Answer: Nobody can predict the future. With that done, let’s revisit a moment of pain for the KCR team.

October of 2010 marked the single first ranking list produced by KCR. The top-ranked stocks were a magnificent collection of companies, in our view. Stocks like Lubrizol, Microsoft, Lorillard, Discover Financial and the 8th ranked stock, Eli-Lilly, sat as our highest ranked healthcare name.

Get our insights direct to your inbox: SUBSCRIBE

2010 was our entire team’s first foray onto the “sell-side” and we had a mission: provide investment advice based on facts with no conflicts or hidden agendas. The fundamental work we did on these names left us euphoric.

Upon publication we learned just how hard it is to be truly independent. Critics came fast and furious. Summary:

- Lubrizol – weak business model, unclear path to growth, and….it got bought out by Buffett’s Berkshire

- Microsoft – losing market share, horrible capital allocation, ex-growth, and…now it’s a market darling

- Lorillard – tobacco is bad, smoking is in decline, and…the stock was bought out +235% by Reynolds

- Discover – terrible brand, slow-growth and…. the stock exploded 1,493% and is now owned by COF

- Lilly – awful R&D productivity, pipeline and patent problems, and…. Monjaro sent the stock up 2,921%

The criticism on all the names came back to the idea that the KCR team is “just quants.” Many readers dismissed the significant fundamental bona fides of our investment team and the fundamental nature of our ranking methodologies. Oddly, the team found it easier to defend our position on Lilly than we did, say, Microsoft.

Some of us came from large asset managers replete with analysts who were doctors and scientists working with expert networks at the FDA. We had watched as investment firms poured fortunes into trying to out-guess the firms making the drugs and then guess the odds a given medicine would make it through various trials. The experience was informative: it was, without exception, a total waste of money and time.

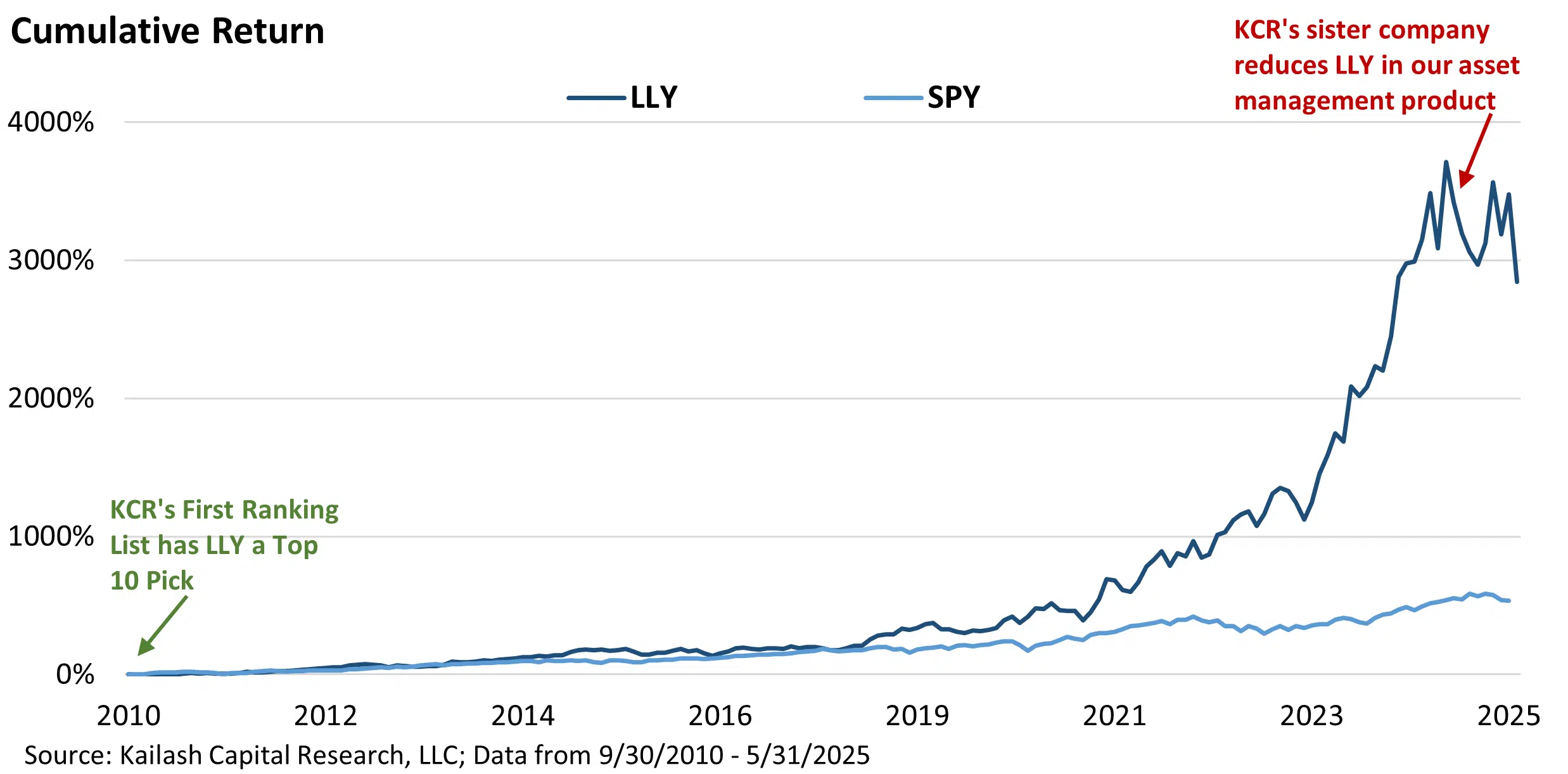

KCR had precisely no idea what, if anything, Lilly would invent. But in 2010, the stock was so cheap we estimated that the run-off value of the existing book of drugs could more than justify its valuation. If anything of even modest value came out of their R&D efforts it would be upside. Below we show the returns to LLY vs. the S&P500 since that first ranking list. Even more interesting, KCR’s sister firm, L2 Asset Management, which runs everything from Index Funds to SMAs posted a very public rationale for cutting our LLY exposure on October 10th of 2024. Not bad for a bunch of “quants.”

There is no denying we had some weak picks in that first list. Names like Intel, Glaxo, Goldman, Hasbro, and Bank of Hawaii all trailed the S&P500 since they first premiered on that list. As longtime readers know: KCR has a tradition of highlighting our worst performing models as pain is the parent of all progress.

To be clear, we had no idea a life-altering weight loss drug was in the offing. But that is the point. We relied on the margin of safety that came from Lilly’s low-valuation, solid margins, and overwhelming investor pessimism. This “skill” – using historical evidence to help us pinpoint risks and opportunities across sectors, industries, and stocks – has and continues to serve us well across many verticals where people have told us it will fail.

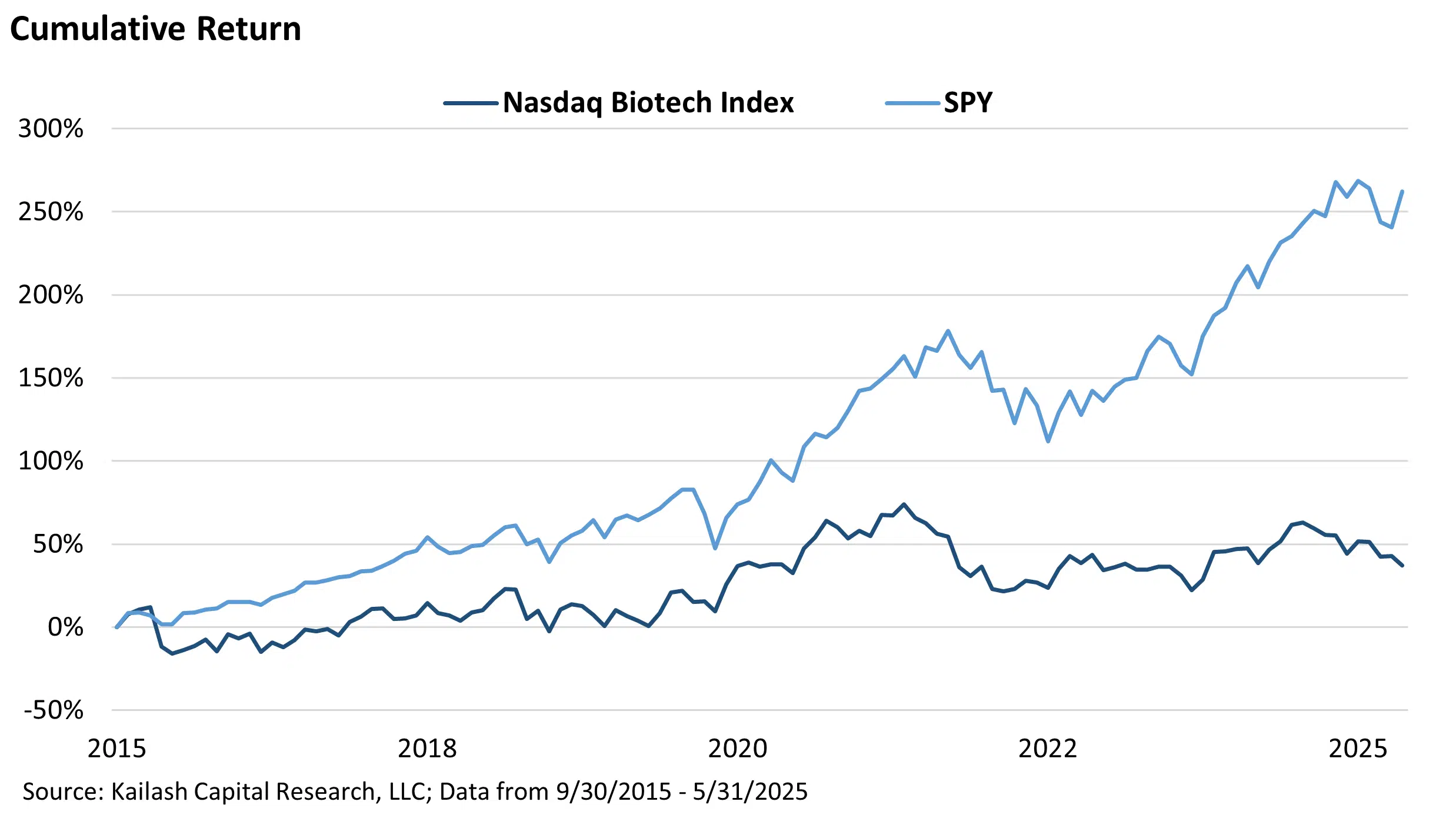

At the request of readers, in October of 2015 we wrote Where Are We in the Biotech Cycle? That piece pounded on biotechs as being overpriced and offering investors’ poor risk-reward trade-offs. Specifically, we panned the bellwether Biotech Index as a disaster on the make.

How could a group of alleged quants have a view on biotechs? What could we possibly know? Well, we know what can be (legally) known. And with that information comes an advantage. Despite no specialized scientific knowledge, no contacts at the FDA, and a total aversion to expert networks, below is how that call panned out. Over a decade the once high-flying biotech index has been a dud, rising only 38% or 3.4% per year vs. the S&P 500 rising 247% or over 13.7% a year.

For subscribers to our models, they know that many of the big biotech names have recently been making routine appearances at the top of our lists. And with that we have decided to highlight one of our favorites: Amgen.

Similar to our thesis on Lilly in 2010, we do not need much to go right for AMGN to put up solid compound returns, in our view.

Even better, unlike Lilly where we had no idea what positive catalysts might be coming down the R&D pipeline, Amgen has a material and plausible catalyst that could send the stock soaring, in our view.

The next 11 pages offer a detailed thesis on why we believe AMGN offers investors’ compelling value.

Founded 45 years ago, Amgen Inc. (AMGN) is one of the world’s largest and most successful biotechnology/pharmaceutical companies. It is no exaggeration to say that AMGN produces some of the world’s most important medicines. AMGN’s stock has been one of the prime beneficiaries of investors’ decision to allocate significant dollars to the healthcare sector since the beginning of 2025. We believe there is more upside.

Why We are Bullish on AMGN:

Fundamental Strengths:

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

June 11, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

June 11, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin