Best Charts of 2025

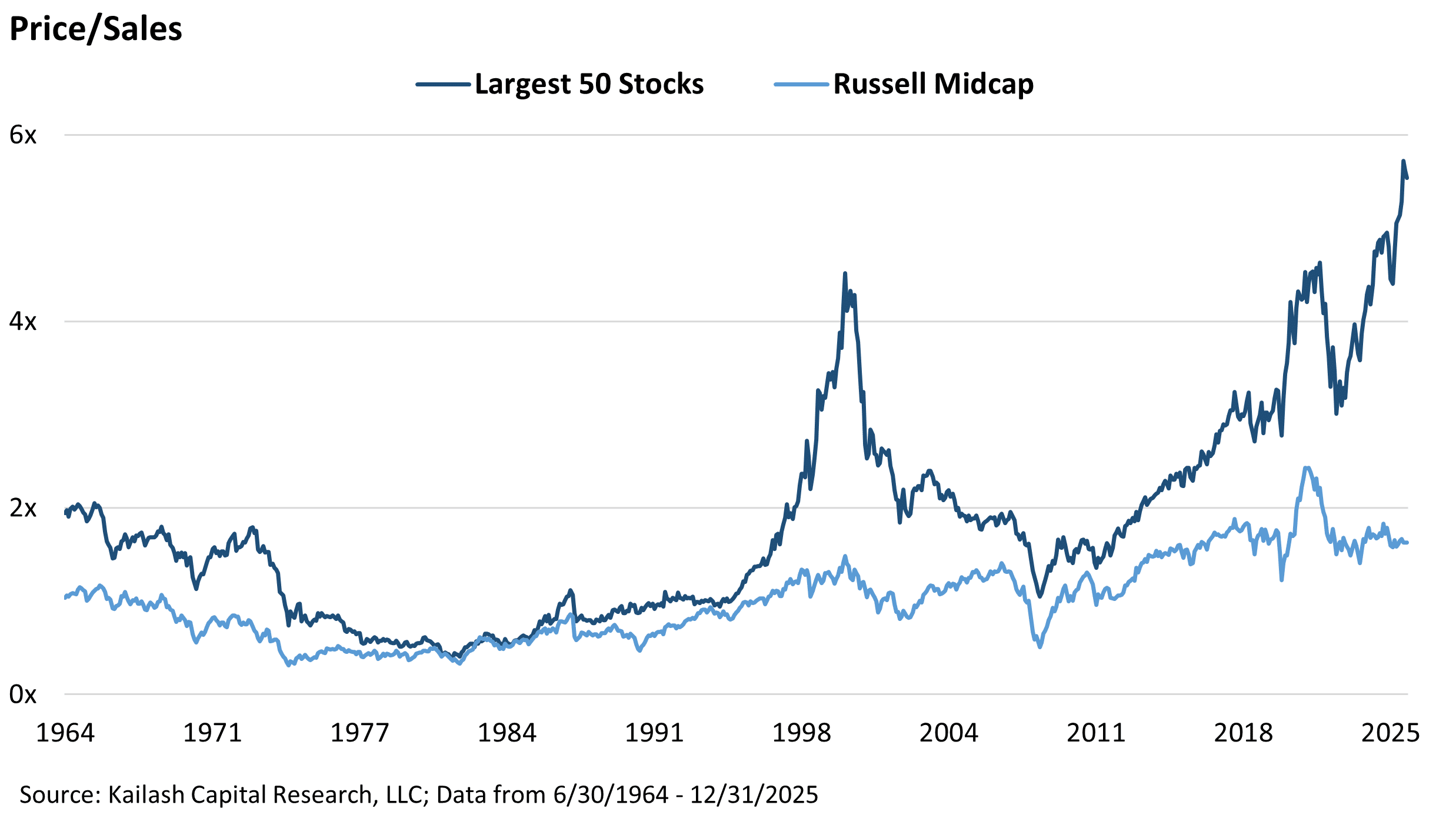

Markets don’t usually give investors clean signals—but 2025 did, and they weren’t subtle. This year’s “Best Charts” update shows a market increasingly dominated by a handful of mega-caps characterized by extreme valuations. Several measures have climbed into the unfortunate “we’ve never been here before” territory.

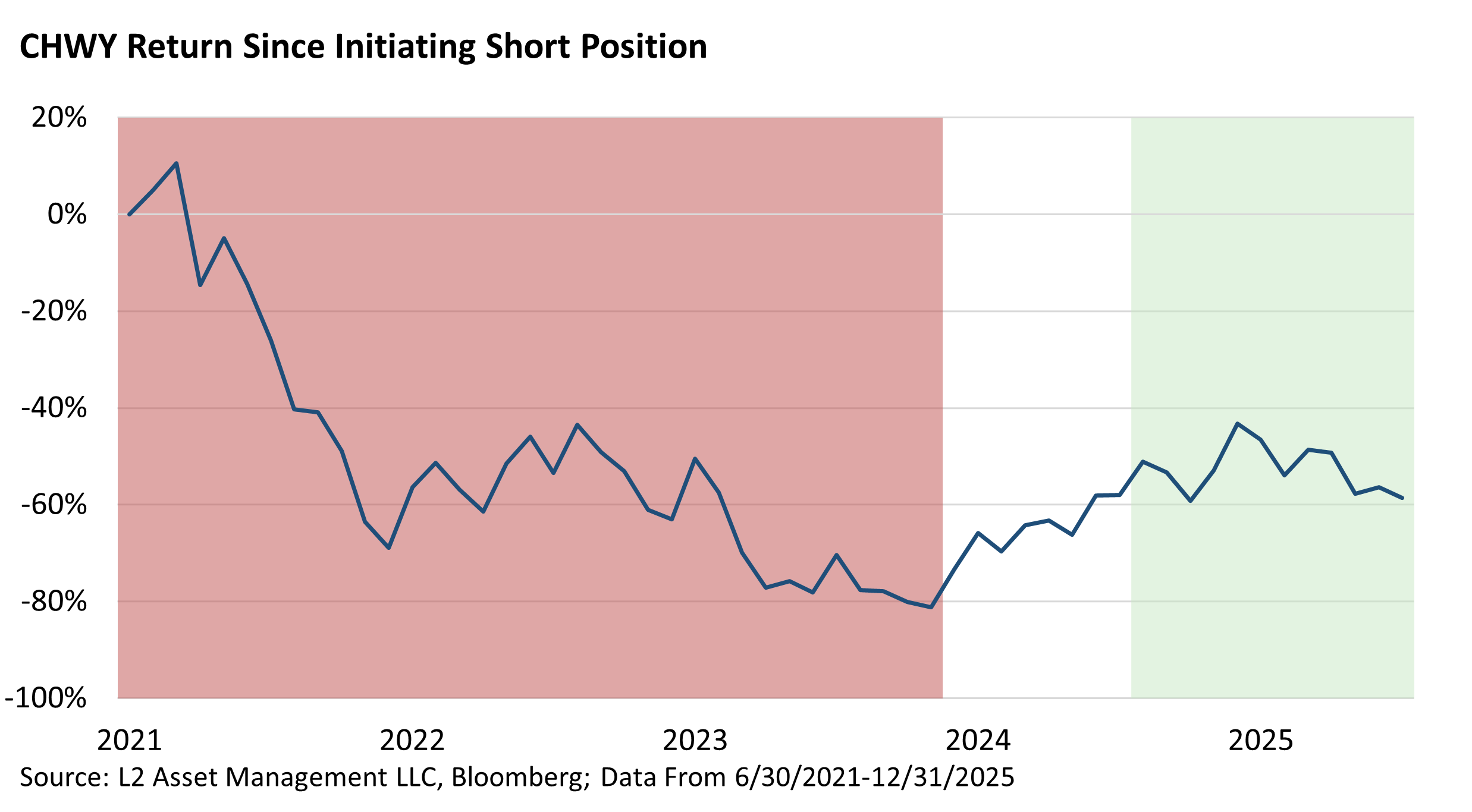

Former Bears Make Their Bull Case on CHWY

We are in the Moneyball Business, NOT the crystal ball business.TM -KCR Philosophy It is absurd to think that the general public can ever make money out of market forecasts. -Benjamin Graham We have long felt that the only value of stock forecasters is to make fortune-tellers look good. -Warren Buffett Few things are more rewarding for our investment team than when a stock our sister company (L2 Asset Management) is short collapses.

Could HubSpot, Inc (HUBS) Stock be Vulnerable to Further Collapse?

HubSpot, Inc. (HUBS) is an AI-powered software platform that helps businesses simplify and centralize their sales, marketing, and relationship management efforts. HUBS’ business clients, which are typically mid-market businesses (up to 2,000 employees), use feature-rich and intuitive software to automate sales and marketing processes, serve customers more effectively, and allow their teams to work together more efficiently.

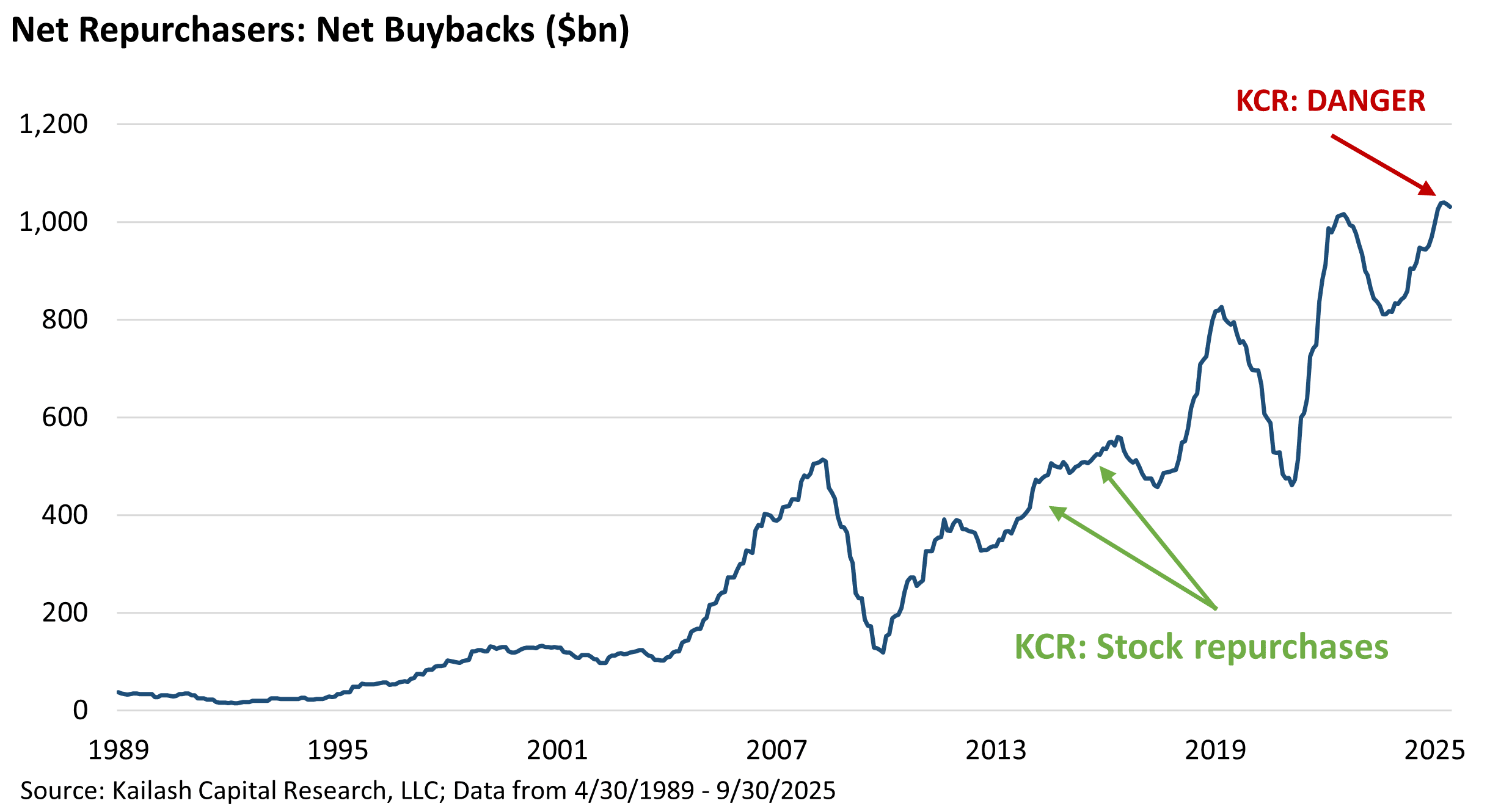

What a Fright: Stock Buybacks that Keep Us Up at Night

In our prior piece analyzing the entire cohort of companies that are net repurchasers of their own company’s stock, we highlighted how the group’s aggregate valuations had hit record highs. We also highlighted that the funding required to facilitate buying back stock at the highest multiples on record, were being funded by debt.

Could AMD’s Newest Chip & Software Challenge Nvidia’s Dominance?

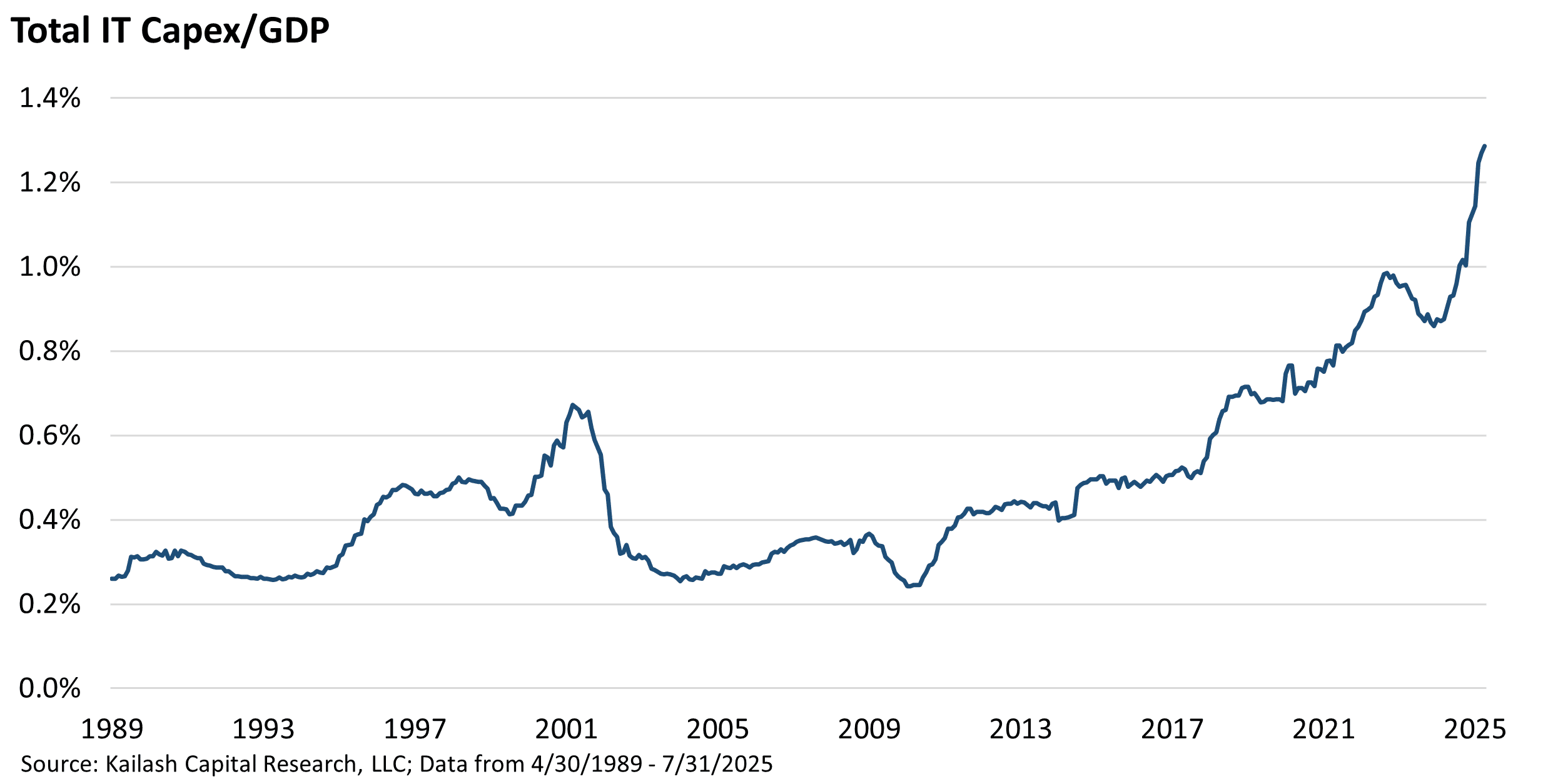

We have presented to a large number of Financial Advisors and institutions of many stripes. The questions around AI are many. They range from “what inning are we in?” to “how can you think this is a bubble when the big tech stocks today are so much healthier than in the dot.com bubble?”

Are Stock Buybacks in Your Best Interests? An Update on our 2016 Work: Politicians & Corporate Stock Repurchases

As early as 2014, the financial news media became obsessed with the idea that stock buybacks were being funded by debt and that a reprise of the Great Financial Crisis was looming. By 2016, politicians got involved with many in our political class claiming that stock buybacks were hurting the US economy by reducing capital expenditures and R&D.

Low Quality Small-Caps Tear Higher – The Consequences of Late-Stage Capitalism?

“Late Capitalism” [has] two paradigms [that] combine to swamp the efficient, free-market allocation of capital: 1. Crony capitalism and corruption…choke[s] out the rule of law and reduce the extent to which markets are “free.” 2. The transformation of markets from capital-allocation machines to casinos in which finance becomes just another form of gambling. Reasonable people can argue how far down the path we are… but I do not believe anyone would claim that we weren’t on the road.

Could Cisco Systems, Inc (CSCO) Soar Over 100%?

Through its core hardware and software technologies of switching, routing, and wireless, Cisco Systems, Inc. (CSCO) is the clear leader in global computer networking. CSCO’s capabilities have made -- and continue to make -- the company a central player in shaping the operations of the modern internet, including the growing internet of things (IoT) landscape.

The Power of Price & the Case for GIII Apparel Group Ltd (GIII)

Some of our recent work has highlighted growing economic risks, especially in tech and crypto, with signs of a looming profits recession. The pieces document the remarkable grift from vendor finance, preliminary appearances of consumer weakness, inflated valuations, and debt-driven demand.

Manchester Explorer: A Profits Recession in Tech & Crypto Ahead?

“As soon as you allow politicians to determine that which is bought and sold, the first thing bought and sold will always be politicians.” -P.J. O’Rourke, Parliament of Whores: A Lone Humorist Attempts to Explain the Entire U.S. Government, 1991

Uncertainty: The Leading Cause of Illness in Healthcare Investing?

What’s causing the current malaise in healthcare stocks? Returns have been lagging and valuation multiples are lower than the vast majority of stocks in the S&P 500. We doubt everyone has become so much healthier that we no longer need medicines and hospitals. Is this as simple as “Healthcare isn’t Tech”? We don’t think so.

Accountability with KCR: Our Views on Tech Since Our Founding

The research published in this newsletter is organized and authored by a group of fund managers and researchers who have over 90 years of combined experience and have worked together for over 14 years. As long-time readers know, our sister company, L2 Asset Management, runs a collection of long-only as well as long/short products.