How “Bro-Culture” Grifters are Distorting Price Signals, Capitalism & Culture

Over nearly 15 years, KCR has never highlighted any one person, instead preferring to make our points by referencing groups that fit into various behavioral cohorts. After an internal team vote we decided to make an exception. This rant highlights Chamath Palihapitiya’s spectacular, no-consequences implosion on Twitter to point out that rampant disinformation by promotional people has dire real-world consequences.

Mr. Palihapitiya became the focal point of ruthless pillorying on Twitter after anointing himself “The Man in the Arena” for his investment activities in 2020. We found this self-styled analog typical of the intellectually shallow bro-culture grifters that have dominated much of the Covid bubble cycle. The Man in the Arena quote comes from Theodore Roosevelt’s 1910 “Citizenship in a Republic” speech at the Sorbonne in France.

The speech was and is a moving reminder that democracies depend on “…the way in which the average man, the average woman, does his or her duty…” and implores us to recognize that the fight must be for “…a worthy cause…” that requires character above all else and “…good faith and a sense of honor.”

Get our Rants & Raves direct to your inbox: SUBSCRIBE

Roosevelt spoke at length about money. We quote sparsely and inadequately from his stupendous speech:

If he has earned or uses his wealth in a way that makes him a real benefit, of real use – and such is often the case – why, then he does become an asset of real worth. But it is the way in which it has been earned or used, and not the mere fact of wealth, that entitles him to credit. … It is a good thing that they should have ample recognition, ample reward. …

But we must not transfer our admiration to the reward instead of the deed rewarded; and if what should be the reward exists without the service having been rendered, then admiration will only come from those who are mean of soul. … It is a bad thing for a nation to raise and to admire a false standard of success; and there can be no falser standard than that set by the deification of material well-being in and for itself. …

…human rights must have the upper hand … Courage, intellect, all the masterful qualities, serve but to make a man more evil if they are merely used for that man’s own advancement with brutal indifference to the rights of others. … and we of to-day should in our turn strive to shackle or destroy that individualism which triumphs by greed and cunning…

Roosevelt’s message of individual accountability, integrity, and the need for mutual respect and cooperation was met with thundering admiration. As one newspaper of the time wrote:

At the Sorbonne…The façade bristled with American and French flags, and fully 25,000 persons packed the streets and acclaimed Col. Roosevelt on his arrival. Within the building, enthusiasm was unbounded, the vast crowd in the amphitheater interrupting again and again with storms of applause as the speaker defined the duties of the individual citizenship in a republic, scorning the sluggards, cynics and idle rich and preaching the gospel of work, character and strenuous life.[i]

We understand that in this “TL;DR” – “Too Long, Didn’t Read” age – that long-form dialogue is unpopular. But for the few interested, you can listen to Roosevelt’s entire speech here. Considering the divisive rancor advanced by the loud voices at the edges, we found his words positive and inspiring. We also felt it best practice to provide the whole speech so those who admire “SPAC Jesus” (aka Chamath) can tell us if they disagree with our interpretation of Roosevelt’s words.

To paraphrase Mr. Palihapitiya: We’re in the arena trying stuff too! Some will work. Some won’t.

Anywhooo…

In Mr. Palihapitiya’s case, the “Man in the Arena” came out a winner. But those who listened to him did not. His recent decision to tell those who were crushed following his advice “To stop being a victim, the world will pass you by,” has been called one of the most tone-deaf comments in history.

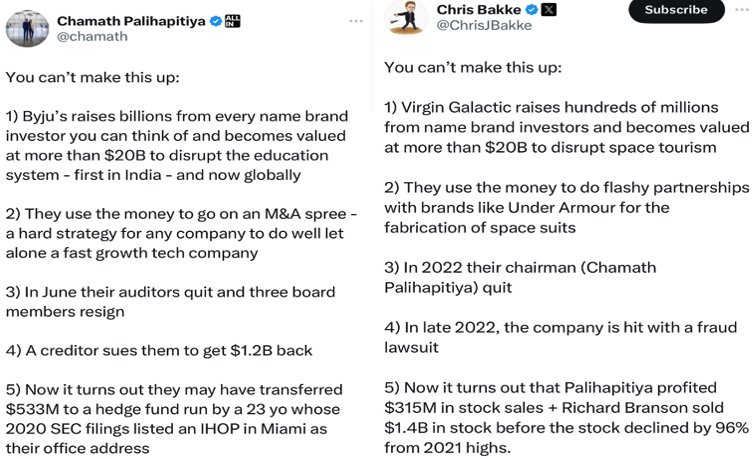

Seemingly oblivious, Mr. Palihapitiya would go on to publicly castigate the folks behind Byju for potentially fraudulent behavior. Chiding others for regulatory slippage aged poorly. One clever Tweeter created a hilarious comparison with his conduct at Virgin Galactic (SPCE). Here are the now-famous tweets side-by-side.

Source: https://twitter.com/anothercohen/status/1702129568008532330

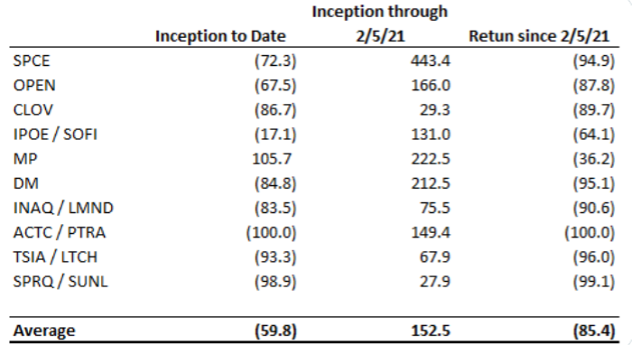

The investments Chamath championed are a veritable murderers’ row of financial catastrophe.

Sources: https://twitter.com/EconomPic/status/1694133425723351158 & https://twitter.com/EconomPic/status/1694130502935208030

Sources: https://twitter.com/EconomPic/status/1694133425723351158 & https://twitter.com/EconomPic/status/1694130502935208030

To be clear, KCR is all for free speech. But it used to be if someone used language to promote investing in specific securities they were directly involved with, and it turned out that many of those statements were possibly patently false, and those securities crushed investors….you got into trouble.

And Mr. Palihapitiya’s record on accurate statements is hardly envious. In early 2021, Mr. Palihapitiya sat down with Bloomberg for an interview where he managed to:

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2023 Kailash Capital Research, LLC – All rights reserved.

October 5, 2023 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

October 5, 2023

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin