“As soon as you allow politicians to determine that which is bought and sold, the first thing bought and sold will always be politicians.”

–P.J. O’Rourke, Parliament of Whores: A Lone Humorist Attempts to Explain the Entire U.S. Government, 1991

Since KCR’s founding in 2010, we have stood fast in our evidence-based approach to active investing. Despite the frequently speculative nature of markets in the post 2017 period, our process has worked. All but one of the nine strategies run by our sister company is ahead of their respective benchmarks.[1]

KCR’s investment team has numerous members who have been in the investment business for 30+ years each. We have seen booms, bubbles, busts, currency devaluations, asset seizures and other unfortunate financial mayhem. Yet we have never seen anything quite like what is going on today.

Get our insights direct to your inbox: SUBSCRIBE

Our endeavors here at KCR have blessed us with a sizeable collection of wonderful relationships among active managers. And yes, they know we designed and sub-advise a passive-index product. Typical of this newsletter, we are quick to recognize there are benefits to cheap-beta while simultaneously documenting the increasingly ridiculous price dislocations underway.

Many pieces published by KCR had their origins in dialogue with the organizations we are honored to know. Along the way we have had the good fortune of intermittently reading the wonderful missives penned by the folks at Manchester Asset Management. Manchester is a life sciences focused micro-cap activist fund.

As readers of our work on micro-caps know, this is a space we are fond of. Similarly, we recently penned a piece advocating for investing in Healthcare. What that research lacked was Manchester’s 22-year track record that has trounced the S&P 500 despite operating in two of the most unloved spaces in markets today.

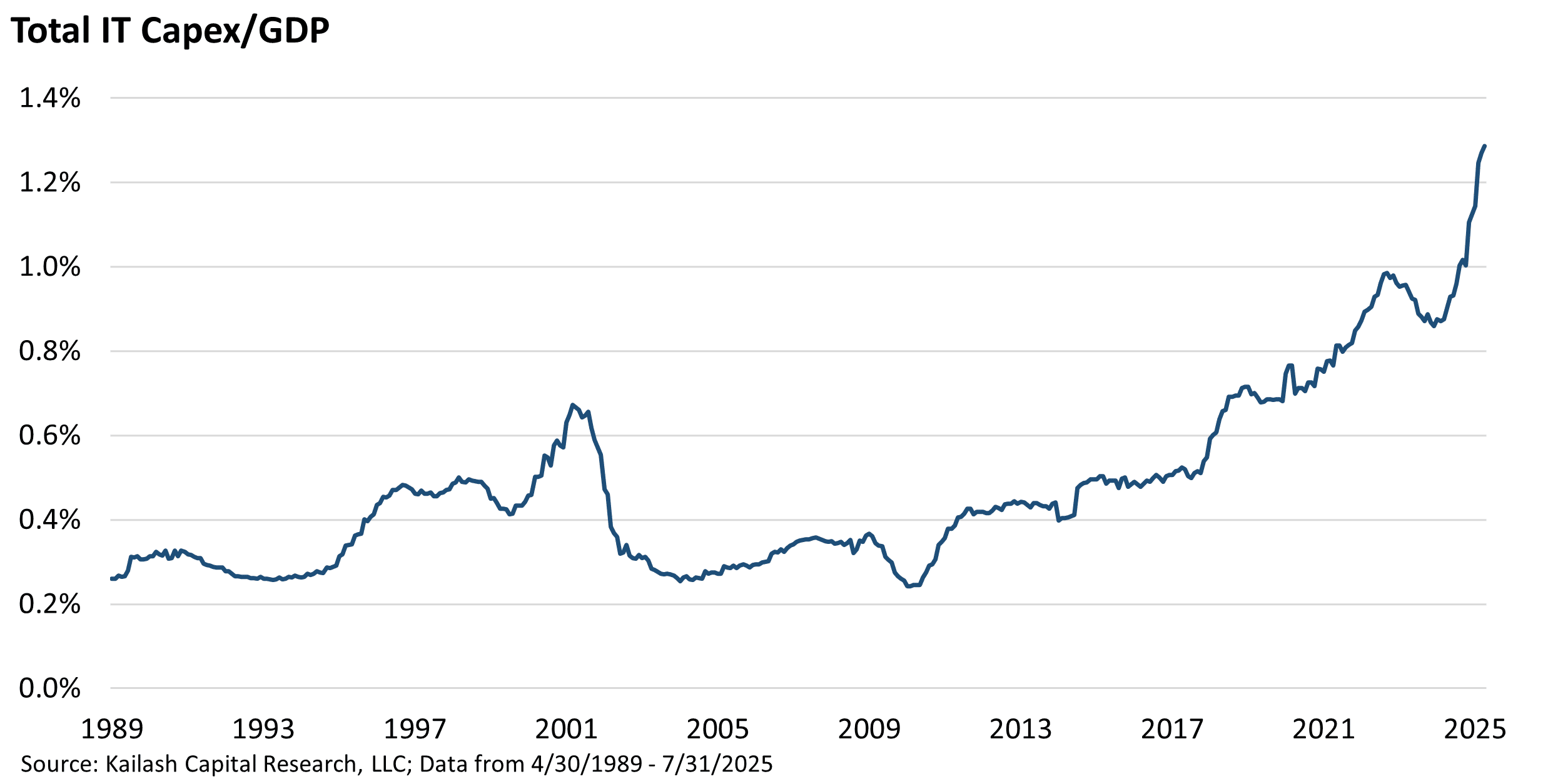

Our readers have seen us document the increasingly untenable bubble in index valuations and tech’s profits. We have been relentless in highlighting the vulnerability of a sector that recycles capex into profits. In Manchester’s brilliant August missive to investors, they noted that tech [2] capex to GDP was far beyond the dot.com peak. We took that idea and created the chart below which needs no further explanation.

In the pages that follow we have, with Manchester’s permission, reprinted their letter without editing. We hope you enjoy it as much as we did!

“It was a tale of two economies” remains one of the more overused and hackneyed framings in all of hedge fund newsletterdom, but perhaps this is because it is so often apt. The overwhelming sense we’re getting is one of bifurcation, of those in on the AI/datacenter/crypto joke and those who are finding their own circumstances more and more definitively unfunny. It seems a fine time to be in the top 10% and asset heavy, but a rough time for many others. Many American consumers are tapped out, debted up, and struggling. The CEO at McDonalds recently said this:

“With middle and lower income consumers, they’re under a lot of pressure. If you’re upper income earning over $100k, things are good. Stock markets are near all time highs. You’re feeling, quite confident about things. You’re seeing international travel, all those barometers of upper income consumers are doing quite well. What we see with middle and lower income consumers is actually a different story. It’s that consumer is under a lot of pressure in our industry. Traffic for lower income consumers is down double digits, and it’s because people are either choosing to skip a meal. So we’re seeing breakfast, people are actually skipping breakfast, or they’re choosing to just eat at home.”

This industry exemplifies what we suspect is true in many others: prices passed price elasticity convexity and drove nominal drops in demand. They cannot be raised further but input costs keep rising. This is how you get a profits recession.

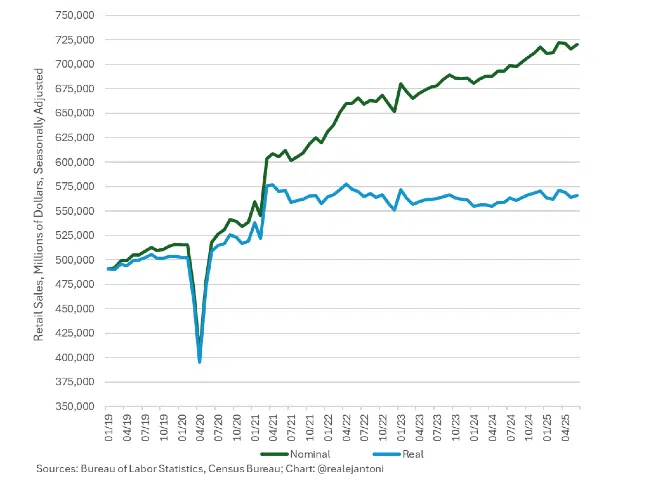

The headwinds have been manyfold. Prices rose. A lot. When price could not stretch further, quality and portions got cut. And Consumers started to notice. And this creates some truly intractable problems where consumers are finding the quality of goods or services or restaurant meals whose prices they already think are too high eroding rapidly and start asking some pointed questions about “so why on earth should I buy this?” The road back likely lies in price cuts and quality increases which constitutes a double-sided vise for profits. If you pull the data apart, you can see what’s been going on: basically all the retail sales growth since early 2021 has been driven by price. In real terms, nada.

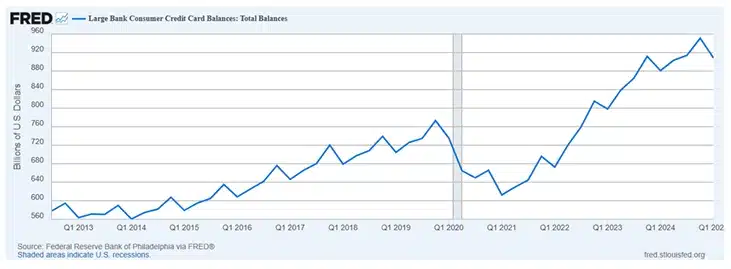

It’s been a widespread trend from food to shoes to furniture. The huge bolus of “covid money” got exhausted and consumer debt started to climb. Credit card balances are up 25% from late 2022 (when they reached pre covid levels)

Student loan payments resumed and jobs growth keeps getting reported as good then adjusted to awful. We suspect there has been nearly none all year and that this will become clear once all the revisions are in. This is making people cautious, even fearful. Take out data-center spending and a lot of the US is likely in its own “subset recession.” As the tariff effects on price bite (and they will) much of this will express as dropping demand. The consumer is showing signs of real exhaustion. Real personal consumption expenditure has been flat since December (16.408 in July vs 16.358 in Dec).

That’s not a sign of a healthy economy and the Fed balance sheet is showing us interesting signs of what’s to come. The Fed reverse repo facility that surged to nearly $2.5 trillion in 2022-3 has now basically dropped to zero. Last read we saw was $21 bn. This money all got lent and added to the economy, though how much wound up in T-bills which now yield a bit more than the Fed repo is an interesting question.

The desire of the administration to cut rates is acute. They are hoping for stimulus and lower debt costs but the “bond market vigilantes” are taking a different view and bidding up yields even into more likely rate cuts. The very short end of the curve dropped, but anything at ~2 years or longer is going nowhere. Past 10, yields are rising and 30 is blowing out. Questions of “just how much deficit are we supposed to fund?” are being loudly asked. The bond market can read a balance sheet even if congress cannot.

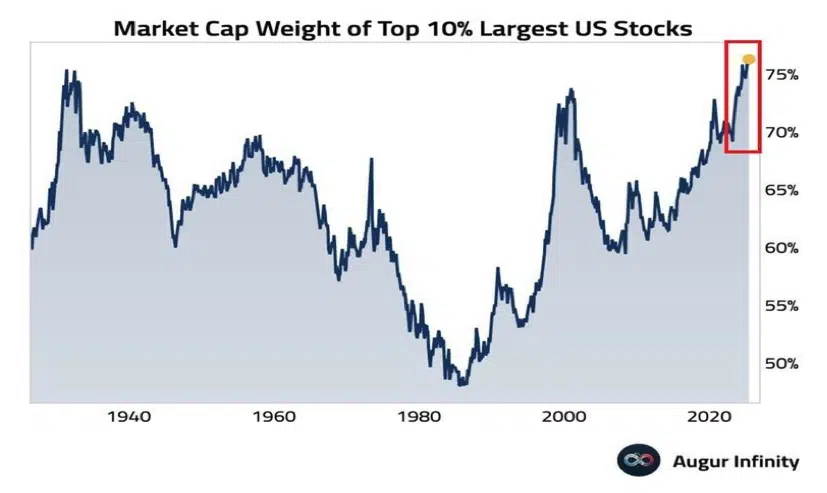

All in all, the US economy looks to us to be on very narrow foundations and US equity markets seem to reflect it. Valuations are incredibly stretched and concentration at unprecedented levels.

As folks who lived through the dotcom bubble with front row seats, it’s difficult not to see the parallels here with AI. “Trees all grow to the sky!” exclaim the bulls who are sure that 1.8% of GDP on datacenters is just the start. (Dotcom internet spend peaked at about 1.2%) “It’s a new paradigm! The old rules do not apply!” they proclaim. “It’s a picks and shovels play! Just buy the chip makers and the datacenter companies! Arms dealers always win arms races!” This is exactly what everyone said about Uniphase and Vitesse and Lucent and Cisco right before they all went down 90% and then dropped another 50-90% from there.

Not even we are crazy enough to try to call the top of this bubble (especially with M2 growth returning to “bubble baby, bubble” rates of +5% yoy and rate cuts coming) but to say that we are not beset by heebie geebies about what a one trick pony this economy seems to would be a lie. Bubbles never pop when people can see the bubble. That insight occurs 2-3 years before the top. (The irrational exuberance speech was 1997) The tops of bubbles are made by shorts who figured it out 2 years too early being forced to capitulate. By the top, no one dares say “bubble” for fear of being associated with how much money has been lost. And then the wheels come off. That’s the game. It does not change.

If you would like to read the remaining commentary from Manchester that includes some of their stock specific comments, please click here to let KCR know, and we will connect you.

The entire KCR team would like to reiterate our thanks to the folks at Manchester!

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

September 12, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

September 12, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin