Some of our recent work has highlighted growing economic risks, especially in tech and crypto, with signs of a looming profits recession. The pieces document the remarkable grift from vendor finance, preliminary appearances of consumer weakness, inflated valuations, and debt-driven demand. Summarily:

- Consumer fatigue is real: Lower- and middle-income Americans are skipping meals and slashing spending as debt piles up.

- Markets look bubbly: AI and datacenter spending echoes dot.com euphoria, with investors using old bubble logic (“picks and shovels!”).

- Retail growth is a mirage: Sales have risen due to price hikes, not increased demand; real consumption is flat and further price increases could hurt demand.

Having said all that, here we are writing up a consumer apparel stock. How could that be? Well, as we always say What You Pay MattersTM and “cheapness” can fix a lot of potential problems. How do we know this?

Get our insights direct to your inbox: SUBSCRIBE

We saw a very similar narrative around luxury brand company Ralph Lauren back in late 2024. We wrote about all of these effects and then explained 1) how Ralph Lauren’s stock price had baked the pessimism in and 2) highlighted that even if the bears were right, the stock seemed far too cheap. Since our deep dive on Ralph Lauren (RL) was published on September 26th last year, the stock has ripped nearly 60% higher.

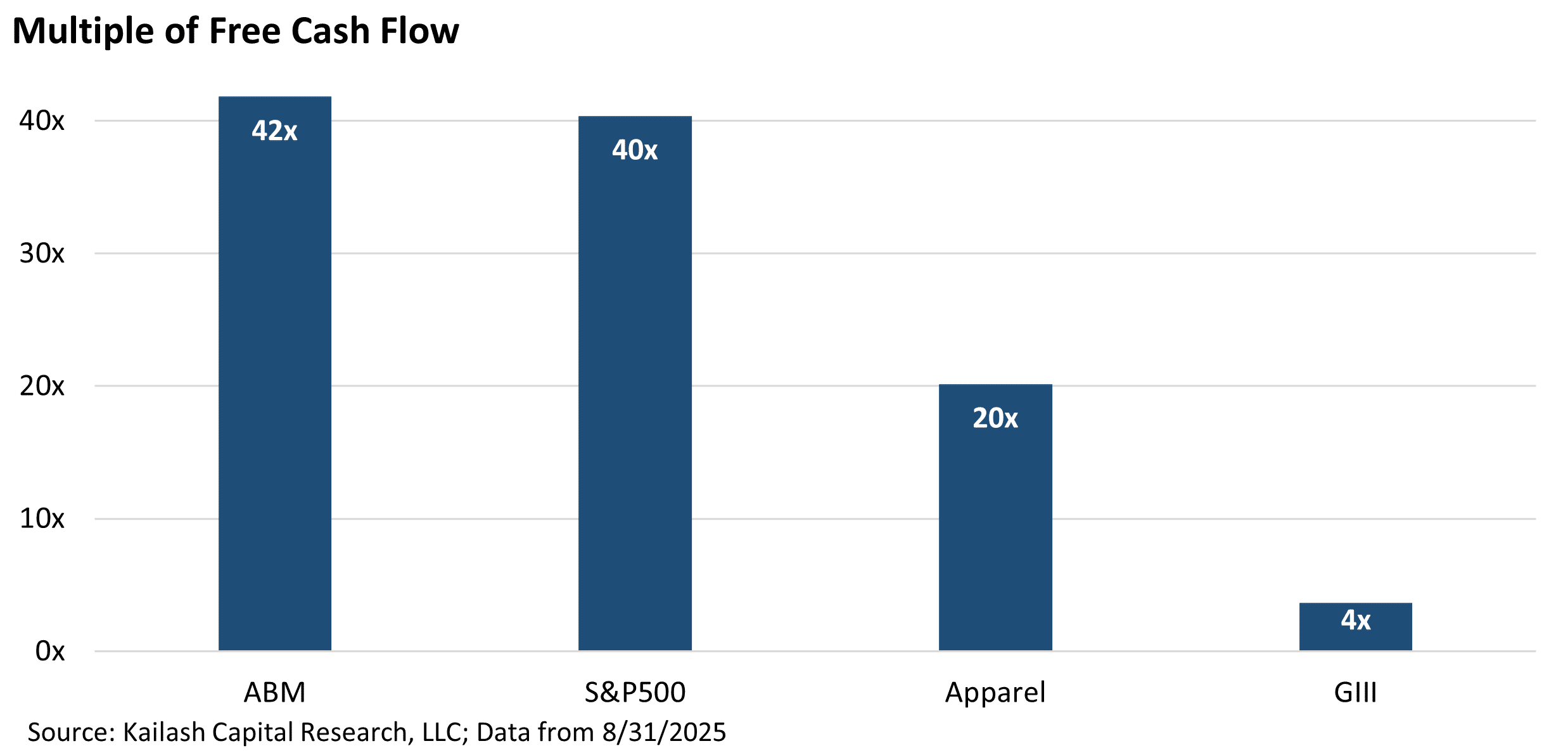

G-III Apparel Group (GIII) owns DKNY, Karl Lagerfeld, and Donna Karan and has licensing for Calvin Klein and Tommy Hilfiger. Having completely restructured its balance sheet – swinging the company from bloated with debt to net cash – the firm’s market cap and enterprise value are both $1.1bn. The company generated over $300ml in free cash flow (FCF). That’s over a 25% FCF Yield. That is just 4x free cash flow.

That is cheap. How cheap? The chart below is a reminder that those long popular All Cap and S&P 500 type index funds are paying 40x free cash flow. So the S&P 500 is 1,000% more expensive than GIII.

At just 4x FCF a lot can go wrong at GIII and the stock might still do well, in our view….so let’s dig in!

A global leader in fashion apparel, G-III Apparel Group, Ltd. (GIII) has a portfolio of 30+ owned and licensed brands. Its key owned brands are DKNY, Karl Lagerfeld, and Donna Karan; while its most important licensed brands are Calvin Klein and Tommy Hilfiger. Sales of DKNY and Karl Lagerfeld products represented nearly 40% of GIII’s FY 2025 (twelve months ended January 31, 2025) revenue, and this proportion is poised to increase sharply in FY 2026.

Why We are Bullish on GIII:

- GIII is a deep-value, out-of-favor play which we believe already discounts a worst-case scenario. If the company can offset some of the financial impacts of two major challenges — the effect of tariffs and the staggered expiration of licenses to sell Calvin Klein and Tommy Hilfiger products over the next 2+ years — GIII’s share price could be revalued much higher.

- We believe it is quite likely that GIII reaches back-to-back agreements/understandings with suppliers and wholesale customers that mitigate even more of its $155 million of tariff burden than it already has ($80 million) through a combination of cost reductions and product price increases. After all, almost all apparel brands are feeling the same tariff pressure, and it stands to reason that the large retailers of GIII’s goods, with which GIII has built strong and long-standing relationships, will acknowledge reality and consent to adding most of the tariffs to their retail prices. Of course, a risk in all this is consumers could choose to buy less GIII apparel, but evidence of strong demand for DKNY, Donna Karan, and Karl Lagerfeld products suggests this effect could be fairly minor.

- We think growth in GIII’s popular owned brands in FY 2027 can bridge a significant portion of the gap from the lost revenue related to licensed Calvin Klein and Tommy Hilfiger products next year, just as the brands are doing in FY 2026 (which is essentially calendar 2025). Licensed Calvin Klein and Tommy Hilfiger products comprised 34% of GIII’s revenue in FY 2025 (twelve months ended January 31, 2025). Furthermore, it seems quite probable that GIII will offset much of the foregone revenue by securing other license opportunities or utilizing its unlevered balance sheet to complete an acquisition.

- If GIII can surmount the effect of these challenges, a reasonable estimate of its worst-case earnings power may be management’s adjusted EPS guidance for FY 2026 of $2.55-$2.75. Based on GIII’s average 11.9x P/E ratio over the last ten years, this implies that a current fair value for GIII stock, even under the tariff and license expiration pressures the company faces, is in the low $30 range. Bolstering this argument that GIII is trading near a depressed valuation is its low enterprise value (EV)-to-EBITDA ratio. If the company were to achieve the ~$200 million of FY 2026 adjusted EBITDA which management forecasts, its EV-to-EBITDA multiple is only 4.4x. Even if GIII stock were to trade into the low $30’s, its EV-to-EBITDA multiple would only reset to around 5.5x, or about a 60% discount to the S&P 500.

What is the Bear Case?

If GIII were unable to further mitigate its tariff exposure or cannot secure new licensing deals over the next couple years to replace the expiring Calvin Klein and Tommy Hilfiger agreements, GIII shares would likely suffer. However, GIII has an experienced, well-connected management team with deep and longstanding relationships in the apparel industry. Given these advantages, we believe the chance of such inaction is quite small.

Investment Summary Begins on the Next Page – thank you for reading!

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

September 15, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

September 15, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin