Excelerate Energy, Inc. (EE) provides key integration services and infrastructure along the natural gas-to-power liquefied natural gas (LNG) value chain. More specifically, the company operates ten floating storage regasification units (and has contracted with Hyundai Heavy Industries to build another), which has allowed EE to complete around 3,000 ship-to-ship transfers of LNG with more than 50 LNG operators since EE began operations. As of February 28, 2024, 701 LNG vessels were active across the globe, 47 of which were floating storage regasification units (FSRUs). EE owns ten of the 47, underscoring its position as a leader in FSRUs and downstream LNG infrastructure.

Get our insights direct to your inbox: SUBSCRIBE

Why We are Bullish on EE:

- EE has minimum contracted sales under time charter and terminal use contracts of more than $4 billion, equal to roughly 120% of the company’s $3.4bn enterprise value. [1]

- EE’s cash flows have built impressively, rising to $173ml over the four quarters through 09/30/2024.

- The company is investing its free cash flow by expanding its fleet of FSRUs and eventually LNG tankers.

- These additions should allow the company to bolt on significant, predictable, and high multiple cash flows.

- Even after this new investment spending, EE is generating enough surplus cash that they are fortifying their strong balance sheet by paying off debt, repurchasing shares and paying a modest dividend.

- Strong demand for LNG across much of the world is the foundation for all EE’s growth potential. Most analysts and economists foresee consistent demand growth for this commodity amid rising global geopolitical uncertainty.

- Many countries have made the decision that contracting for the delivery of LNG, even at high prices, is preferable to depending on the delivery of piped natural gas. The world has discovered that unforeseeable factors can derail pipeline deliveries across national borders.

- With EE’s dominant position in FSRUs and a newbuild delivery in early 2026, the stock appears to be at a modest discount, assuming nothing goes right. This suggests to us there is tremendous upside optionality via the company’s expanding asset base and superb capital allocation.

- There seems to be a daily article regarding a breakthrough in AI, the chips, the software etc., we see no such proliferation of new competition in LNG FSRUs…

- …is it possible EE has a more durable moat than NVDA?

What is the Bear Case? Aside from a potential surprise decision by a customer to abrogate a contract, it is difficult to identify significant near-term risks for this heavily contracted company. Furthermore, EE has a solid balance sheet ($608 million of cash as of September 30, 2024) that would allow it to weather short-term cash flow interruptions from such an event.

Company Description

Excelerate Energy, Inc. (EE) provides key integration services and infrastructure along the natural gas-to-power liquefied natural gas (LNG) value chain. More specifically, the company operates ten floating storage regasification units (and has contracted with Hyundai Heavy Industries to build another), which has allowed EE to complete around 3,000 ship-to-ship transfers of LNG with more than 50 LNG operators since EE began operations. [2] As of February 28, 2024, 701 LNG vessels were active across the globe, 47 of which were floating storage regasification units (FSRUs). EE owns ten of the 47, underscoring its position as a leader in FSRUs and downstream LNG infrastructure.

By cooling gas down to about negative 162 degrees Celsius, gas condensates and becomes liquid. In turn, its volume decreases by about 600 times compared with the gaseous state. In a regasification process, heat is used to convert LNG from a liquid to a gas, which renders the commodity much easier to transport and distribute.

Interestingly, and a testament to the rapid growth of the LNG industry, the number of active LNG vessels nearly equals the 910 total very large crude carriers, or VLCCs, that carry crude oil around the world. [3] We note, however, that the heat content of the 170,000 cubic meters of LNG carried by a typical LNG tanker is only about 30% of the two million barrels of crude oil carried by a VLCC. [4]

EE delivers to a diversified collection of LNG regasification terminals across the globe. EE is the largest provider of regasified LNG capacity in Argentina, Bangladesh, Finland, the UAE and is one of the largest providers in both Brazil and Pakistan. [5]

Excelerate Energy, Inc. – Asset Overview

Excelerate Energy, Inc. Corporate Background

EE was incorporated in September 2021 and closed its IPO in April 2022. Its sole asset is a controlling stake in the Exchange Energy Limited Partnership (EELP). As of September 30, 2024, George B. Kaiser, a billionaire energy investor and philanthropist from Tulsa, Oklahoma, and his affiliates owned 76.9% of EELP in the form of EE Class B shares. EE owned the balance, or 23.1%, of EELP in the form of EE Class A shares. As of September 30, 2024, EE Class A and Class B shares outstanding totaled 26.4 million and 82.0 million, respectively. [6]

What is an FSRU?

An FSRU is a seagoing vessel which can transport, store, and regasify LNG, and which can be readily relocated. An FSRU can be used as a conventional LNG carrier, but its greatest utility is in the regasification process. It is typically moored to a docking facility near the shore of the country which has contracted for the LNG. The LNG carrier transfers the LNG commodity to the FSRU which regasifies the LNG and delivers it to an onshore natural gas pipeline system as high-pressure (around 1,000 psi) gas. An FSRU can regasify the 170,000 cubic meters of liquified gas contained in a typical LNG carrier in about six days. [7] An FSRU usually has about the same capacity as an LNG tanker.

Building an FSRU can take 36 to 42 months and costs about $300 million. The cost to convert an existing LNG tanker to an FSRU is approximately $100-$150 million, and the time to complete a conversion is around 18-24 months. Importantly, an FSRU requires some onshore and port infrastructure to operate, but the necessary infrastructure investment is small in comparison to the extensive berthing, piping, and storage tanks required for conventional LNG import terminals. [8] As an aside, building a single regasification terminal can cost from $500 million to $2 billion depending on its size, and the time from the start of construction until it can begin to operate can be several years. [9]

LNG Promises to Become an Even More Vital Energy Source for the World

Demand for LNG should be strong for the foreseeable future. Indeed, the global demand for natural gas is projected to increase 2.5% in 2024 and by a similar percentage in 2025, per the International Energy Agency’s (IEA) Global Gas Security Review. Fast-growing markets in Asia account for most of the projected demand increases. At the same time, new supply of natural gas to the market was limited in 2024 due principally to the slow growth in LNG production.

The IEA further states that LNG’s role in the global gas trade has become more vital since the onset of the global energy crisis (caused by Russia’s early 2022 invasion of Ukraine), and this role should only become more central. Two potential vulnerabilities of the LNG market are potential constraints across the Panama Canal and the Red Sea. Issues and conflicts in both locations have impacted shipping volumes generally, but so far have not affected LNG supply. However, it is not difficult to envision future geopolitical events that would limit LNG shipments through those chokepoints.

A likely positive for LNG as a commodity — and a concern for European natural gas availability — is the possibility that the pipeline transit of all Russian gas through the Ukraine may cease at year-end 2024, as those contracts expire on December 31, 2024. [10] This would of course mean that even more LNG must be delivered to Europe to make up the difference.

Russian gas deliveries (blue bars) have fallen short of contracted volumes (orange bars) for years:

Another positive for LNG: the U.S. oil and natural gas industry hopes that President-elect Trump will end the U.S. DOE’s “temporary pause” on reviews of LNG export terminal projects. Applications for four LNG export terminals and two other projects in pre-filing have been on hold since the January 2024 action by the regulatory agency to update its processes for determining whether such approvals were in the “public interest.” [11]

According to the FERC, the U.S. currently has eight LNG export terminals, seven that have been approved and are under construction, and eight others which have been approved by federal officials but are not yet being built. On November 25th, Reuters reported that President-elect Trump plans not only to end the temporary pause on reviews of LNG projects in the first few days of this term, but also to approve new export permits soon after his January 20, 2025 inauguration. [12]

Aside from LNG’s advantages from a supply perspective, demand for the commodity is also poised to grow. More specifically, the differential between the natural gas prices at the Henry Hub in the U.S. and the benchmark TTF trading facility in the Netherlands is set to increase to about $11/thousand cubic feet (MCF) in 2025 from around $8/MCF in 2024. [13] This of course implies higher profit opportunities for U.S. and other exporters of LNG because efficient markets will likely cause LNG prices across the globe to rise as well.

Natural Gas Forward Curves Suggest Significant Boost in Profits for LNG Exporters in 2025

