Pediatrix Medical Group, Inc. (MD) operates a nationwide network of more than 2,300 affiliated physicians who provide neonatal, maternal-fetal, and pediatric specialty care. As of December 31, 2024, 1,335 of MD’s neonatal physician specialists provided clinical care, primarily within hospital-based neonatal intensive care units (NICUs), to babies born prematurely or with complications. Together with MD’s nurse practitioners and other pediatric clinicians, these physicians manage clinical activities at more than 350 NICUs across 30 states, or about a quarter of the aggregate 1,424 NICUs currently operating in the U.S.

Get our insights direct to your inbox: SUBSCRIBE

Why We are Bullish on MD:

- MD is an unusual company: it is a publicly traded specialty physicians practice. Such practices — if successful, as MD’s is — generate significant cash flow, have a high degree of predictability, and are almost always privately owned. MD easily checks the first two of these boxes. The company generated around $200 million of annual free cash flow in 2023 and 2024 and appears quite likely to produce an even larger amount in 2025.

- A business with such positive characteristics is typically highly sought after and highly valued. However, MD trades at single digit P/E and enterprise value (EV)-to-EBITDA multiples: about 8x and 7x, respectively.

- Perhaps because of its relatively small stock market capitalization, many investors do not yet appreciate how undervalued MD stock is. If MD were revalued to just a 10x forward-year P/E multiple or if its EV-to-EBITDA ratio were to improve by just one turn, the stock price would be 20% higher.

- For some time, physicians’ practices have been popular acquisition candidates for private equity investors because of their predictability and projected moderate growth in the cash flow of their businesses, two of MD’s most attractive investment characteristics.

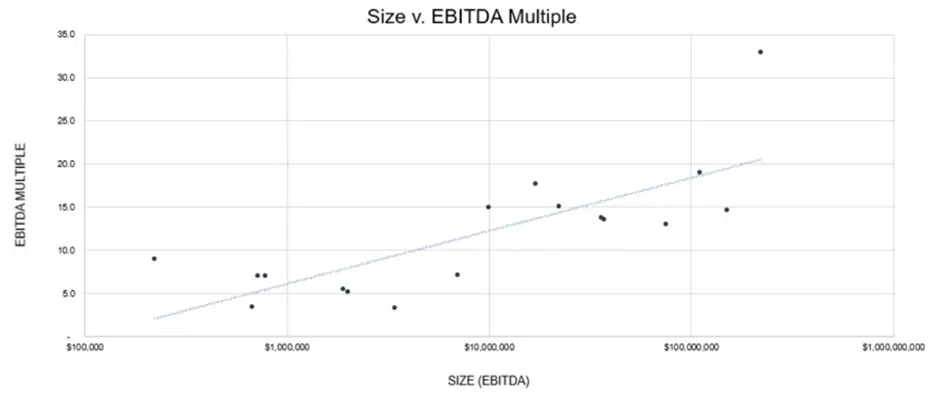

- In 2022 and 2023 combined, private equity entities acquired about 760 physician practices. A healthcare data analysis firm closely analyzed 33 such transactions which closed between May 2022 and May 2024. These deals had a median EV-to-EBITDA multiple of 13x, and the transaction multiples tended to be higher for practices with larger EBITDA levels (e.g., $100+ million). This data suggests that the stock market is currently ascribing a much lower valuation to MD than many sophisticated investors do.

- MD’s patient volumes have increased on a year-over-year basis for each of the last five quarters, including by more than 2% on average over the last three. Furthermore (and also over the last five quarters), MD is being reimbursed for an increasing portion of the services it provides by non-government-sponsored insurance payors. This gradual transition is key because compensation rates from private sector health plans are almost uniformly much higher than Medicaid-based programs.

What is the Bear Case?

While the headlines surrounding long-term Medicaid cuts entailed in the One Big Beautiful Bill Act are real, these spending reductions should have a limited impact on MD because the legislation: 1) does not reduce federal participation across-the-board for adults under 65 with an income of up to 138% of the federal poverty limit (FPL); and 2) does not alter the existing framework whereby children under the age of one and pregnant women are covered up to an income limit of 138% of the FPL in the states in which MD provides service

Investment Summary

Pediatrix Medical Group, Inc.’s (MD) stock price has approximately doubled since early July 2024 lows of around $6.80 but remains far off its highs above $30 in the summer of 2021. Even more important, MD stock has the enviable combination of significant upside potential with limited downside risk. The company’s business is growing and highly predictable and generates significant free cash flow, making MD an attractive takeover candidate. Nevertheless, the stock trades at single digit P/E and enterprise value (EV)-to-EBITDA multiples. If MD were revalued to just a 10x forward-year P/E multiple or if its EV-to-EBITDA ratio were to improve by just one turn, the stock price would be 20% higher.

Company Description

MD operates a nationwide network of more than 2,300 affiliated physicians who provide neonatal, maternal-fetal, and pediatric specialty care. As of December 31, 2024, 1,335 of MD’s neonatal physician specialists provided clinical care, primarily within hospital-based neonatal intensive care units (NICUs), to babies born prematurely or with complications. Together with MD’s nurse practitioners and other pediatric clinicians, these physicians manage clinical activities at more than 350 NICUs across 30 states, or about a quarter of the aggregate 1,424 NICUs currently operating in the U.S. [1]

Some hospitals, including Johns Hopkins All Children’s Hospital and the Mayo Clinic, operate and staff their own NICUs, [2] but many of these sprawling and heavily scrutinized institutions, pressured by rising costs and the increasing complexity of healthcare operations, continue to outsource both clinical and non-clinical services. [3] Consequently, the number of NICUs managed by MD certainly could increase over the medium and longer terms.

In addition, about 490 MD maternal-fetal physicians, along with nurse practitioners and nurse mid-wives, provide inpatient and clinical care to expectant mothers and their unborn babies. MD’s specialists in this area practice mainly in metropolitan areas. Finally, about 490 MD physicians provide hospital-based pediatric care, including intensive care and surgical care.

As an aside, MD’s ability to retain its best physicians seems to be high. According to a recent American Medical Association study, more and more doctors are moving from private practices to practices owned by larger organizations, including private equity firms. Physicians cite inadequate payment rates, costly resources, and burdensome regulatory and administrative requirements as key reasons for this migration. [4]

Regrettably, Preterm Births are Increasing, But This Trend Boosts MD’s Business

Unfortunately — though it is a constructive factor for MD’s business — the percentage of preterm births in the U.S. is noticeably increasing. According to a New York University study, 7.5% of babies were born prematurely in 2022, up from 6.8% in 2011. Rates of preterm births grew across nearly all racial/ethnic and socioeconomic groups. [5] Some believe abortion bans put in place in many states, particularly in the southeast after the Supreme Court overturned Roe v. Wade in June 2022, could cause even more babies to be born prematurely. [6]

MD’s Quarter-By-Quarter Operating Metrics Continue to Improve

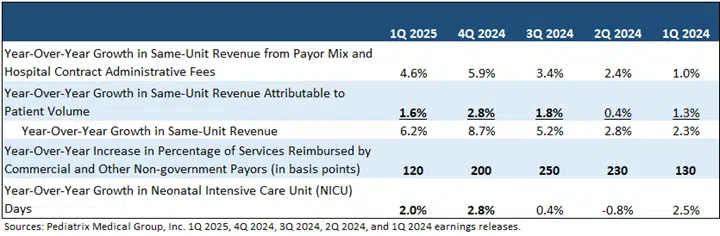

MD’s operating metrics have been impressive over each of its last five reported quarters. Perhaps more importantly, the growth rates in these parameters have been accelerating over the last six to nine months.

Pediatrix Medical Group, Inc. — Key Operating Metrics

We note the following points:

- MD’s same-unit revenue has increased, on a year-over-year basis, by 6.2%, 8.7%, and 5.2%, respectively, over the last three quarters, easily outpacing inflation during these periods. Notably, these gains are predicated on patient volume increases of 1.6% to 2.8% in these periods.

- 2.0% and 2.8% increases in NICU days in 1Q 2025 and 4Q 2024, respectively, drove these gains. See section above on preterm birth trends.

- Not only has MD’s revenue been growing, but the margins attached to these revenues are improving as well. More specifically, the percentage of MD’s services that are covered by commercial insurance and other non-Medicaid sources has jumped 1.3% to 2.5% in each of the last five quarters. Medicaid compensation rates, including compensation rates under Medicaid managed care programs, are generally much lower versus private sector health plan rates.

MD Sold or Exited Uneconomic Business Lines in 2024 …

In 2Q 2024, MD decided to exit its affiliate office-based practices other than maternal-fetal medicine and return to its hospital-based roots. Over a number of years, MD had expanded its pediatric service to such practices; however, this expansion not only added to the complexity of its operations but proved to be uneconomic. In turn, MD recorded one-time pretax impairment charges totaling $40.3 million in 2024 related to the abandonment of the office-based practices. [7]

In 2024, MD also concluded that the time and investment required to build its primary and urgent care businesses to the desired level were more than the company wanted to commit. Consequently, MD discontinued these business lines and incurred an $11.0 million loss on disposal. [8]

Importantly, MD expects these portfolio decisions will in aggregate boost the company’s annualized adjusted EBITDA by $30 million. A portion of this favorable impact was realized in 2024; the full effect should be reflected in MD’s financial results in 2025. [9]

… Which Played a Role in MD’s Robust Financial Results Over the Last Three Quarters

Boosted by exiting its uneconomic businesses, MD has posted robust cash flow and earnings for three successive quarters. Indeed, in both 4Q 2024 and 1Q 2025, the company’s adjusted EBITDA increased 30+% on a year-over-year basis in both 4Q 2024 and 1Q 2025, and its adjusted EPS has jumped about 60% in both of these quarters.

Pediatrix Medical Group, Inc. — EPS and EBITDA Summary Data

MD’s adjusted EPS over the most recently reported twelve months is $1.62, up from $1.51 in 2024 and $1.26 in 2023. Analysts as a group expect 2025 EPS of $1.67, [10] but that may be a conservative estimate as well.

MD generates significant free cash flow: $204 million (about $2.35 per share) in the twelve months ended March 31, 2025, $195 million in 2024, and $113 million in 2023. We note that MD’s operating cash flow was negative $116 million in 1Q 2025, a slight improvement versus negative $123 million in 1Q 2024. The company typically realizes negative cash flow in the first quarter because it pays out incentive compensation, primarily to its affiliated physicians, and makes matching contributions to employee benefit plans during the first three months of the calendar year. From an accounting perspective, MD accrues all these payments over the course of the previous calendar year. [11]

Pediatrix Medical Group, Inc. — Cash Flow Summary Data

The OBBBA Legislation Has Negative Overall Long-Term Implications for Medicaid … But the Direct Effect on MD Should Be Minimal

The source of MD’s net revenue is more dependent on government-sponsored or government-funded healthcare (GHC) programs than hospitals. MD receives more than half its net revenues — 53% in 2024 and 55% in both 2023 and 2022 — from GHC Programs, principally state Medicaid programs. [12] On the other hand, the category of “private insurance/self pay/other” accounts for around 69% of hospital revenue [13]. Consequently, any changes to government health coverage reimbursement rates could have a significant impact on MD’s financial results. As of March 2025, 71.3 million lower-income Americans, or 20.5% of the population, were enrolled in Medicaid. [14]

We believe that changes to health coverage specified in the One Big Beautiful Bill Act (OBBBA) will have limited negative effect on MD’s business; furthermore, any negative impact will not commence until 2027 (or not coincidentally after the November 2026 mid-term elections). We note the following:

- The Affordable Care Act (ACA) allows states to expand their Medicaid programs to cover more low-income adults through federal payments that fund most of the cost of increasing the Medicaid eligibility income limit to 138% of the federal poverty level (FPL). [15] The FPL in 2025 is $15,650 and $32,150 for an individual and a family of four, respectively.[16] As of May 2025, 41 states and the District of Columbia D.C. have allowed this expansion. Importantly, every state in which MD operates covers children in their first year of life and pregnant women up to an income limit of 138% of FPL, and some states offer expanded coverage with income eligibility thresholds of 138% to 400% of the FPL. [17]

- The OBBBA over time does limit health coverage for the poorest Americans in a variety of ways, but it does not reduce federal participation across-the-board for adults under 65 with an income of up to 138% of the FPL, as did legislation the first Trump Administration attempted to introduce. [18] Equally important, the new law does not alter the situation that children under the age of one and pregnant women are covered up to an income limit of 138% of FPL in the states in which MD provides service.

- However, the 41 states plus D.C. that have taken up Medicaid expansion will gradually lose access to a potential revenue source for financing their share of rising Medicaid program costs. In the past, according to a complicated “hold harmless” provision, states were allowed to impose taxes on health providers and then make them whole for this tax through supplementary payments received from federal sources as long as the state revenues produced by the tax were no more than 6% of the revenue of the health provider. Effectively, this “hold harmless” stipulation provision increased the proportion of federal versus state funding for Medicaid service payments. The OBBBA legislation gradually reduces this 6% ceiling to 3.5% over fiscal years 2028 and 2034, effectively transferring a growing proportion of the costs of the Medicaid programs from the federal government to the states. [19]

- Effective January 1, 2027, the OBBBA requires states to implement work requirements for most of the ACA expansion population to qualify for Medicaid or to retain eligibility. [20]

MD’s Valuation Versus Comparable Companies

There are no direct publicly traded comp’s to MD, one of the nation’s leading providers of physician services. However, LifeMD, Inc. (LFMD), a direct-to-patient telehealth company which allows its patients to access virtual and in-home healthcare in a cost effective way; Teledoc Health, Inc. (TDOC), a global leader in virtual healthcare; and The Oncology Institute, Inc. (TOI), a highly specialized provider of cancer care to patients in clinic locations across five states, are reasonably similar companies. Below we compare MD’s EV-to-EBITDA, EV-to-revenue, and P/E with these companies.

Pediatrix Medical Group, Inc. — Valuation Comparison with Peer Companies

We note the following points regarding MD’s relative valuation:

- MD trades at an EV-to-2025E adjusted EBITDA ratio of 7.2x, a discount of more than 50% compared with the S&P 500 Index. TDOC trades at a slightly lower multiple, 6.9x, but TDOC’s EBITDA is expected to decline about 10% in 2025. In contrast, MD’s EBITDA is projected to increase around 5%. LFMD trades at more than twice MD’s EV-to-adjusted EBITDA multiple, and TOI management expects its 2025 adjusted EBITDA to be negative.

- MD’s P/E multiple based on estimated 2025 earnings is only 8x, or a 60+% discount to the average stock. Of the comp’s shown above, only LifeMD is projected to post positive net income in 2025. LFMD’s P/E ratio is around 37x.

- Of the four companies profiled above, only MD (>$200 million) and TDOC ($185 million) are projected to generate appreciable free cash flow in 2025.

MD: An Undervalued Stock with Good Growth Potential and Limited Risk

MD is an unusual company: it is a publicly traded specialty physicians practice. Such practices — if successful, as MD’s is — generate significant cash flow, have a high degree of predictability, and are almost always privately owned. MD easily checks the first two of these boxes. The company generated around $200 million of annual free cash flow in 2023 and 2024 and appears quite likely to produce an even a larger amount in 2025.

In addition, its nationwide neonatal, maternal-fetal, and pediatric specialty focus allows its operating cash flow and earnings not merely to be consistent, but to show marked growth. Indeed, while no one wants to see the percentage of babies born prematurely increase, this trend is occurring in the U.S. Furthermore, the attention these babies require, as well as the dollar cost for this care, likewise stand to rise for the foreseeable future.

Unsurprisingly, a business with such positive characteristics is typically highly sought after and highly valued. However, MD trades at single digit P/E and EV-to-EBITDA multiples: about 8x and 7x, respectively, both more than 50% discounts to the S&P 500. Perhaps because of its relatively small stock market capitalization ($1.15 billion), many investors do not yet appreciate how undervalued MD stock is. However, many sophisticated investors do. Consider the following:

- For some time, physicians’ practices have been popular acquisition candidates for private equity investors because of their predictability and projected moderate growth in the cash flow of their businesses, two of MD’s most attractive investment characteristics. Indeed, in 2022 and 2023 combined, private equity entities acquired about 760 physician practices. [21]

- Even more interesting, a report by Scope Research, a healthcare data analysis firm, analyzed 33 such transactions which closed between May 2022 and May 2024. These deals had a median EV-to-EBITDA multiple of 13x, and the transaction multiples tended to be higher for practices with larger EBITDA levels (e.g., $100+ million). [22] This data suggests that the stock market is currently ascribing a much lower valuation to MD than many sophisticated investors do. Each 1x EV-to-EBITDA multiple improvement would equate to about a $2.75 boost in MD’s stock price.

EV/EBITDA Transaction Multiples for Selected Physician Practice Acquisitions, May 2022 – May 2024

Source: Scope Research Healthcare M&A Valuation Database.

A linchpin of the MD story is its improving fundamentals. Indeed, patient volumes have increased on a year-over-year basis for each of the last five quarters, including by more than 2% on average over the last three. Furthermore (and also over the last five quarters), MD is being reimbursed for an increasing portion of the services it provides by non-government-sponsored insurance payors. This gradual transition is key because compensation rates from private sector health plans are almost uniformly much higher than Medicaid-based programs. Finally, while the headlines surrounding long-term Medicaid cuts entailed in the OBBBA legislation are real, these spending reductions should have a limited impact on MD because the legislation does not alter the existing framework whereby children under the age of one and pregnant women are covered up to an income limit of 138% of the FPL in the states in which MD provides service.

NOTE: This stock is an existing long position in our sister company, L2 Asset Management, LLC’s “True Micro SMA” portfolio. Although we are not sure, we would not be surprised to see the strategy increasing its position in the stock.

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

July 25, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

July 25, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin