Today’s piece will discuss the current state of tech investing in US markets. [1] A decade of zero interest rates coupled with the dramatic and unsustainable fiscal stimulus post Covid has taught investors a precarious lesson: every decline in the market’s most popular stocks is a buying opportunity. Financial history is littered with the inevitable ebb and flow of investor sentiment from fear to greed and the negative consequences of both.

When the masses are fearful, you should be greedy. When the masses are greedy, you should be fearful. This advice, rendered by Mr. Buffett and many other famous investors, is as obvious as it is intuitive. Yet the disciplined application and implementation of this proves illusive for most. Why? ENVY.

Get our insights direct to your inbox: SUBSCRIBE

As economic historian Chrales Kindelberger once quipped “There is nothing as disturbing to one’s well-being and judgement as to see a friend get rich.” In our experience this effect is prone to powerful amplification if we add on “….get rich without working.” Listening to a neighbor talk about the stunning wealth accumulated by simply having clicked “buy” on Nvidia, Microsoft, Apple, or Google a few years ago creates an almost unstoppable urge to follow suit.

Add in the steady drumbeat of the imminent wonders promised by the promoters of Artificial Intelligence, and the aforementioned urge simply grows stronger. These companies are not just making your neighbors rich; they’re reinventing the world. This is common knowledge. Suddenly not investing in tech feels foolish.

As a firm that faced withering criticism for our models’ overwhelming preference for US tech stocks in 2010 – 2017, we are blowing the whistle on what is now reckless speculation. We appreciate the power of technology, the remarkable earnings growth these companies have experienced recently, and the seemingly relentless rise higher in the stocks. Remember: we loved these companies when they were hated.

Everything KCR does is based on empirical evidence. As we are fond of saying, “We are not in the crystal ball business, we are in the Moneyball business.TM” With that, let’s keep it simple, let’s set our emotions and envy aside, and let the data tell the story.

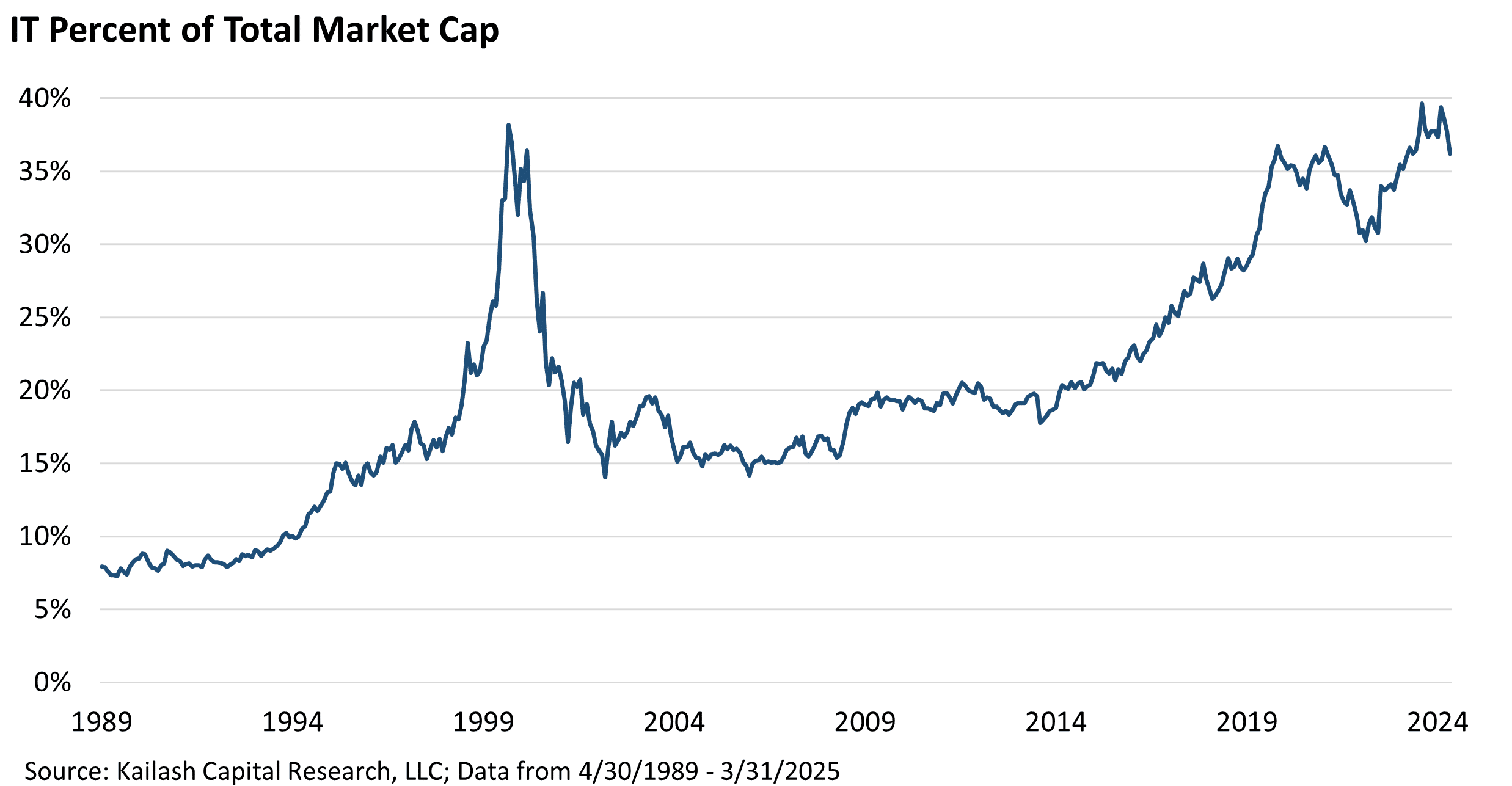

The chart on the following page illustrates the Information Technology (IT) sector’s percentage of total market capitalization from 1989 through March 2025. The IT sector experienced two major peaks: one during the dot-com bubble around 2000 and another record high near 40% today.

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2025 Kailash Capital Research, LLC – All rights reserved.

May 2, 2025 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

May 2, 2025

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin