Flush With Cash & the Quick Swing in Sentiment

How the Rotation from Risk On to Risk Off is…Creating Risk - The Oxford University Press tells us that the principal meaning of being “flush with cash” is having a lot of money, usually for a short period of time. The last part of the definition is interesting considering investors’ newfound interest in holding abundant piles of cash. A recent article headlined with “Retail money market funds inflows are the highest in 30 years as investors seek safety.”

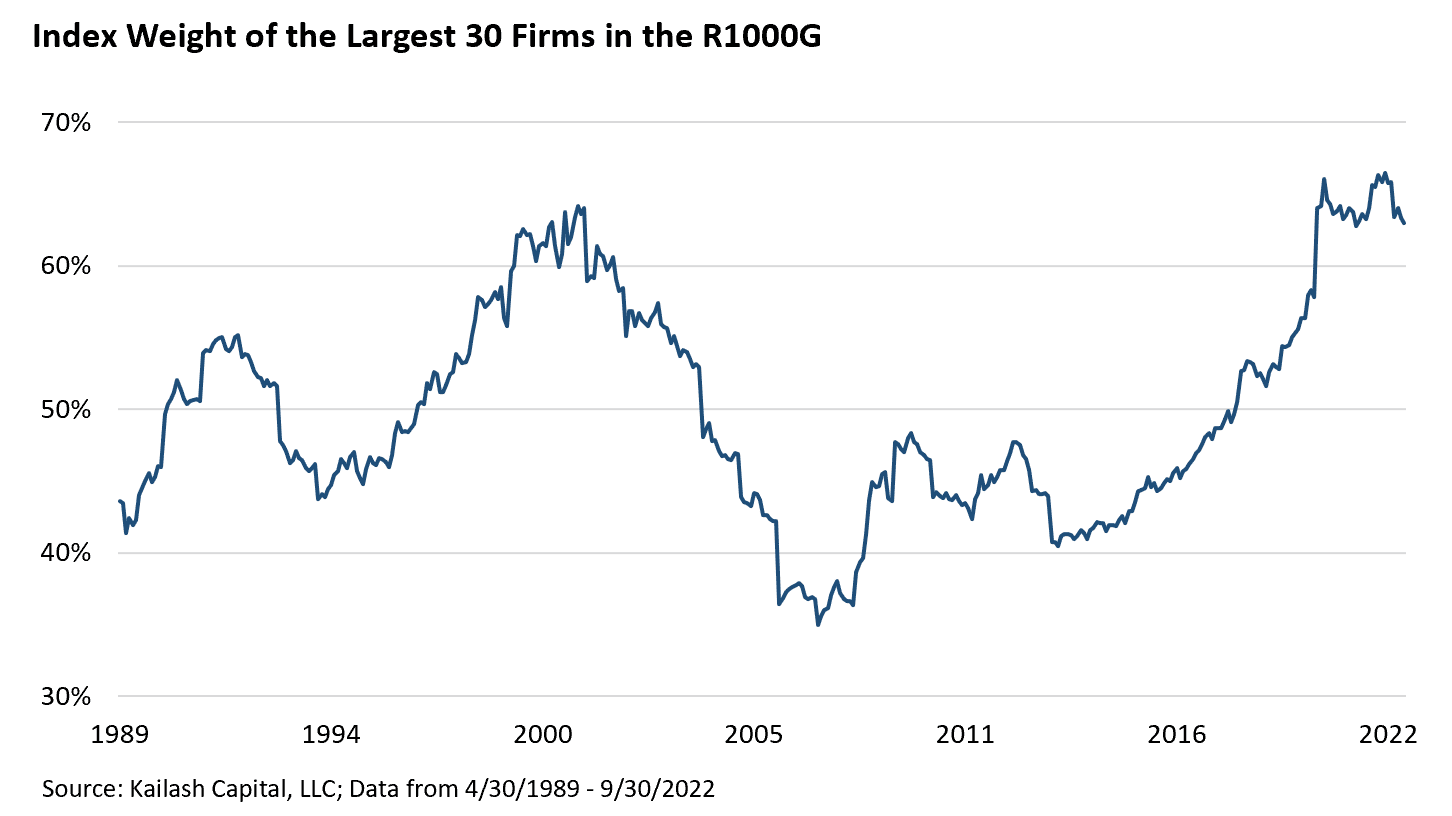

Large Cap Growth Index Funds & the Path to Poverty

A Quick Peek at the Russell Large Cap Growth Index - Understandably smitten with low fees and a long bull market, index fund promoters appear to have the data on their side. A collection of financial heretics, the authors of this investment newsletter have highlighted what we believe are the defects endemic to index funds today. In the interest of simplicity, we have used single factors to highlight just how these...

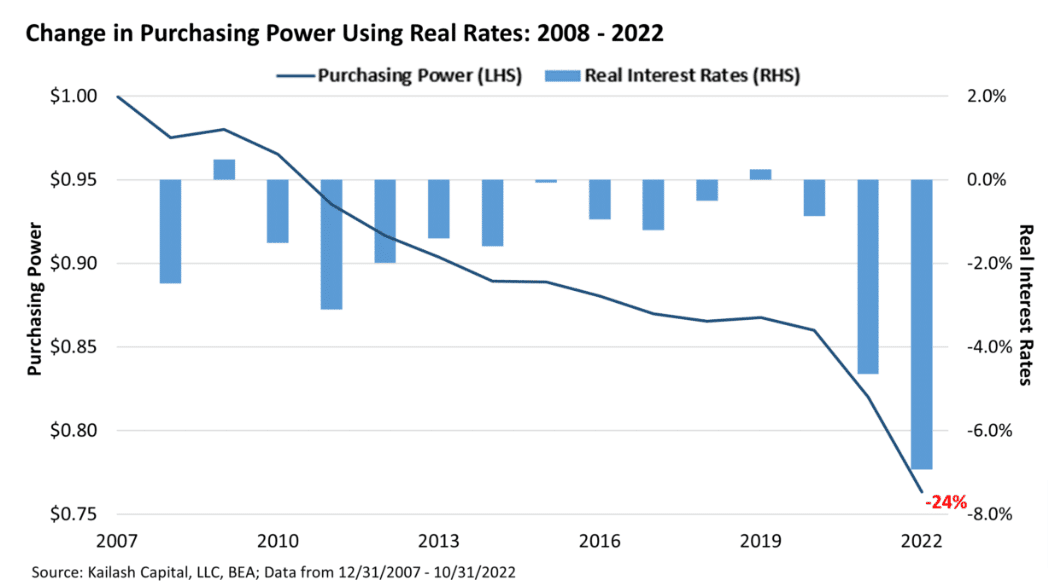

Inflation is Taxation without Legislation or Representation

The Cash Crucible & the Acceleration of Financial Repression - “Cash is a Legitimate Asset Class for the First Time in Decades, Investors are piling into products that shield them from losses in a rising rate environment.” So said a recent article in Bloomberg. Any headline-hailing investors “piling” into anything should trigger instant paranoia.

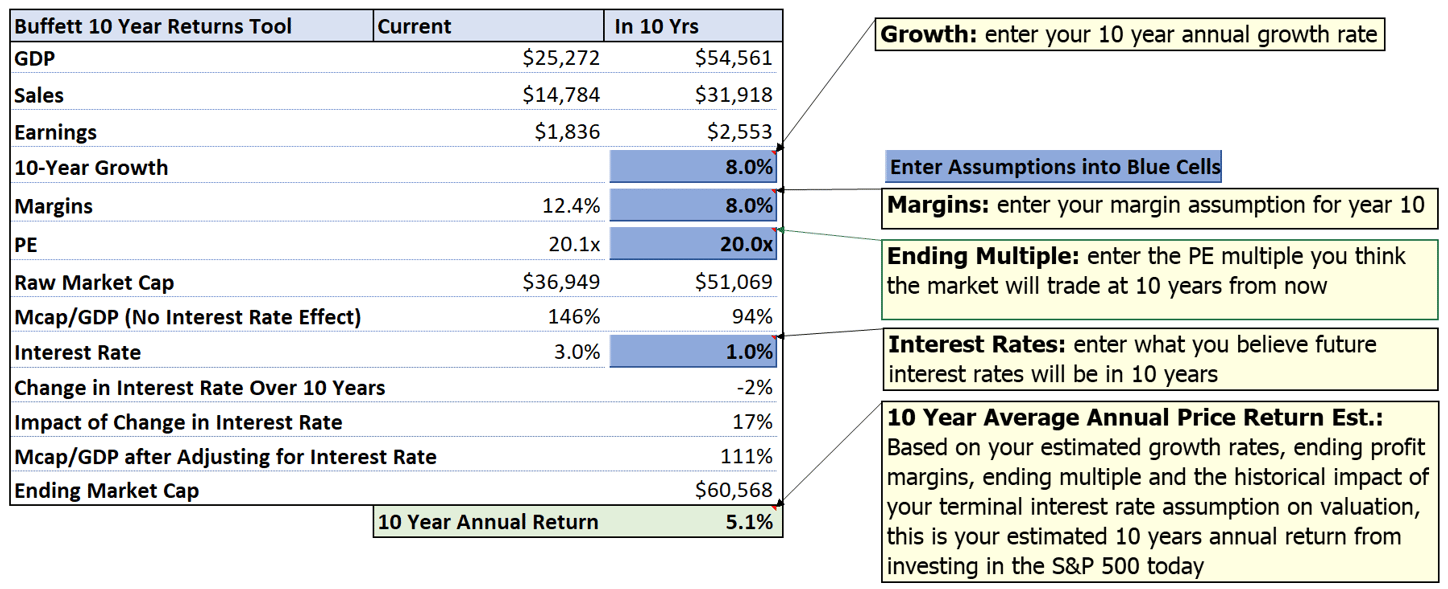

S&P 500 Calculator: Warren Buffett Valuation Spreadsheet

This Tool Can Bring Calm to Chaos - Reverse inquiries looking for our Buffett 10-Year Returns Estimation Tool suggested another post was in order. We’ll explain where the tool came from, how to use it and why it is so important.

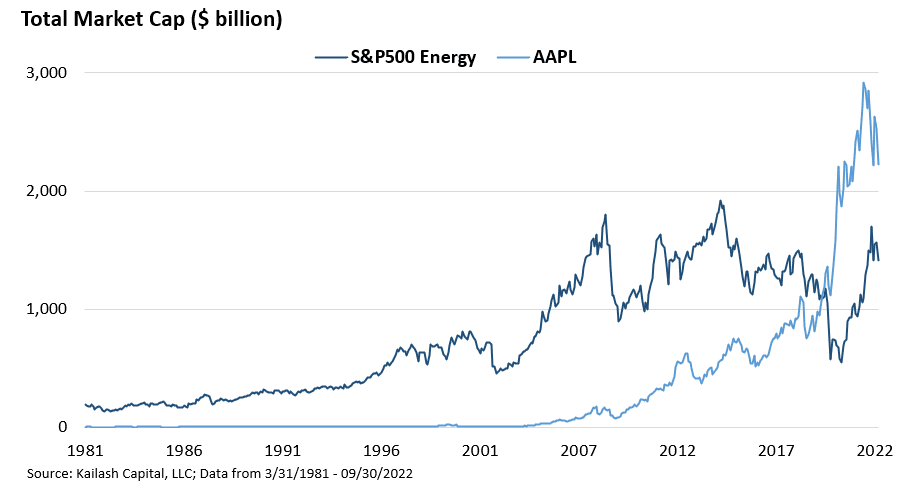

S&P Energy ETF vs. Apple

The Case for Investing in What you Need vs. What you Want Made Simple - Since 2020, this newsletter has used historical data to explain the case for investing in companies that make what you need while shelling overpriced companies that make what you want. KCR’s research has demonstrated that the market’s valuation structure has, and continues to, favor firms that provide popular discretionary goods and novelty technologies over companies that make essentials to human life.

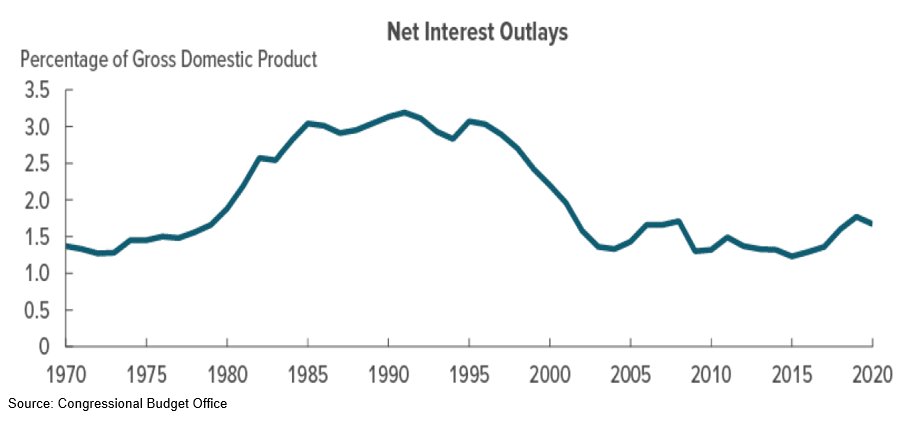

Macro Research: Will Math Ever Matter in the US?

Tap Dancing with TINA & a Moment to Remember in US Monetary Policy - Macro Investing: The Rising Pressure of a Decade of Fiscal Profligacy - KCR’s investment process does not use macro inputs or engage in macro trading. We use historical security-level data around valuation, profitability, quality, and other metrics to identify opportunities for short sellers and long investors alike. Macro investing can be a challenging endeavor.

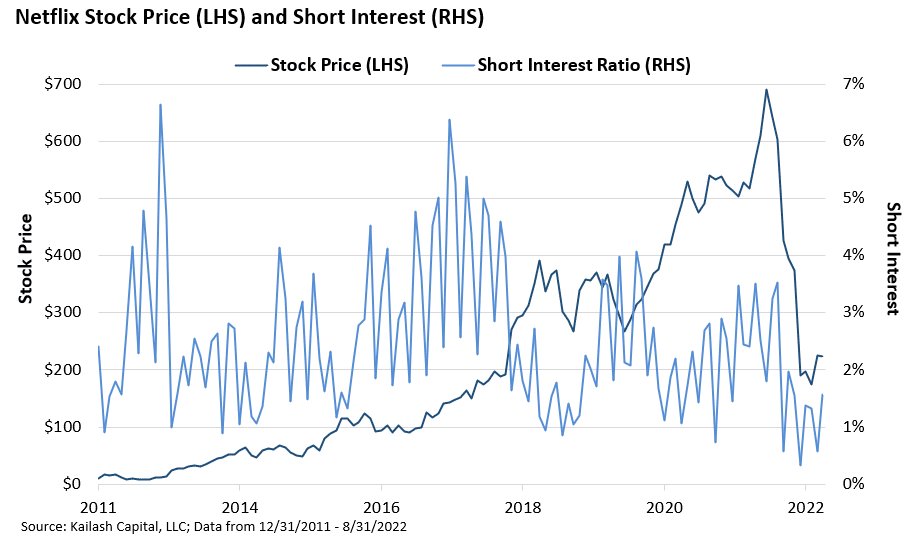

NFLX Short Interest, Regulatory Intrigue & Income Opportunities

What Short Sellers, the Voting and Weighing Machine are Offering Investors Today - KCR’s data-driven and historically informed process helps us avoid bubbles, find mispriced quality, and identify stocks that are simply too cheap.

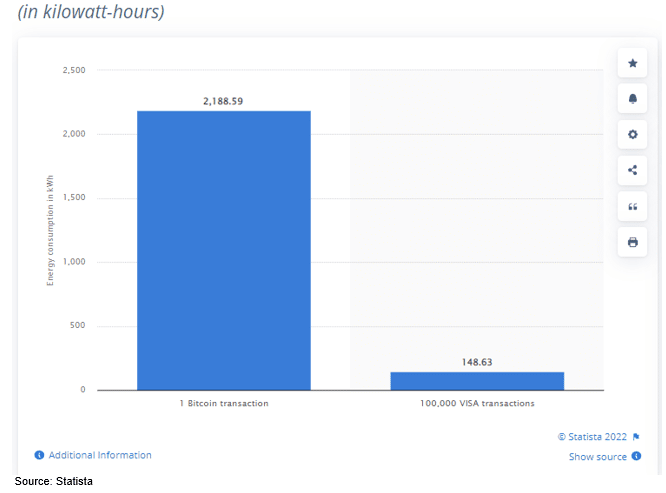

Tesla Gas Mileage & the “Philanthropic” Rush to Ruin

The Tesla Model S MPG Figures Sure are Alluring

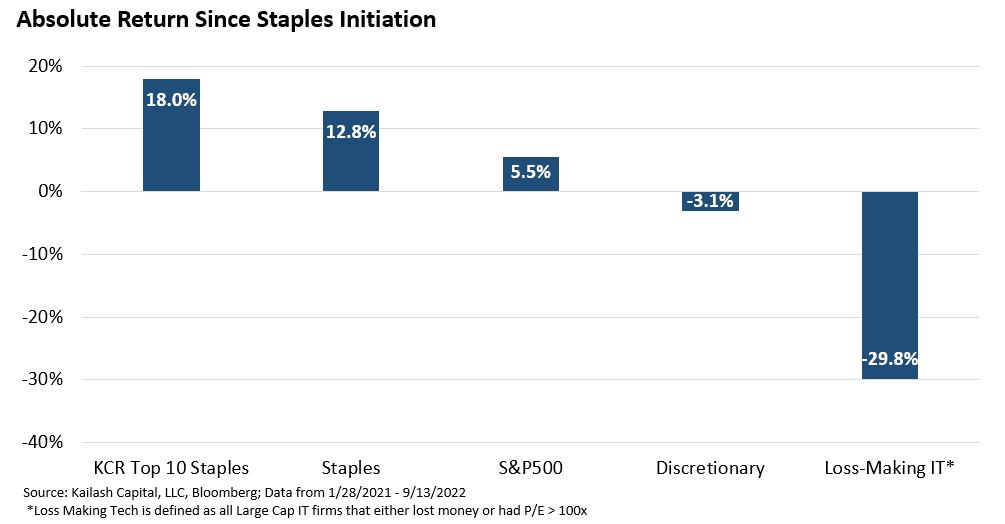

Safe Dividend Stocks: A Staples Update & A Brand New Bag

KCR’s systematic, evidence-based analytical and investment process is driven by the historical record. Our financial faith resides in what the data shows. Human beings have made the same mistakes in slightly different forms again and again for centuries. Stick to a low-cost, tax efficient process and winning is inevitable.

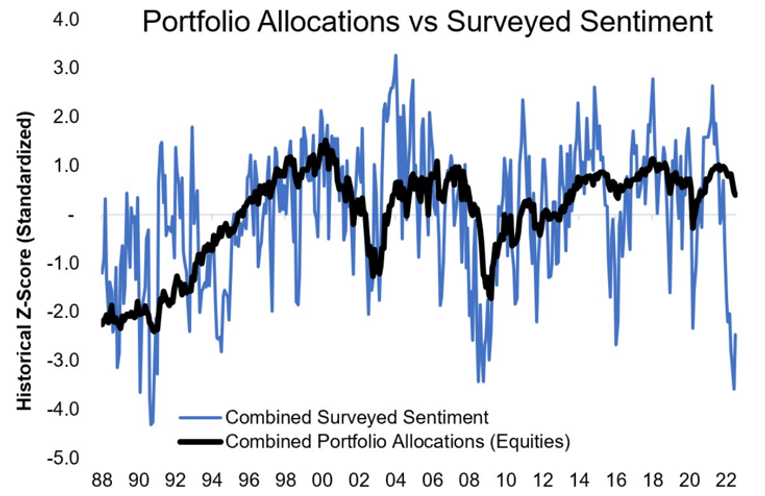

Equity Positioning, Sentiment, and the Disposition Effect

KCR’s work leans heavily on sentiment for good reason. The presence of our in-house academic and co-founder does not mean we are advocates of efficient markets. Much of the research in behavioral finance that our systematic approach to fundamental research leans on is dedicated to finding undue pessimism and optimism. These are often a critical ingredient in...

Nabors Investor Relations Has a Terrific Story to Tell

Profiting from the Reckoning with Reality - KCR readers know we have been long-term bulls on energy stocks and have relentlessly panned the high-priced promises of so-called clean-tech energy stocks. While others read the IEAs’ path to net-zero emissions and forecasted the end of oil, we read the work and wrote our piece, Net Zero Emissions: The Possible vs. the Plausible, which explained how their...

A Tight Labor Market Returns the Upper Hand to American Workers

A Tight Labor Market Returns the Upper Hand to American Workers - The always wonderful John Authers put out a recent piece on inflation. Discussing comments out of the UK, he observed, “I cannot remember a central bank of a large, industrialized country being this negative about its own economy.”