What’s causing the current malaise in healthcare stocks? Returns have been lagging and valuation multiples are lower than the vast majority of stocks in the S&P 500. We doubt everyone has become so much healthier that we no longer need medicines and hospitals. Is this as simple as “Healthcare isn’t Tech”? We don’t think so.

Get our insights direct to your inbox: SUBSCRIBE

We believe the primary underlying affliction here is massive uncertainty, with strong doses of confusion and fear. Healthcare companies, which include pharma, hospitals, and health insurers, face an uncertain future due to political pressures and a shifting regulatory landscape. Why do we think uncertainty is the key source of healthcare’s problem? Because we saw this during the Clinton-era attempts at healthcare reforms in the early 1990s, when almost every healthcare-related stock suffered.

We see important similarities between what happened to healthcare stocks back then and what the sector is experiencing today:

Widespread confusion:

- Early 1990s: The White House Task Force of National Health Care Reform led by Hillary Clinton proposed sweeping, complicated healthcare reforms. This caused a great deal of confusion and uncertainty, leading investors to sell healthcare stocks across the board. [1]

- Today: The U.S. healthcare sector seems to be under attack. There is talk of regulations that would limit drug reimbursements and shine a bright light onto opaque pricing practices. Pharmacy benefits managers (PBMs) are being scrutinized for their practices. [2] Government reimbursements under Medicare and Medicaid are being squeezed. None of it sounds good for health care stocks, but no one knows what, when, or if anything will happen.

Worries about Cost Controls and Profit Squeezes:

- Early 1990s: Investors feared the Clinton Plan, whatever it turned out to be, would greatly reduce the healthcare sector’s pricing power and hurt profits. Pharmaceutical companies in particular were strongly opposed to the reform ideas. Price controls and other ways to contain costs that were being discussed would have changed the way we purchased and paid for medications. [3]

- Today: The Trump administration is questioning why pharmaceutical companies charge U.S. customers much higher prices than what their drugs sell for elsewhere. Lowering drug prices by a meaningful amount could decimate margins. PBMs, often owned by health insurers, are being investigated and facing lawsuits over anti-competitive practices. This could upend their business models.

Fear

- Early 1990s: The fear about potential reforms caused investors to sell across the entire healthcare sector, even though many companies were profitable. Between January 1992 and August 1993, healthcare stocks declined -28%, while the S&P 500 rose 16%. [4]

- Today: Policy and regulatory risks that might threaten future earnings are prompting pre-emptive selling across the healthcare sector, regardless of an individual company’s fundamentals. This has caused healthcare stocks to lag the broader market.

Uncertainty, confusion, worries, and fears were the key drivers behind declines in healthcare sector in the Clinton era, and we believe the same may apply today. Investors are penalizing the entire sector in anticipation of changes before any new rules materialize, showing how sensitive investors are to ambiguity.

Markets have once again gone full-on “FOMO” and “YOLO” with investors piling into speculative nonsense of all types. Despite average 1 year performance of -14.8%, there are now at least 103 leveraged single stock ETFs that have inhaled over $30bn. [5] Equally disconcerting is the penchant for “Bitcoin treasury companies” which, according to the Google, “…are publicly traded firms whose main purpose is to provide investors with price exposure to bitcoin.” In our view that is a polite way to describe unregistered investment funds that traffic in the greatest decentralized pyramid scheme ever seen: cryptocurrencies.

Microstrategy, a company with negligible operating assets that borrows money to buy bitcoin (and pay the dividends on earlier debt they issued), now has a market cap of $103 billion, nearly double the value of the bitcoin it owns. [6] With the two most senior fund managers at KCR each having 30+ years of experience, we’ve heard our fair share of foolish investment ideas. But we would suggest that paying 2x for an “asset” that can be bought directly through a low cost ETF, is nearly as ridiculous as believing Sam Bankman-Fried’s explanation of how bitcoin and “yield farming” made economic sense. [7]

All of this is perverting the benefits of capitalism by redirecting investment dollars from products and goods that advance the broader causes of improving humanity into speculative junk. Readers of this research newsletter have watched us repeatedly move to “where the puck is going”…too early.

But again and again, eventually fundamentals drive returns and our reputations have been mercifully resuscitated. Similar to the dreadful year of 2020 when we pounded the table for energy and staples amidst a speculative meme-mania with tremendous results in the following years, we are back doing it again. Now.

The only major difference is our evidence based models have been surfacing a growing number of healthcare stocks. We’ve written up detailed single-stock notes on the likes of everything from AMGN to a remarkable microcap stock, MD, that seems positively recession resistant and primed to potentially double. We take more comfort in this most unpopular position after seeing Mr. Buffett take a stake in United Health – potentially the most controversial stock in the sector.

Aside from the recent malaise in the sector’s performance, we can see how out of favor the sector is by looking at Healthcare’s weight in the popular S&P 500. The chart below shows that these stocks now represent the lowest level of the index in nearly 40 years.

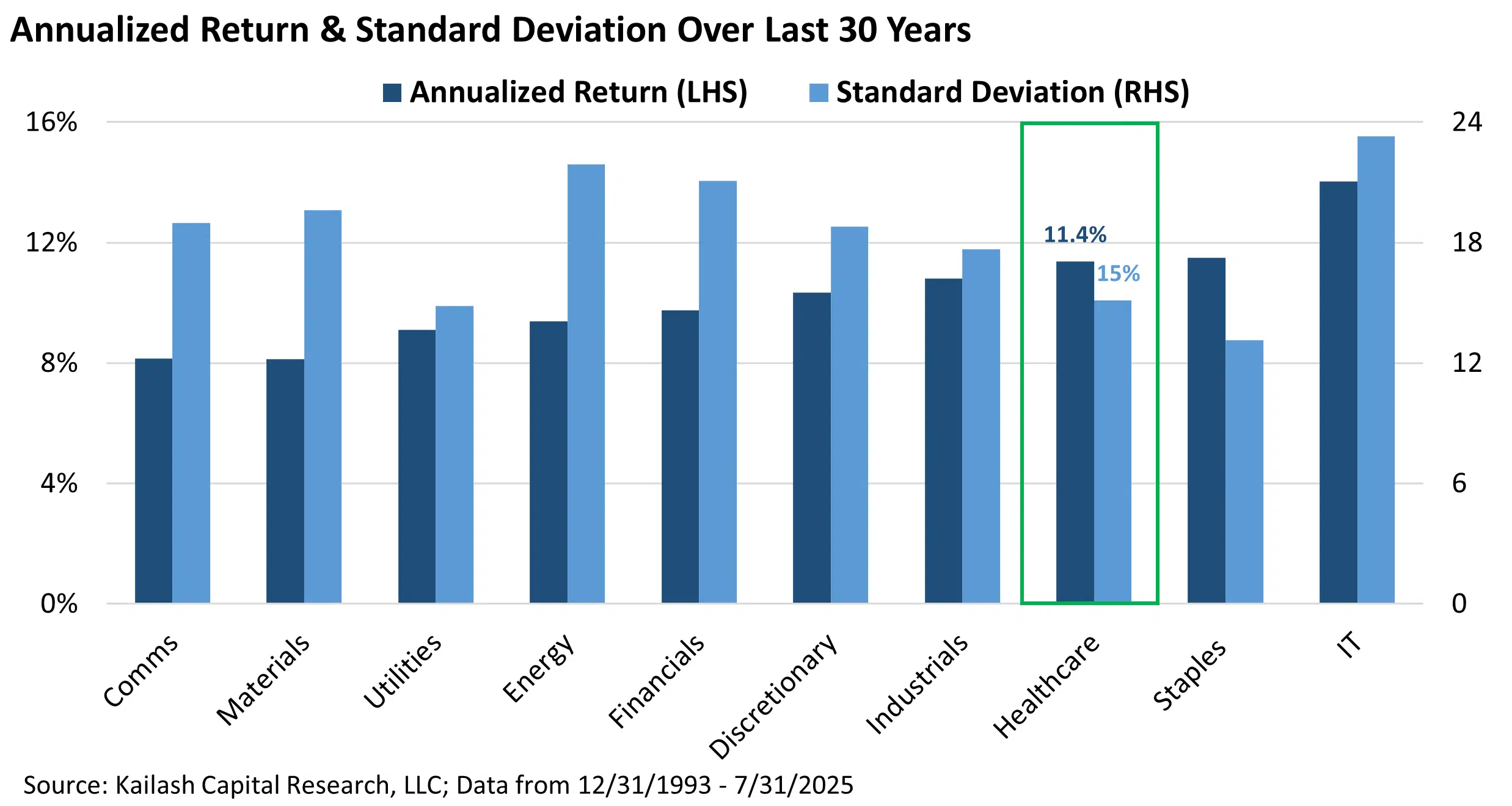

The chart below shows the annualized returns of each GICS sector in the navy blue bars. Next to each of those is the standard deviation, a measure of volatility, of each sector. The chart is sorted by lowest annualized returns to highest. Looking at this proverbial “scoreboard” what do we learn about the Healthcare sector?

The group’s long-run annualized returns vs. realized volatility are fantastic. Healthcare stocks have tied Consumer Staples stocks delivering the second highest sector returns with similarly low levels of volatility.

Similarly, we see that Healthcare, as a sector, possesses an enviable track record of generating strong absolute returns. The chart below shows the rolling 3-year absolute returns of the sector since the late 1980s. There have only been a few instances when investors in the Healthcare sector have experienced negative returns over these short horizons – we’ve circled them in red.

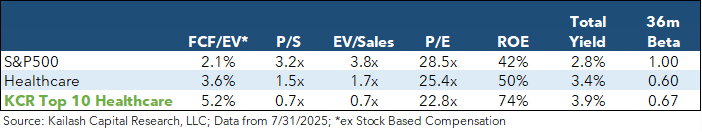

The table below shows the basic fundamentals of:

- First Row: the S&P 500 ETF

- Second Row: the S&P 500 Healthcare Sector

- Third Row: KCR’s top 10 ranked large-cap Healthcare stocks

As usual, this is not complicated. Compare the S&P 500 – bloated as it is with tech stocks trading at peak multiples on peak earnings – to the overall Healthcare sector. The simple Healthcare ETF trades at roughly a 50% discount to the S&P 500, pays you a much healthier yield and has a beta of just 0.60.

Now go down to our top 10 healthcare stocks. The S&P 500 ETF trades at over a 100% premium to our Healthcare picks and the stocks we like have higher ROEs, healthier yields and similarly low betas. Nobody can be certain what the US government will do. We are in the moneyball business, not the crystal ball business.TM But what we can clearly see is there are numerous blue-chip stocks in the sector with powerful cash generation that are predisposed to pay investors to wait, trading with what we believe is a significant margin of safety.

If you want to make your life complicated trying to guess which companies are going to be able to successfully monetize AI – good for you. For those of us who realize you don’t get extra rewards for trying to predict the future, we will sit back in our boring, cheap, steadily growing, a-cyclical healthcare names and compound our wealth safely. See exhibit below for our Top 10 Ranked Large Cap Healthcare Stocks.

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

August 22, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

August 22, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin