We Have Been Wrong: We are SO Back!

Watching the mega-cap bubble reflate in 2024, the research in this newsletter peppered readers with warnings about the law of large numbers, soaring capital intensity, dubious accounting and vendor financing activities.

Could Evidence Based Investment Processes Predict the Future? AMGN & The Case for KCR’s Fact-Based, Forecast-Free, Investment Methods

Answer: Nobody can predict the future. With that done, let’s revisit a moment of pain for the KCR team. October of 2010 marked the single first ranking list produced by KCR. The top-ranked stocks were a magnificent collection of companies, in our view. Stocks like Lubrizol, Microsoft, Lorillard, Discover Financial and the 8th ranked stock, Eli-Lilly, sat as our highest ranked healthcare name.

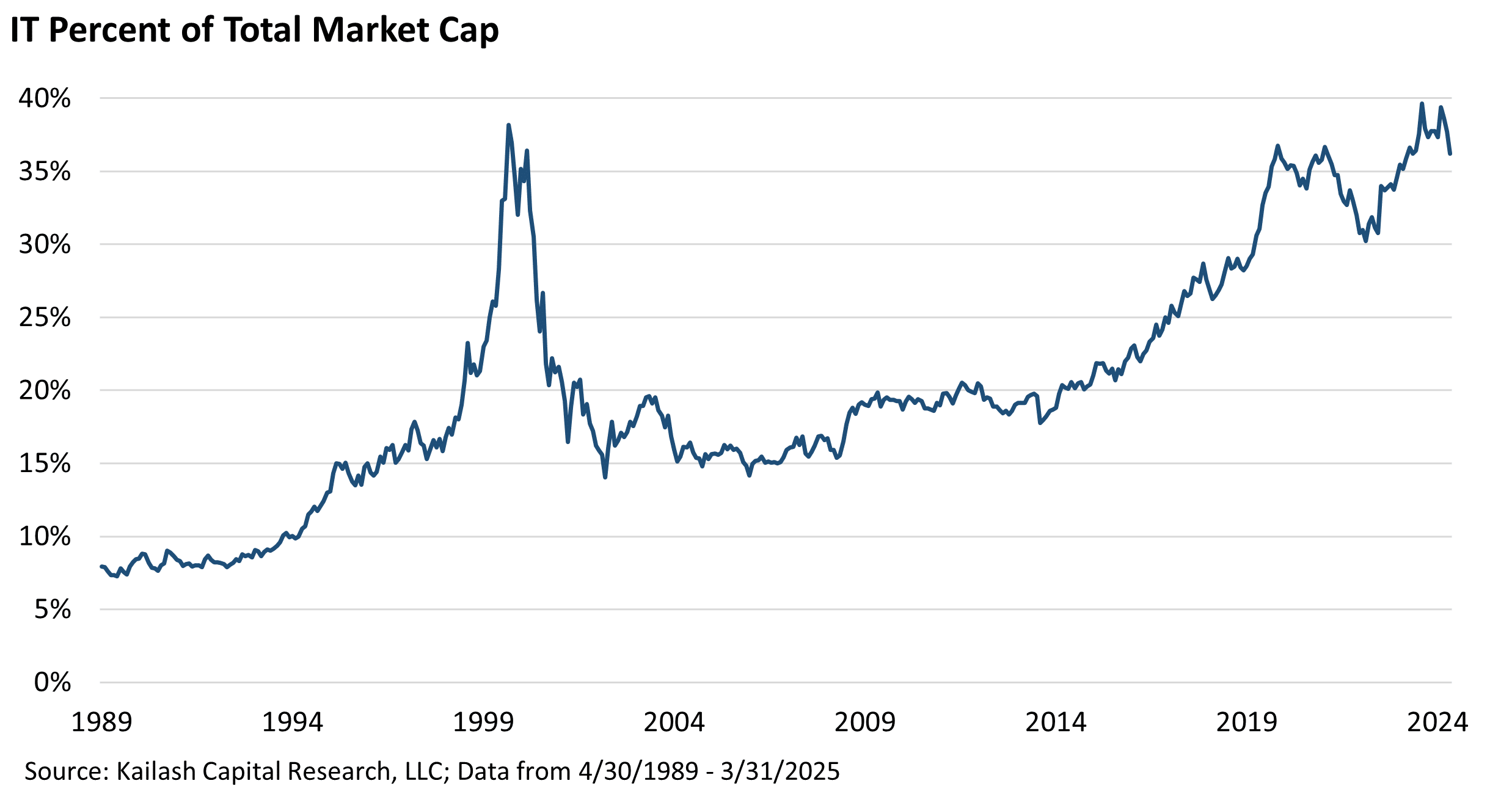

A Tech Talk: The Troubles of 2025 are on Full Display

Today’s piece will discuss the current state of tech investing in US markets. A decade of zero interest rates coupled with the dramatic and unsustainable fiscal stimulus post Covid has taught investors a precarious lesson:

Venture Capital: Turning Today’s Dreams into Tomorrow’s Write-Downs

KCR believes that many of the most speculative, loss-making, hype-driven, low-quality tech companies are actually in private hands today. Many of them held by venture capital funds. Why does this matter?

The Merits of Microcaps Continued: United Natural Foods (UNFI)

Just shy of a year ago, the KCR team wrote A Penchant for Pain: A Search for Big Returns in Small Packages. The piece made a table-pounding case to invest in

Sometimes the Most Obvious Things to Do are the Most Difficult

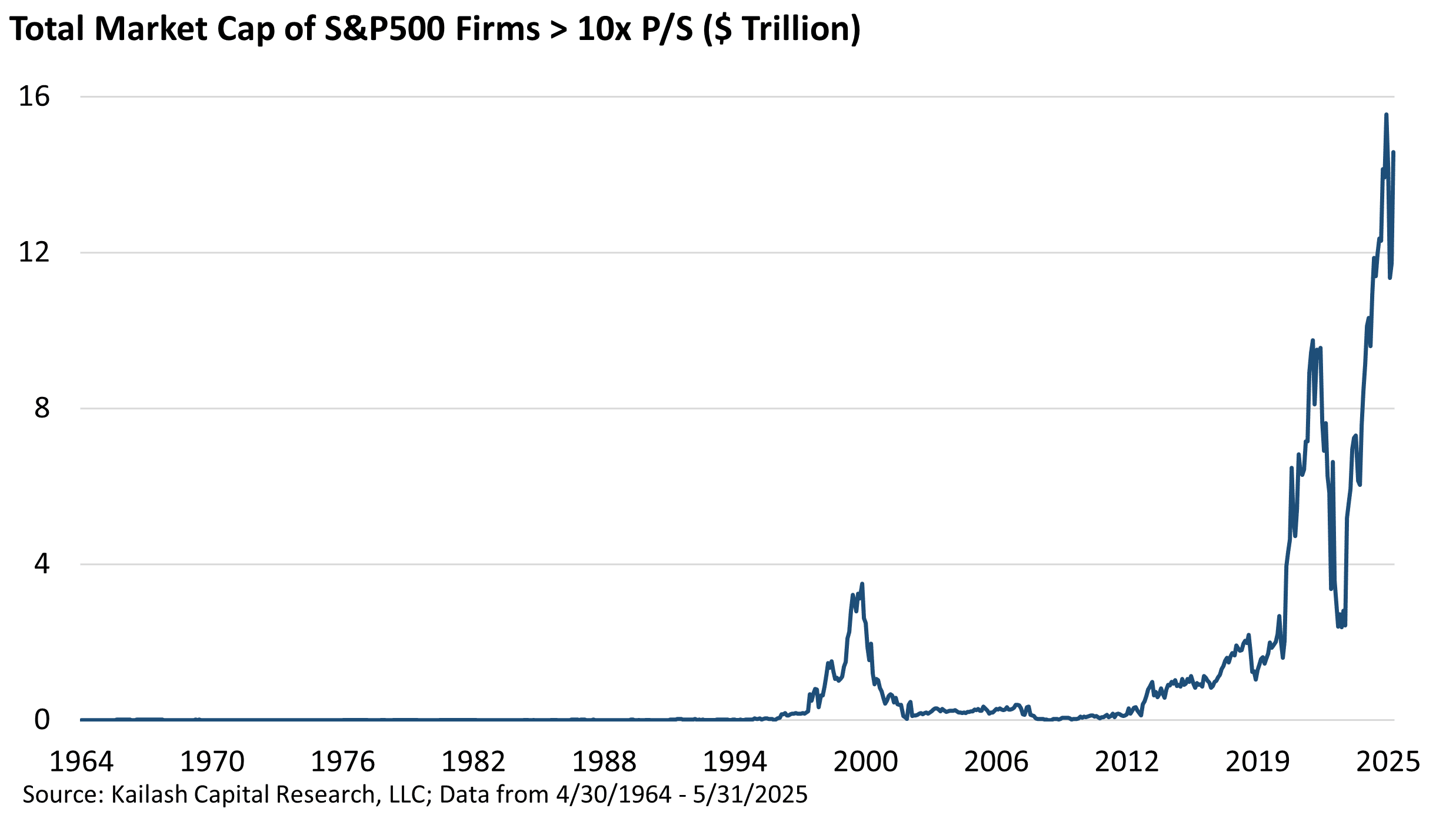

There are two times in a man’s life when he should not speculate: when he can’t afford it, and when he can. -Mark Twain Back in September of 2021, KCR penned a piece The Market Cap of Companies Over 20x Price to Sales is Out of Control. You can see on the chart below that

Is Capitalism in Crisis? Or is this cycle of stupidity just longer and larger than usual?

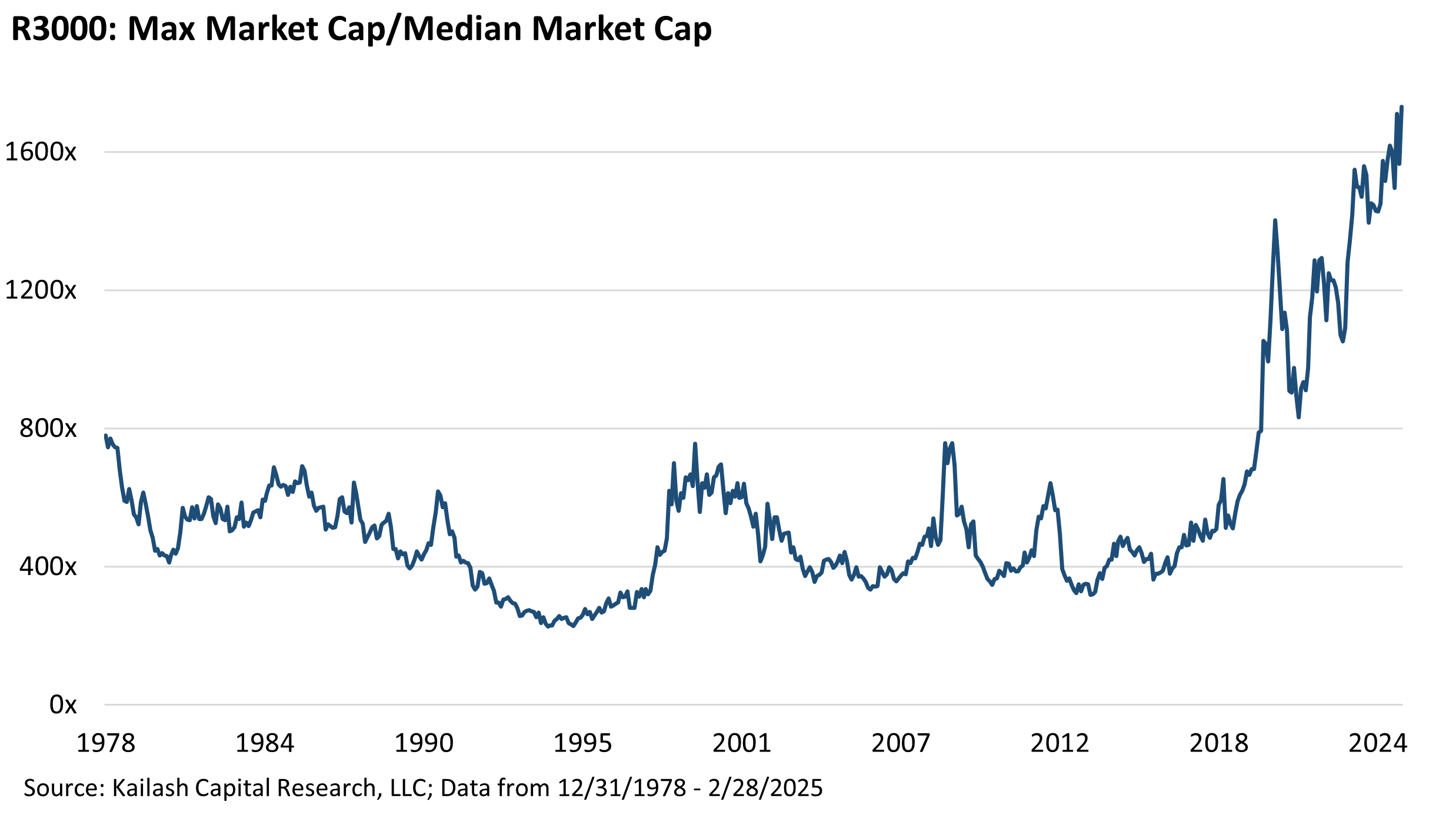

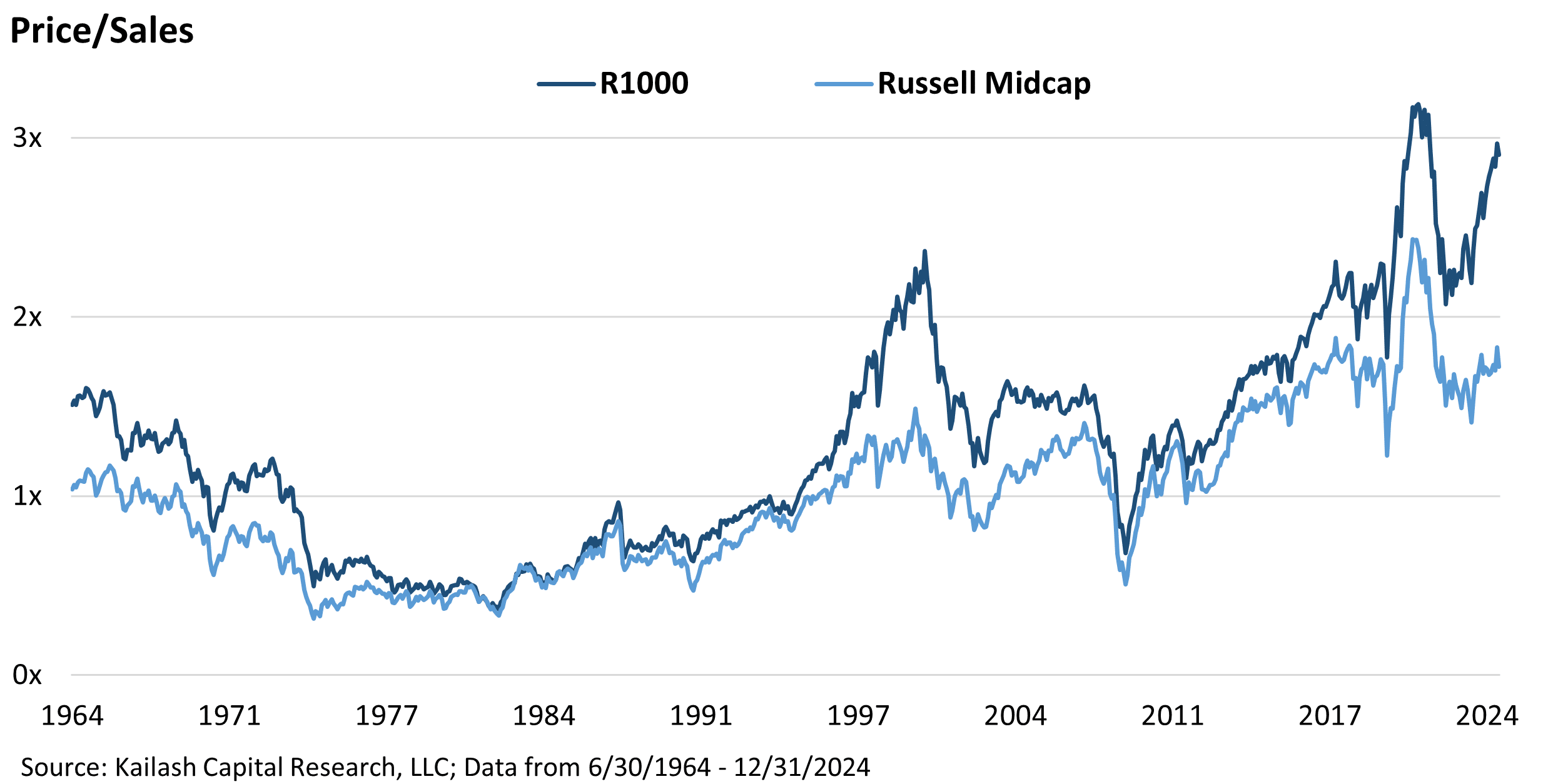

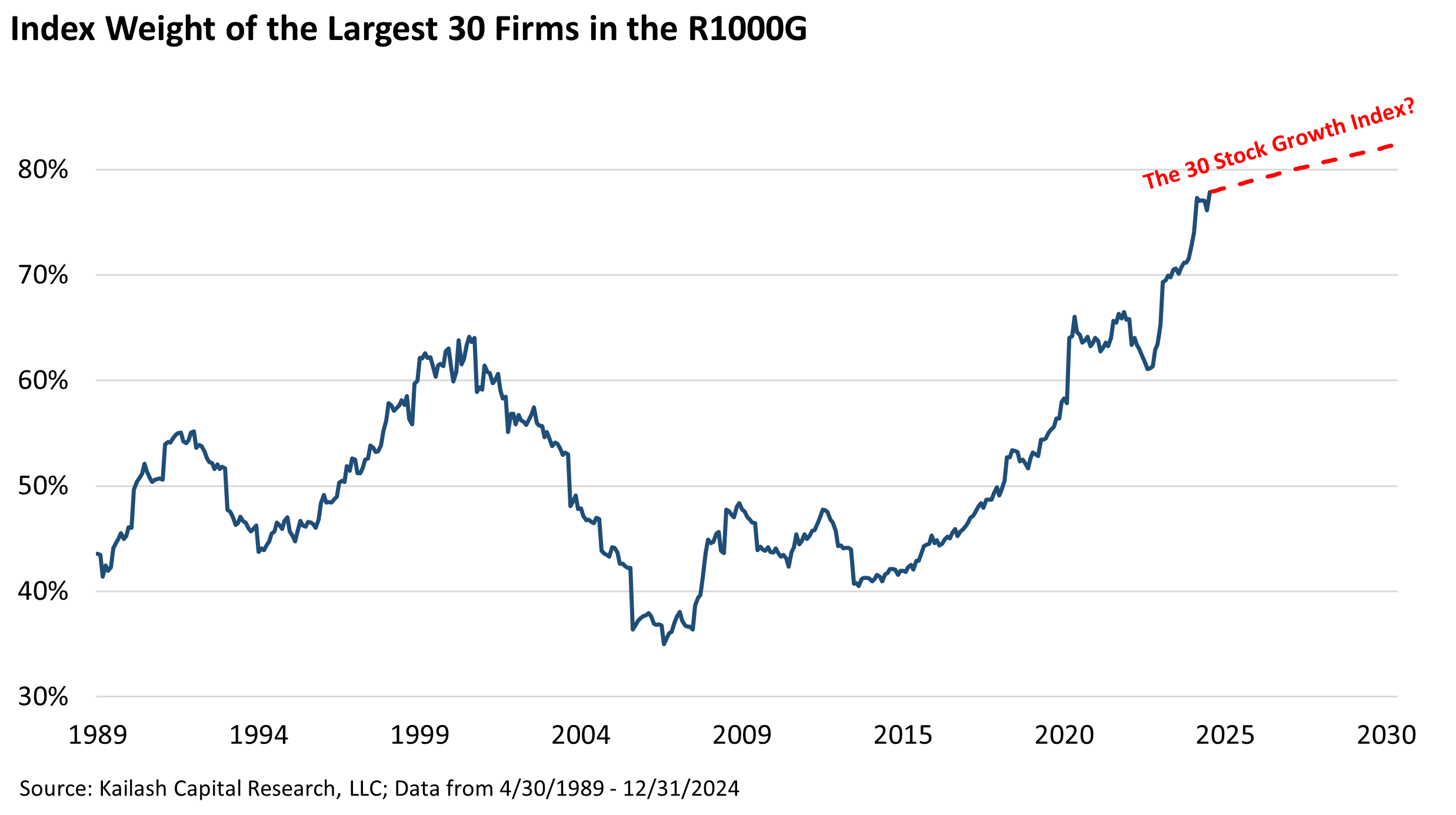

In our recent piece, If Not Now, When?, we pounded the table on the investment merits of mid-cap stocks. Much of the thesis rests on the unforgiving valuation of the Russell 1000 Index of large cap stocks. In that piece, we demonstrated that much of the overvaluation in the large cap index came from just the 50 largest stocks.

Midcap Stocks Part II: If Not Now, When?

In Part I of our piece on Midcap stocks, we led out with a chart showing that investors’ allocation to midcap stocks had fallen to levels last seen at the peak of the dot.com bubble; the lowest levels since 1964. We explained how investors willing to pivot into unloved midcaps in 1999 saw outsized gains while those who remained in the large cap index spent five solid years earning precisely nothing.

Memes & Other Financial Dreams: The Case for Valaris Limited

The first $100,000 is a b*itch, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that you can ease off the gas a little bit. -Charlie Munger, Explaining the Difficulty & Importance of Saving Your First $100k

A Mighty Microcap? The Case for ScanSource, Inc. (SCSC)

In April of last year we published A Search for Big Returns in Small Packages, the first in a two part series on the remarkable opportunities we saw in micro-cap stocks. The piece highlighted that our KCR Micro Model Portfolio was lagging the Russell 2000 – one of its two primary benchmarks.

KCR’s Top Charts Updated

Every year since the launch of our website, we have posted a piece reviewing KCR’s work from the prior year. Today’s post continues that tradition and even includes some 2023 publications that are just as compelling today as they were when published. We would like to thank our rapidly growing list of readers for their support, engagement, and thoughtful kindness.

Is Excelerate Energy, Inc. (EE) a Hidden Gem Due to its Small Float?

Excelerate Energy, Inc. (EE) provides key integration services and infrastructure along the natural gas-to-power liquefied natural gas (LNG) value chain. More specifically, the company operates ten floating storage regasification units (and has contracted with Hyundai Heavy Industries to build another), which has allowed EE to complete around 3,000 ship-to-ship transfers of LNG with more than 50 LNG operators since EE began operations.