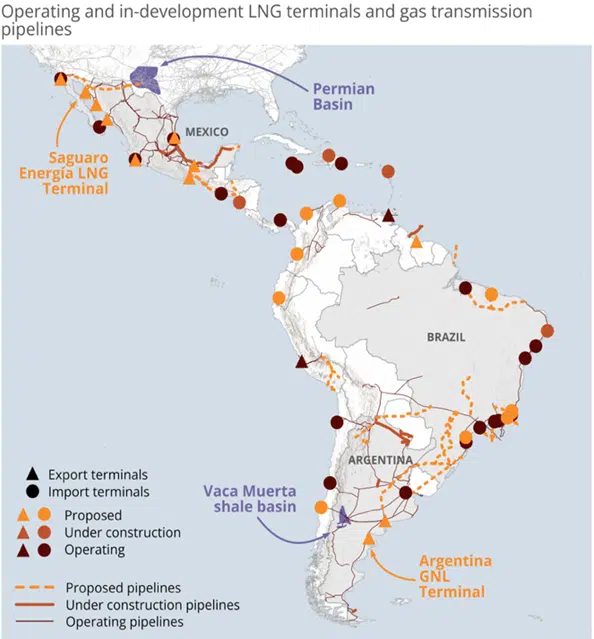

As more LNG export and import terminals are built, the value and utility of EE’s backbone asset, its growing FSRU fleet, should only increase. A good illustration of this point is the vast number of LNG terminals (and investment dollars) which are planned just in the Latin American and Caribbean regions.[14] Clearly, not all these facilities are likely to be built, but some will. In turn, these terminals will spur more demand for FSRUs.

Latin America & Caribbean Region Plan an Estimated $123.6 Billion in LNG Export and Import Terminals

Excelerate Energy’s Growth Plans

EE plans to utilize the significant free cash flow its FSRU/regasification terminals business generates to add to and expand the services it provides along the LNG value chain. The two principal areas the company has identified include: [15]

- Growing its fleet through selective acquisitions and construction of new vessels.

- Establishing a diversified LNG portfolio to support long-term LNG sale and purchase agreements.

Fleet Expansion

As noted above, EE has contracted Hyundai Heavy Industries in South Korea to build a state-of-the-art FSRU capable of delivering 1 billion cubic feet per day (Bcf/d) of natural gas. EE expects to take delivery of the vessel in June 2026. [16]

- Interestingly, EE has not yet signed a long-term contract with a customer for its use, despite presumably strong demand for its services.

- This suggests management is quite confident of the future margins not only for this vessel, but for its entire FSRU fleet.

- According to EE’s management, the FSRU being built by Hyundai is the only new build FSRU without a signed contract for its output. [17]

EE expects to acquire an LNG carrier in 2025 for likely conversion to an FSRU. Before it converts the vessel to an FSRU, EE plans to utilize the tanker to support deliveries of LNG volumes in its portfolio. [18]

LNG Portfolio

EE is building and growing this business quite dramatically. Note the following:

- In November 2023, EE signed a 15-year deal beginning in 2026 to sell LNG to Petrobangla, a government-owned oil and gas company in the South Asian country of Bangladesh. [19]

- EE sourced the LNG through a back-to-back 15-year purchase agreement for 1.0 million tonnes per annum (MTPA) of LNG with QatarEnergy.

- In addition, EE will increase the capacity of one of its FSRUs to accommodate this agreement. The back-to-back deals should generate $15-$18 million of incremental annual EBITDA for EE. [20]

Bangladesh is already an important customer for EE. EE currently has two FSRUs dedicated to the country; together the vessels supply 34% of Bangladesh’s natural gas. [21]

- In February 2023, EE signed an accord to buy 0.7 MTPA beginning in 2027 from the Plaquemines (Louisiana) LNG export facility owned by Venture Global, an owner and developer of LNG liquefaction facilities in that state [22]. The quantity of LNG that EE will buy is equivalent to about ten fully loaded LNG tankers per year.

- In 3Q 2024, EE signed multi-year, midterm agreements for LNG purchases and sales in one of the Atlantic Basin regions in which it does business, totaling 0.65 million tonnes of LNG. EE’s first purchase will be made this quarter. These deals will help to de-risk the expected 2025 LNG carrier acquisition discussed just above. [23] Most importantly, this Atlantic Basin deal is an example of EE’s ability to leverage on its base business and global footprint to deliver LNG to customers.

- In September 2024, EE signed a partnership agreement with a subsidiary of Vietnam Oil and Gas Group, the leading provider of oil and gas services in that country, to jointly study FSRU-based solutions for the rapidly growing Vietnamese LNG market. This follows EE’s signing a term sheet with a Vietnamese private development company to co-develop a greenfield LNG terminal in Hai Phong, Vietnam. [24]

- EE is working with Alaskan utilities and state officials to develop an FSRU-based integrated terminal to receive gas to meet the state’s near-term energy needs, as gas supply in the lower Cook Inlet in Alaska should be fully depleted in around ten years. [25] Production in this region has supplied most of the natural gas used for heating and electricity generation in Anchorage and Kenai Peninsula for about 60 years. [26] The Cook Inlet stretches 180 miles from the Gulf of Alaska to Anchorage in south-central Alaska.

Excelerate Energy’s Key Investment Characteristics

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2023 Kailash Capital Research, LLC – All rights reserved.

January 15, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

January 15, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin