KCR Equity’s Best Charts from 2022: All Charts Updated!

We recently posted a year end piece summarizing KCR’s work from 2022. There were so many blistering charts that we broke the recap into two parts. The first, Short Term Stock Speculators Beat a Hasty Retreat, and A Basic Industries Boom & the Return of the Real Economy as the follow-up. When we posted our 2022 year-in-review we highlighted the charts as they were...

The DAV

As anyone with a wallet and an email inbox can attest, we live in an age of unprecedented crowding in the philanthropy and charitable giving space. Americans donated $485 Billion in 2021, and with charitable organizations jockeying for the biggest slice of that pie, many folks seek out the organizations that are delivering the most benefit. This is why we want to take a moment to highlight the charity Disabled American Veterans (DAV).

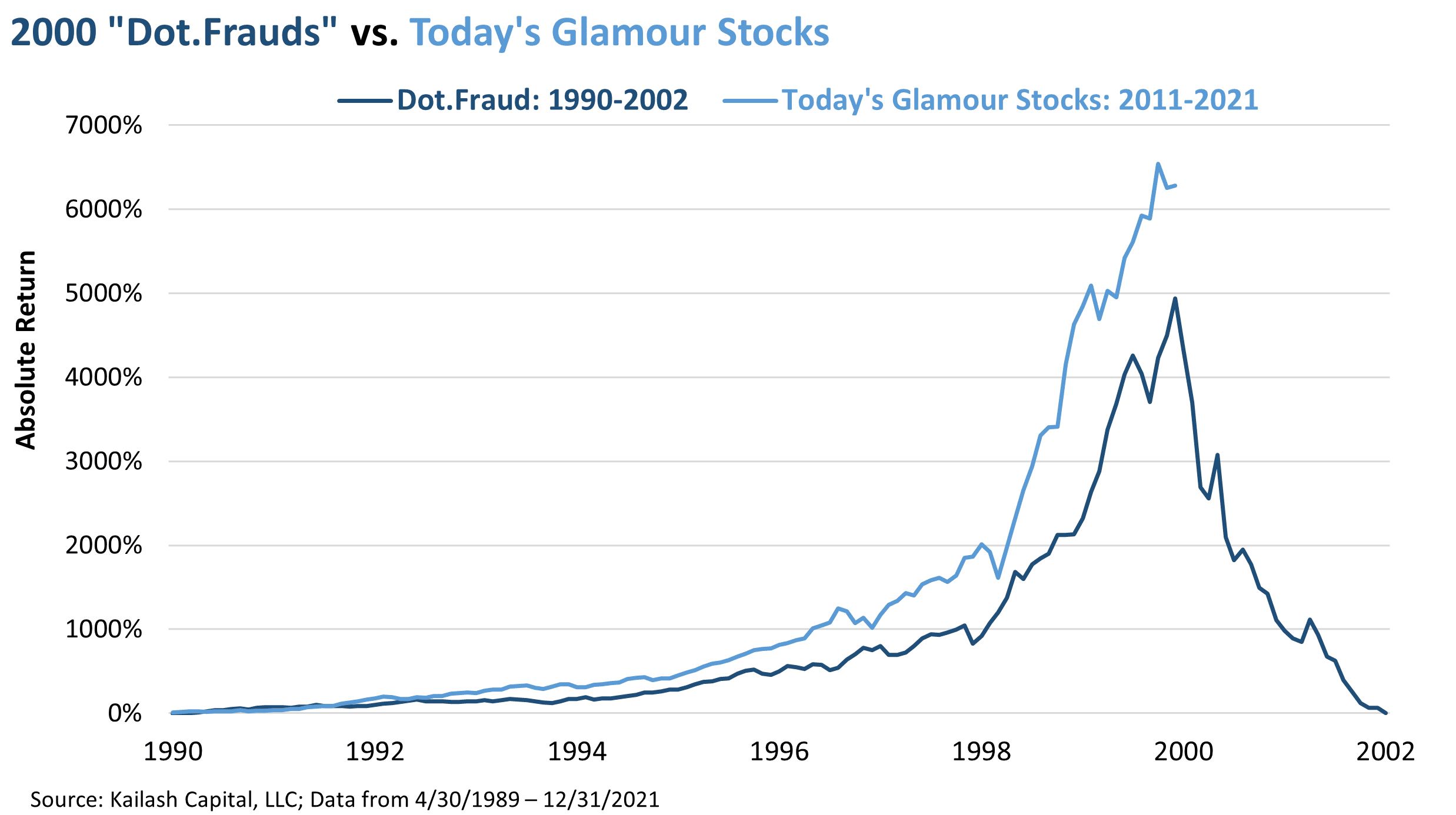

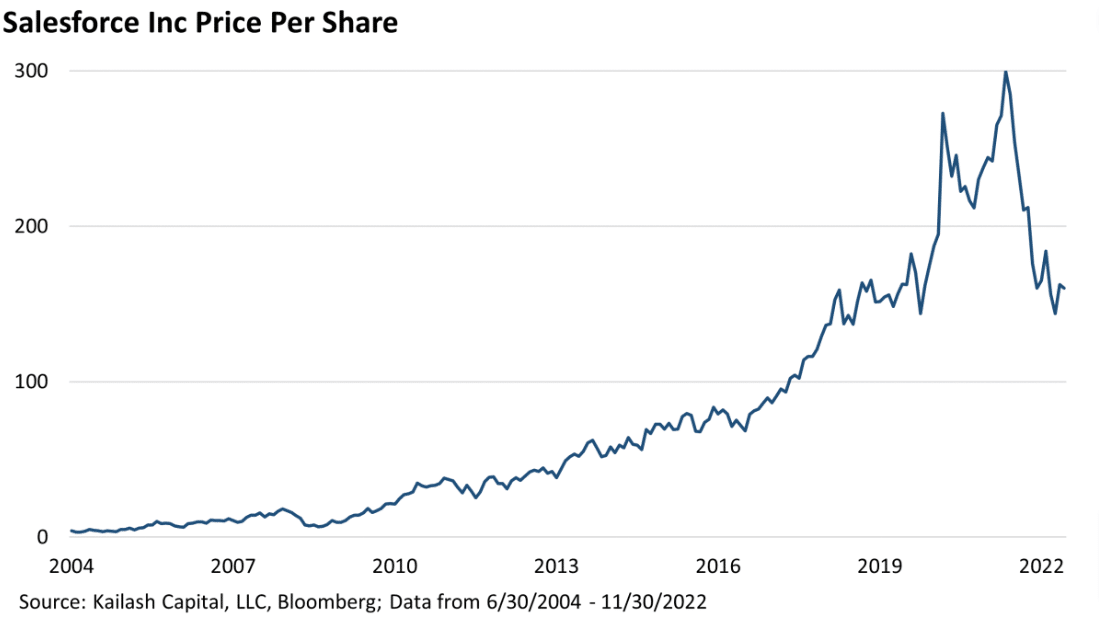

ARKK vs. QQQ in the Dot.Com Bust

2020 was a brutal year for KCR. US bonds rose to offensive levels, offering investors a 0.50% yield, while equities soared to valuations above the dot.com peak. Our evidence-based investment process is driven by historical data, algebra, and common sense. By the end of 2020, there was nothing less common than common sense. Basic math's were tossed out the window and replaced by empirically impossible narratives spouted by promotional fund managers and...

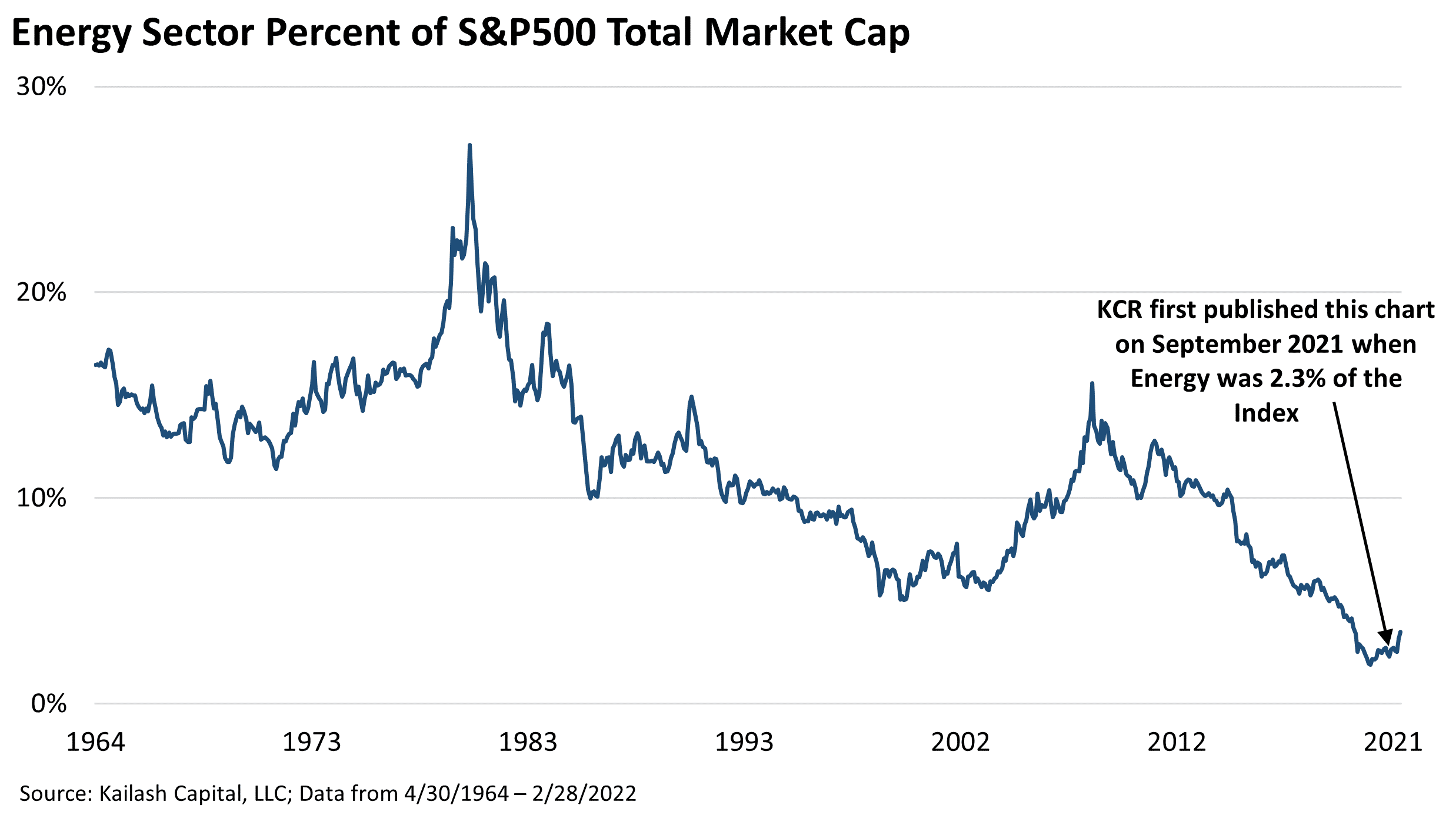

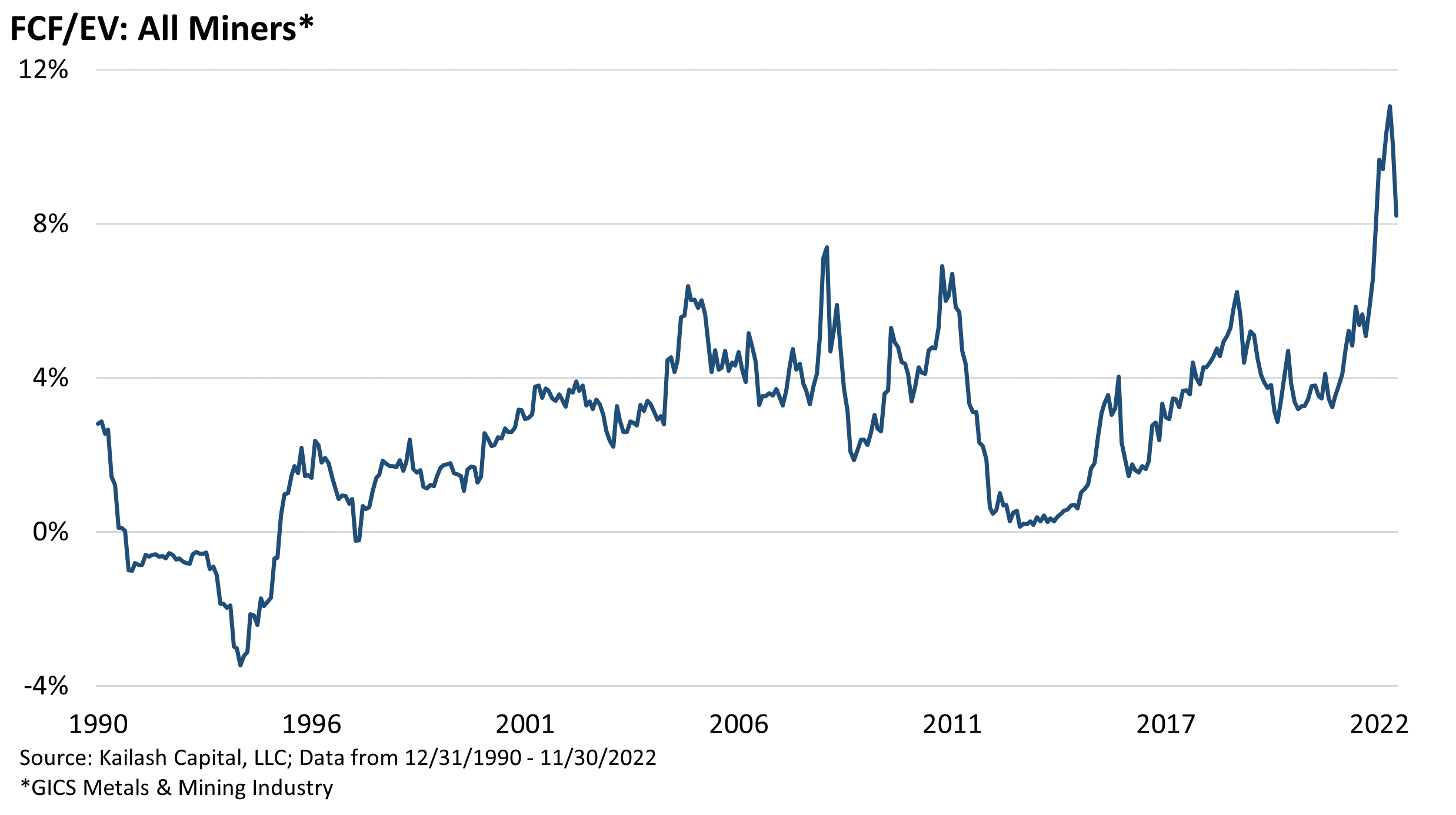

A Basic Industries Boom & the Return of the Real Economy

Last week’s piece Short Term Stock Speculators Beat a Hasty Retreat, walked through the blizzard of work we did on the continued collapse of speculatively priced stocks in 2022.Today, we present the best charts on the bullish material we highlighted last year.

Short Term Stock Speculators Beat a Hasty Retreat 2022 Year in Review: Part I

At the end of last year, we posted a piece reviewing our research from 2021. We explained that after a brutal 2020 where we were bombarded by skeptics, ‘21 had been a terrific year for KCR and we expected more in ‘22 based on the data. Thankfully, fortune favors the patient, disciplined, and empirically inclined.

Cash Flow to Stockholders is Defined As: Misleading?

How the Crypto-FTX-Fraud Could be Masking Epic Capital MisallocationAccounting Tools states that cash flow to stockholders is the amount of money a firm pays its equity owners. They explain that “Investors routinely compare the cash flow to stockholders to the total amount of cash flow generated by a business…”

The Kindness of Strangers

We think it is worthwhile to ask: what do we lose when we close ourselves to interactions with people in our everyday lives?

The Mining Investment Boom Nobody Believes

Market Prices Suggest the Movement to a Green Grid Will Fail - Quick piece on some of the market’s cheapest and most unpopular stocks.

Small Cap Investing Strategies, Large Caps & Active Management

The Role of Critical Minerals in Clean Energy Transitions

Have Policy-Makers Given Investors a Secular Growth Story for Cyclical Stocks? Our research is empirically based and tends towards places that are uncomfortable and out-of-favor. In 2020, as investors gorged on crypto, loss-making tech and growth stocks of dubious merit..

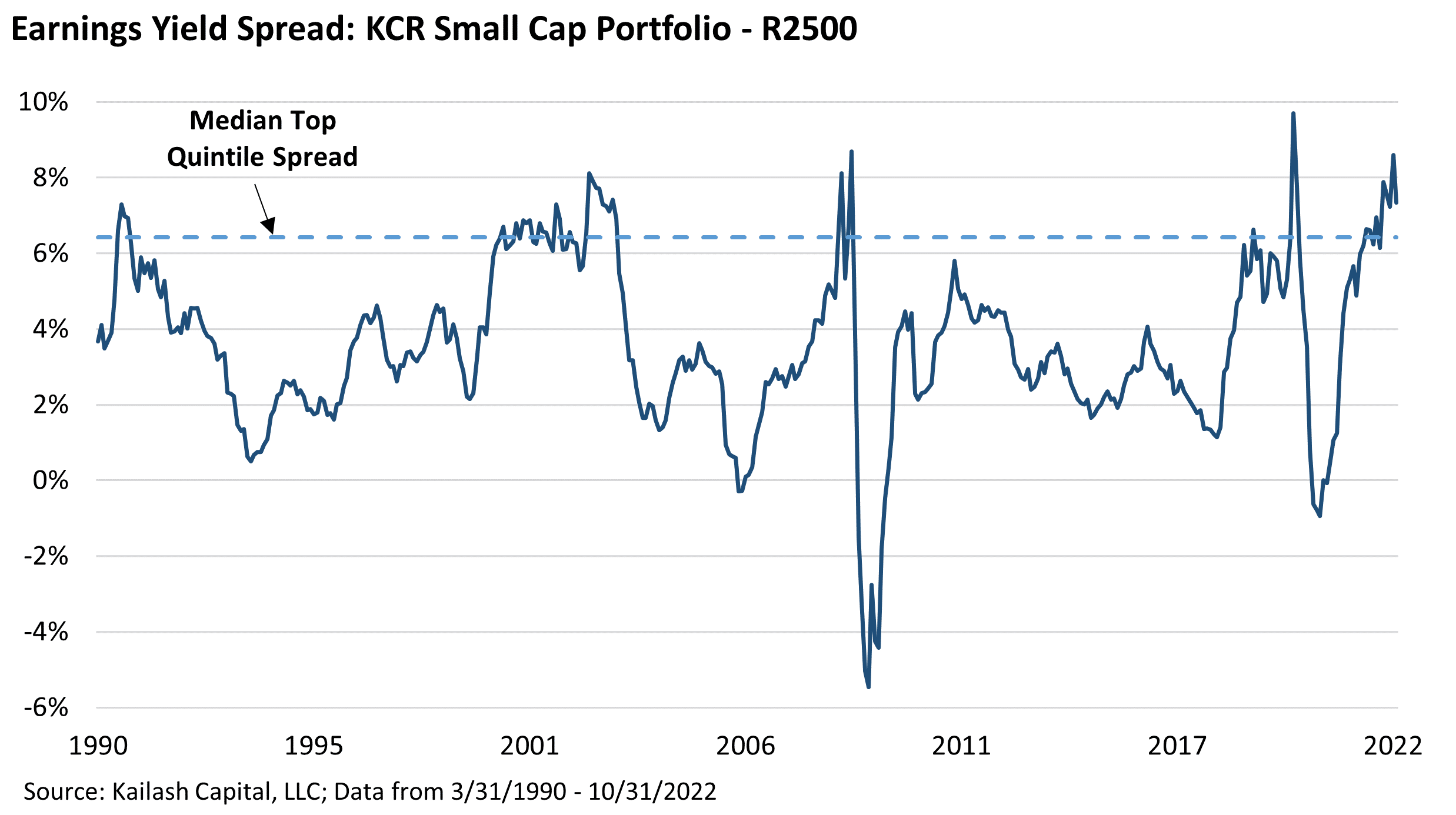

Small Cap Quality Stocks: The Gift from the Index Fund Complex

Our team believes in inefficient markets, behavioral finance, empirical evidence, and common sense. Having penned brutally simple pieces explaining the risks large cap, large-cap, and small cap index fund owners are taking, our recent exchange with an advocate of index funds was inevitable. The caller was upset.

Small Cap Investing Strategies, Large Caps & Active Management