KCR’s Top Charts Updated

Every year since the launch of our website, we have posted a piece reviewing KCR’s work from the prior year. Today’s post continues that tradition and even includes some 2023 publications that are just as compelling today as they were when published. We would like to thank our rapidly growing list of readers for their support, engagement, and thoughtful kindness.

Is Excelerate Energy, Inc. (EE) a Hidden Gem Due to its Small Float?

Excelerate Energy, Inc. (EE) provides key integration services and infrastructure along the natural gas-to-power liquefied natural gas (LNG) value chain. More specifically, the company operates ten floating storage regasification units (and has contracted with Hyundai Heavy Industries to build another), which has allowed EE to complete around 3,000 ship-to-ship transfers of LNG with more than 50 LNG operators since EE began operations.

Could Paysafe Ltd (PSFE) Double Your Money via Digital Wallets?

Paysafe Limited (PSFE) provides payment solutions, including credit and debit card processing, digital wallets, and real-time banking. The company serves 18 million active users in more than 120 countries who can interact with 250,000+ small and medium-sized businesses (SMBs).

Market Cap to GDP & the Importance of Basic Arithmetic

We've written a great deal about Warren Buffett’s favorite measure of market valuation market cap to GDP. Our research on the topic has demonstrated the ability of this simple metric to predict 10 year forward market returns.

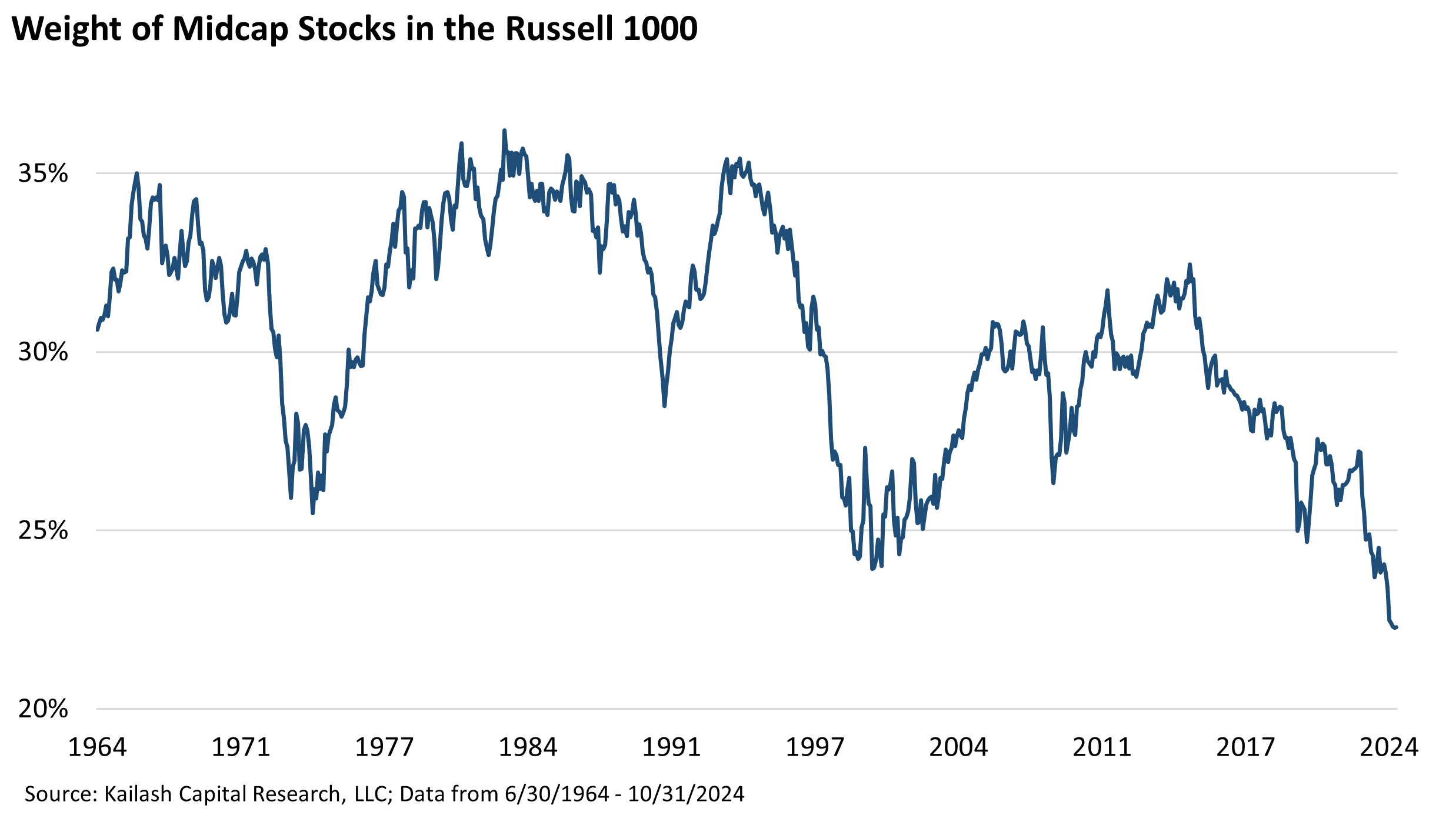

The Merits of Midcaps Made Easy: Part I

Over time, Midcap’s performance, diversified sector exposure, and growth potential suggest that midcaps deserve a dedicated allocation in any long-term portfolio. This series will highlight some key data supporting Midcap’s role in delivering advantaged returns. No matter who you voted for, we would guess that everyone can agree that

President-Elect Trump was Right: Musk, Mid, Small & Microcaps

First things first: KCR is a nonpartisan publication. We have friends across the political spectrum. To a person, we are die-hard Americans who are grateful to be in this country. On to the issues at hand. No matter who you voted for, we would guess that everyone can agree that

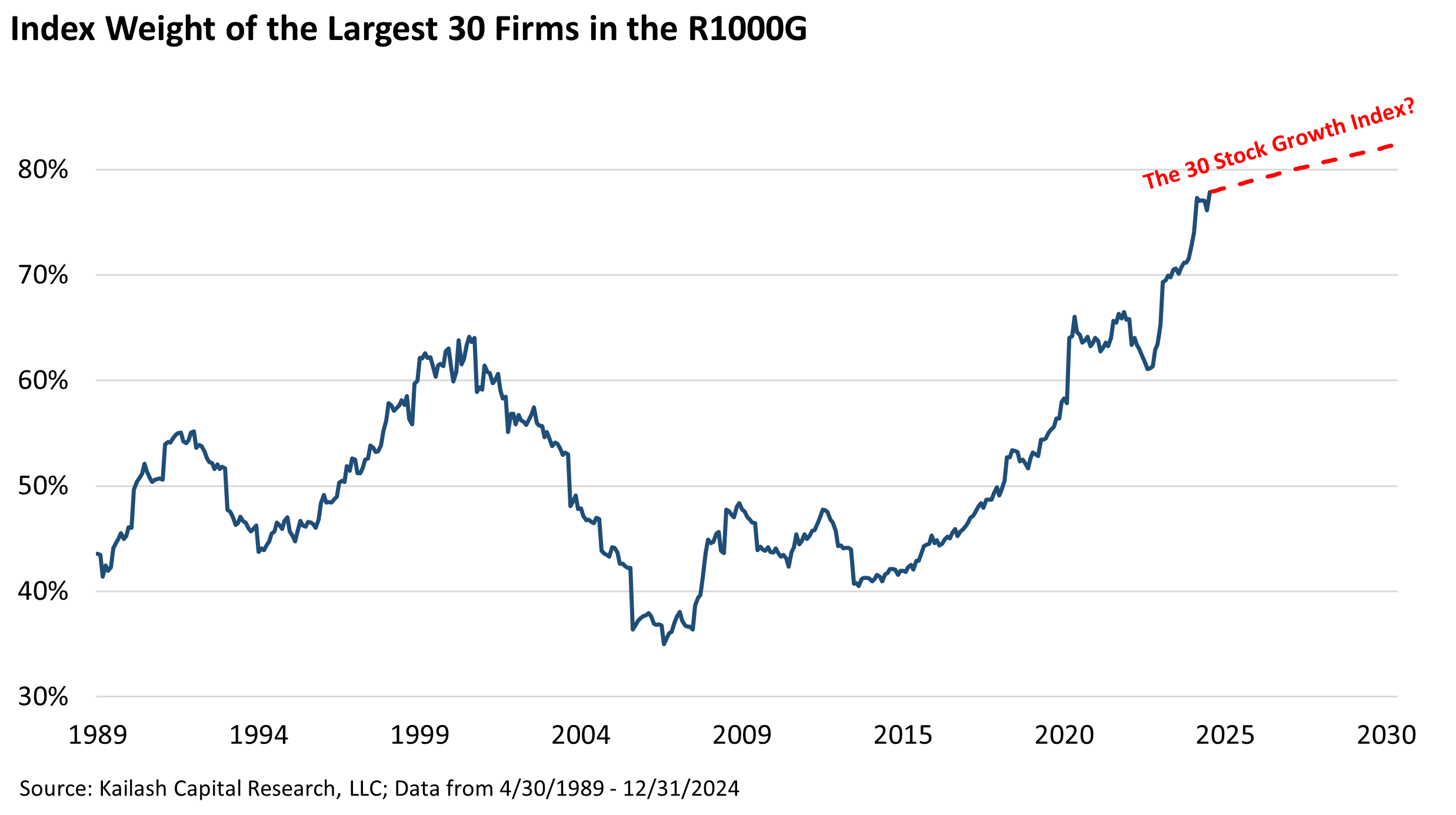

Dot.com, AI and…Kimberly-Clark

Despite a cacophony of narratives around AI, politics, and global conflicts, investors have continued to buy index funds and tech stocks with abandon. What has gone up is what is being bought up. In the short term this feels good. In the long-term, this sort of herding is a potent source of market inefficiencies. These inefficiencies represent opportunities for patient investors.

Does Dicks Sporting Goods (DKS) Have Much Farther to Run?

DICK’S Sporting Goods, Inc. (DKS) is the largest sporting goods retailer in the U.S. It holds about an 8.5% market share in the $140 billion total U.S. sporting goods market for hardlines, apparel, and footwear.

Staples Stocks: A Refuge from a Possible Tech Wreck?

In Part I of our work on Consumer Staples stocks we provided data demonstrating that: 1. Staples stocks had generated the highest risk adjusted return of any sector over the last 30 years 2. That relative to the S&P500 Staples were as cheap as they were at a. The peak of the dot.com bubble and b. The peak of the Covid bubble – a moment when we pounded the table on Staples to great effect 3. Investor interest in Staples’ reliable earnings and income features had fallen to never before-seen lows

Is Ralph Lauren (RL) Ripe to Keep Running?

Ralph Lauren Corporation (RL) is a global leader in the design, marketing, and distribution of apparel and accessories that span the mid-range to luxury segments. RL’s products are sold through a variety of distribution channels under well-known brand names such as Polo Ralph Lauren and the Ralph Lauren Collection.

Staples Stocks: Could Boring Become Beautiful Once Again?

The market’s death spiral in 2008 and early 2009 sent the world into a panic. One KCR staffer was working out of a hotel overlooking one of the busiest container ports in the world. There was no movement.

Financial Advisers: Facing Down the Stock Comp Crisis

On Sept. 15, 2008, Lisa Roitman, a managing director at Lehman Brothers, was enjoying herself at a block party with her family in Greenwich, Connecticut, when a neighbor who worked at Goldman Sachs approached her. “I heard you were filing today,” he said. She was blindsided