSFE processes a credit or debit card transaction for merchants on its system.[16] Notably, these fees are small on a percentage basis and therefore fairly easily tolerated by consumers; they represent only about 1% in aggregate of the dollar amount of digital commerce transactions processed by PSFE ($1.6 billion of PSFE’s 2023 revenue divided by $140 billion of digital transactions handled by the company).

PSFE History

In December 2017, Paysafe was acquired for $4.7 billion, including assumed debt, and taken private by the private equity firms CVC Capital Partners plc and Blackstone. Just over three years later, Paysafe’s owners decided to monetize some of their investment through a SPAC (Special Purpose Acquisition Company) transaction. More specifically, in late 2020, Paysafe Group Holdings Limited announced it would become a publicly traded company via a merger with Foley Trasimene Acquisition Corp. II. The SPAC merger closed in March 2021, creating the combined company now known as PSFE. [17] Blackstone owns 18% of PSFE as of September 30, 2024 and is its largest shareholder. [18]

Partnerships with Revolut and Deutsche Bank

PSFE announced an important partnership in July 2024 with Revolut Group Holdings, Inc., a London-based financial technology company with 10 million customers in the UK and 45 million customers worldwide. Per the accord, PSFE is providing its eCash services to Revolut’s UK customers, allowing them to deposit or withdraw cash from their bank accounts at any of PSFE’s POS locations in the country. Over the first three months of the agreement, 28,000 unique Revolut clients used this service (and PSFE collected fees for providing it). [19]

PSFE announced a similar deal in late October 2024 with Deutsche Bank whereby Deutsche Bank’s retail customers can complete cash transactions at PSFE’s 12,500 POS locations across Germany. A wider roll out to all Deutsche Bank clients is expected in the second half of 2025. [20] This convenience for Deutsche Bank customers is meant to offset about a 10% reduction in the number of operational ATMs in Germany over the last five years. [21]

PSFE’s Financial Results Have Been Impressive in 2023 and 2024

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2023 Kailash Capital Research, LLC – All rights reserved.

January 10, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

January 10, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin