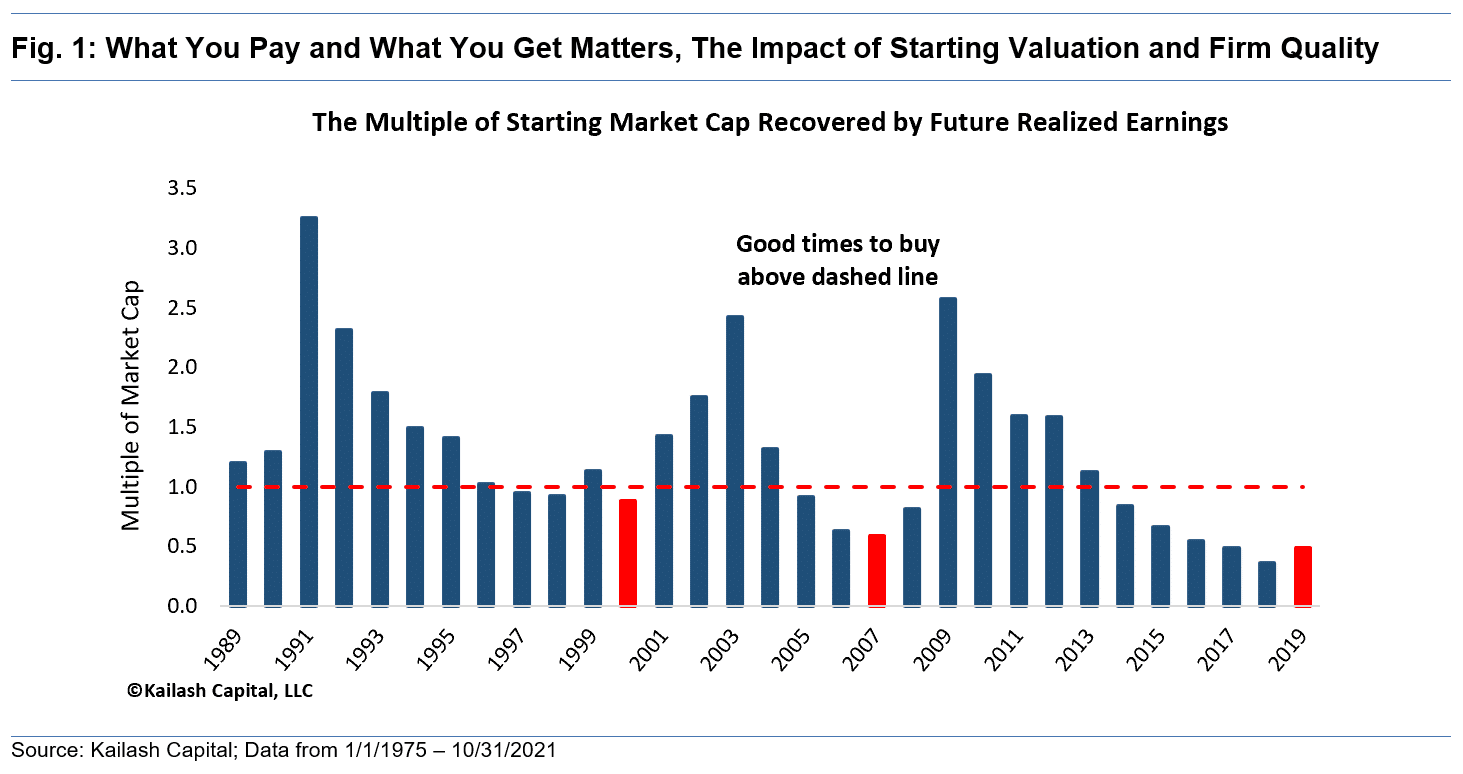

The Costliest Stocks: A Lifetime Earnings Analysis

This piece is based on academic research done in-part by KCR’s expert in behavioral finance. Bhojraj & Co-Authors Provide Compelling Proof that “Price is What You Pay, Value is What You Get”

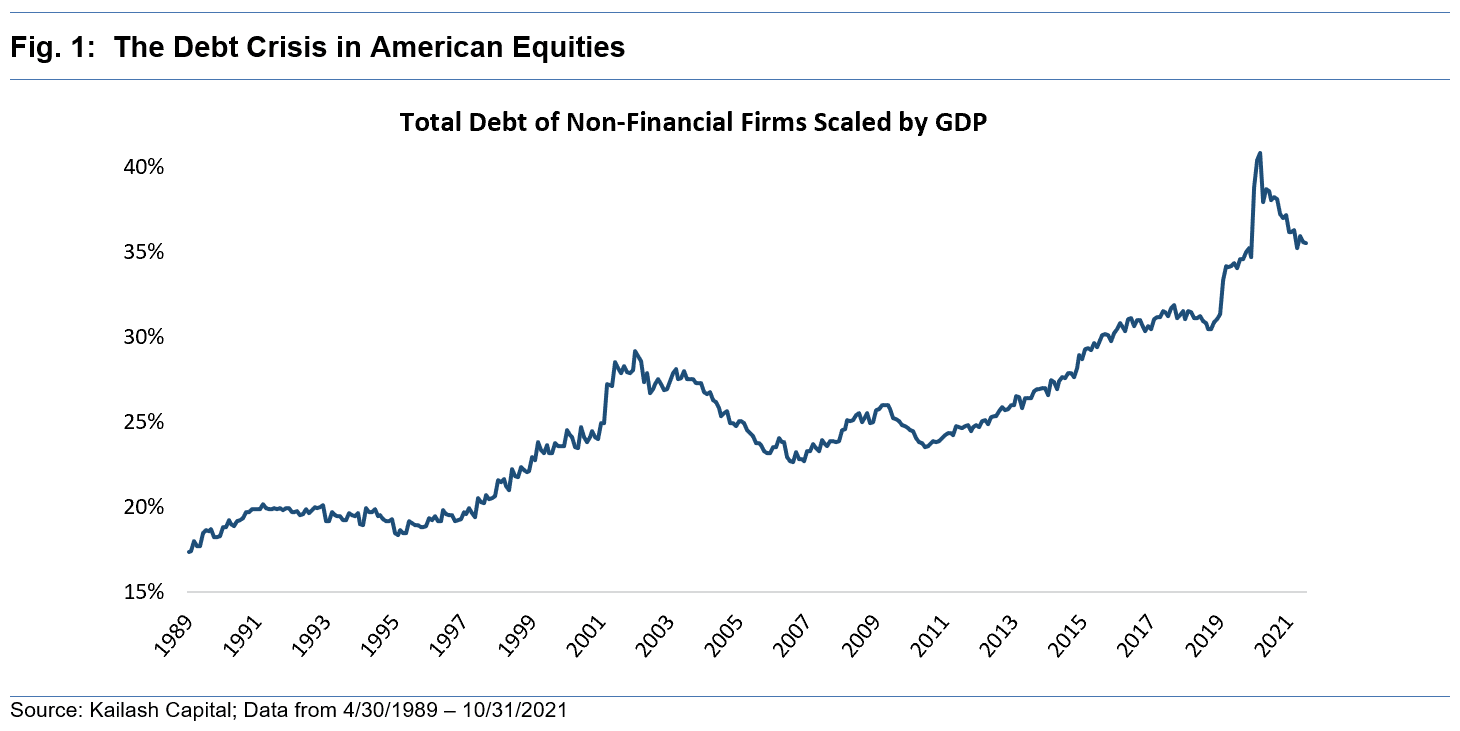

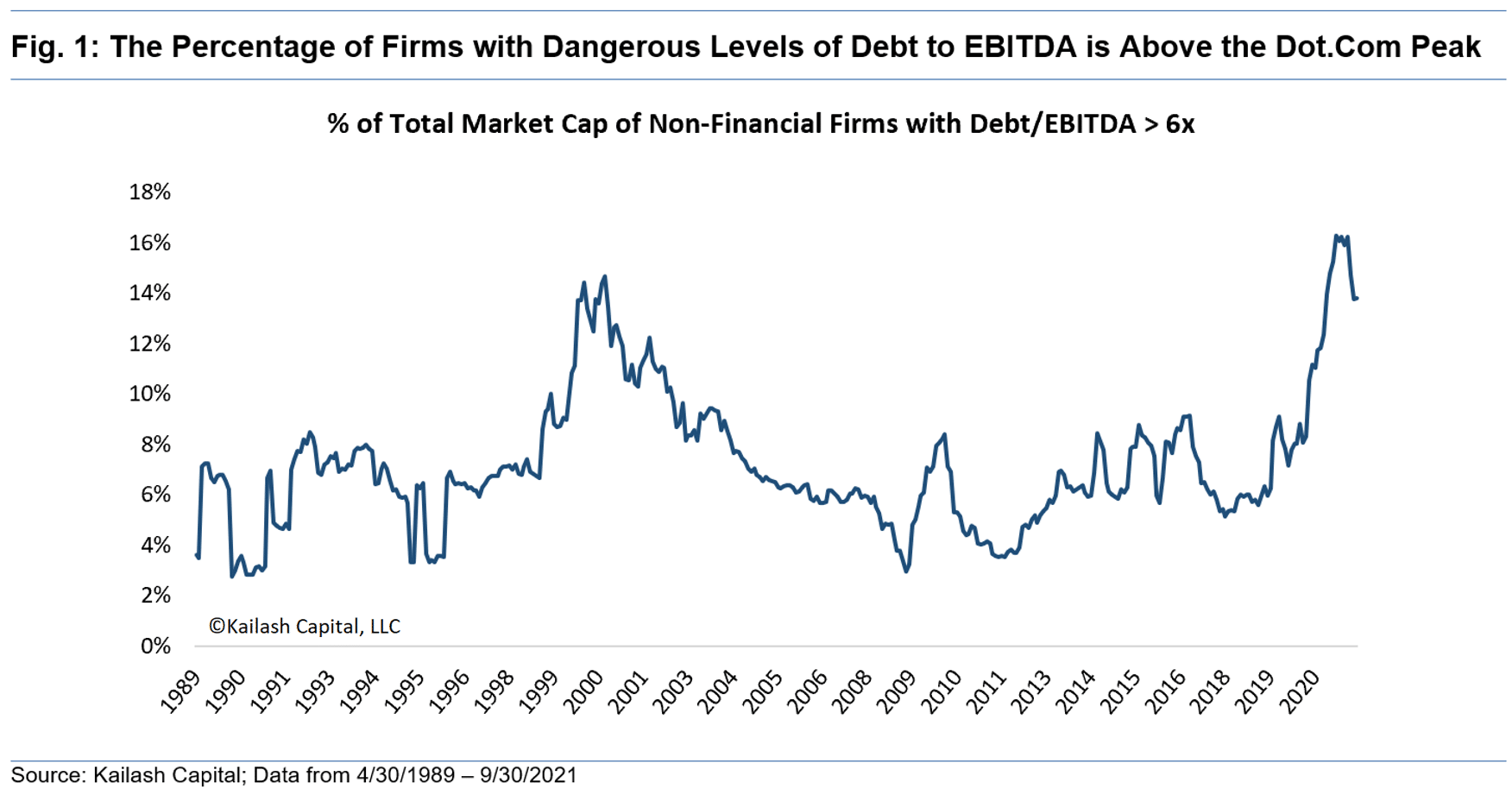

The Next US Financial Crisis: The Problem with Expensive Stocks and High Leverage

Our recent piece Debt to EBITDA Ratios: The Spiral Higher Continues documented the explosive growth in leverage using aggressive accounting to fund deals. This piece intends to...

Are Cleantech Stocks a Short?

This week’s “Chart for the Curious” follows up on our CFTC from last week and our piece on Andrei Shleifer’s legendary book on Behavioral Finance. In those pieces, we discussed how investors piled into Gold after the GFC implosion, which ended up being precisely the wrong time to do so.

Investor’s Long Term Stock Forecasts: A Perfect Path to Poverty?

This week’s “Chart for the Curious” offers less optical intrigue and requires more “Curiosity” than our normal Friday missives. The piece reads more like our typical Quick Takes. Having ...

Andrei Shleifer’s Inefficient Markets: An Introduction to Behavioral Finance — KCR’s Key Lessons from a Legend in the Field

Many Academics believe in Market Inefficiency In 2000 Andrei Shleifer published “Inefficient Markets.” The book brings together some of the best research in Behavioral Finance. Dr. Shleifer’s “Acknowledgements” section ...

Andrew Jassy Amazon’s Next Bob Nardelli?

Andrew Jassy Amazon’s Next Bob Nardelli? So this morning Amazon turfed numbers and guidance. The company missed on both revenues and profits for Q3. The company explained that the ...

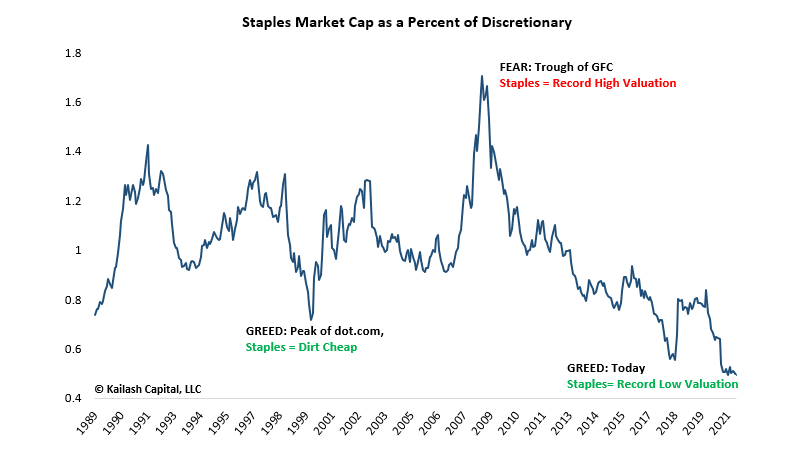

Best Stocks for a Recession: A Simple Solution

Investing in a Recession: A Stunning Chart to Help You Stick to Your Financial Plan This post is designed to update our Chart for the Curious from January of ...

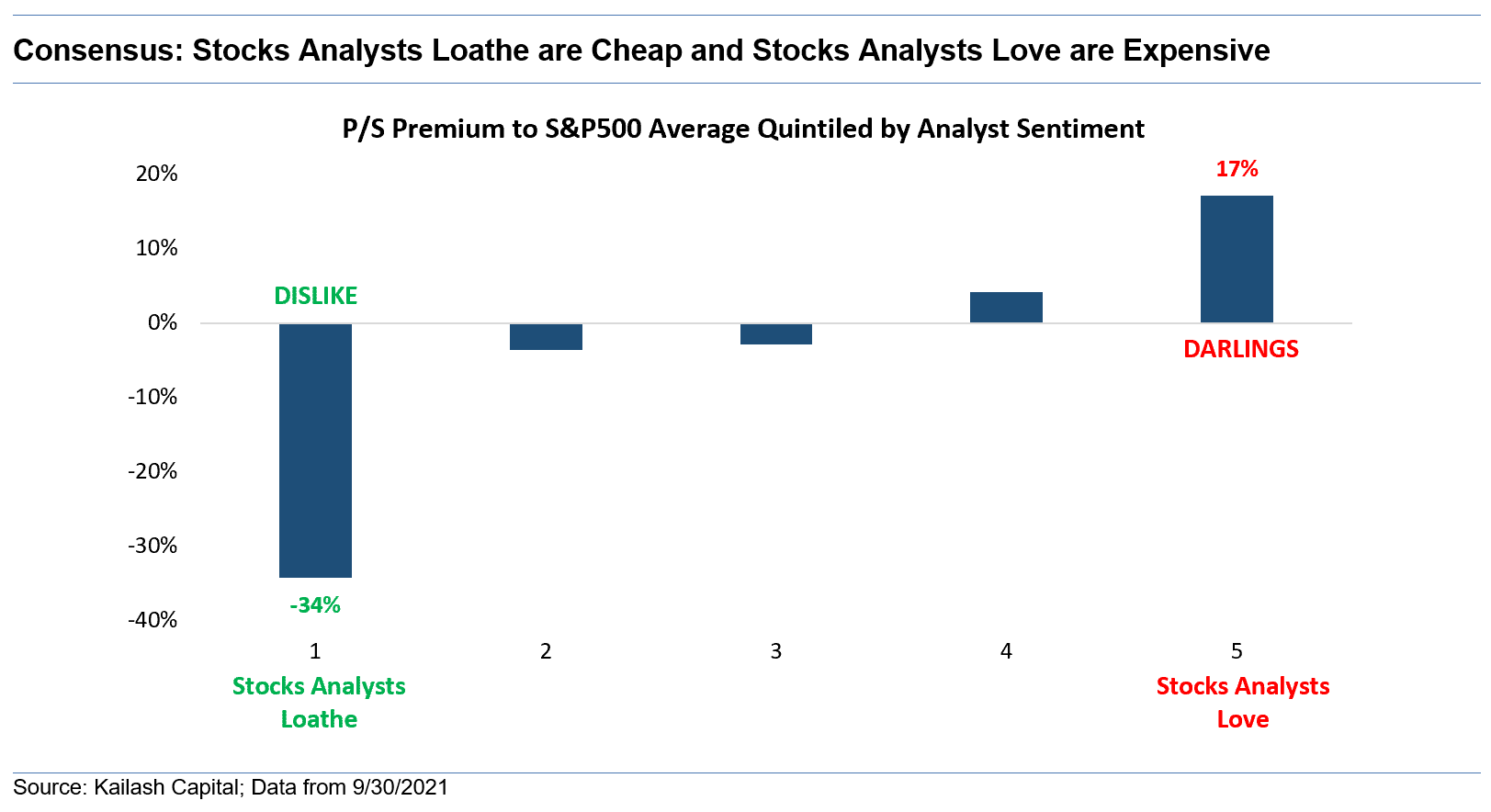

Stocks Analysts Loathe & Love

The chart below takes all the stocks in the S&P 500 and breaks them into five groups The first group on the left are the stocks analysts loathe (the ...

Beware of Greeks Bearing Bonds: A Lesson for Today?

Beware of Greeks Bearing Bonds: A Lesson for Today? In a 2014 interview, the legendary financial writer Michael Lewis commented that when he wrote Liar’s Poker - the legendary ...

Staples Stocks are a Buy Today UPDATE

What You Need Has Never Been Cheaper vs. What You Want: This piece updates our last post on investing in staples The chart below shows the market cap of ...

Debt to EBITDA Ratios: The Spiral Higher Continues

The Wicked Winds of High Leverage, Low Rates & Weak Covenants In our Chart for the Curious (CFTC) last week, we showed that levels of risky debt had hit ...

Debt to EBITDA is Out of Control: The Next GFC?

US Corporate Debt: The Next Crisis? Post the implosion of banks in the Great Financial Crisis the Federal Reserve stated that non-financial firms with debt/EBITDA >6x were a cause ...