Equity Positioning, Sentiment, and the Disposition Effect

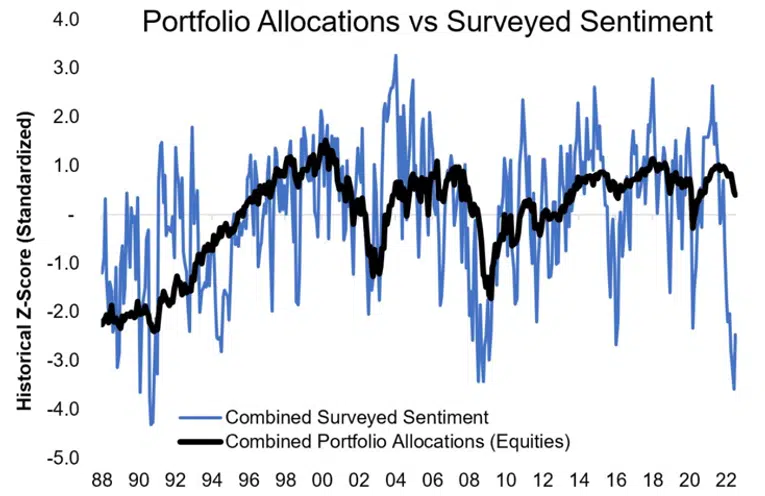

KCR’s work leans heavily on sentiment for good reason. The presence of our in-house academic and co-founder does not mean we are advocates of efficient markets. Much of the research in behavioral finance that our systematic approach to fundamental research leans on is dedicated to finding undue pessimism and optimism. These are often a critical ingredient in...

Nabors Investor Relations Has a Terrific Story to Tell

Profiting from the Reckoning with Reality - KCR readers know we have been long-term bulls on energy stocks and have relentlessly panned the high-priced promises of so-called clean-tech energy stocks. While others read the IEAs’ path to net-zero emissions and forecasted the end of oil, we read the work and wrote our piece, Net Zero Emissions: The Possible vs. the Plausible, which explained how their...

A Tight Labor Market Returns the Upper Hand to American Workers

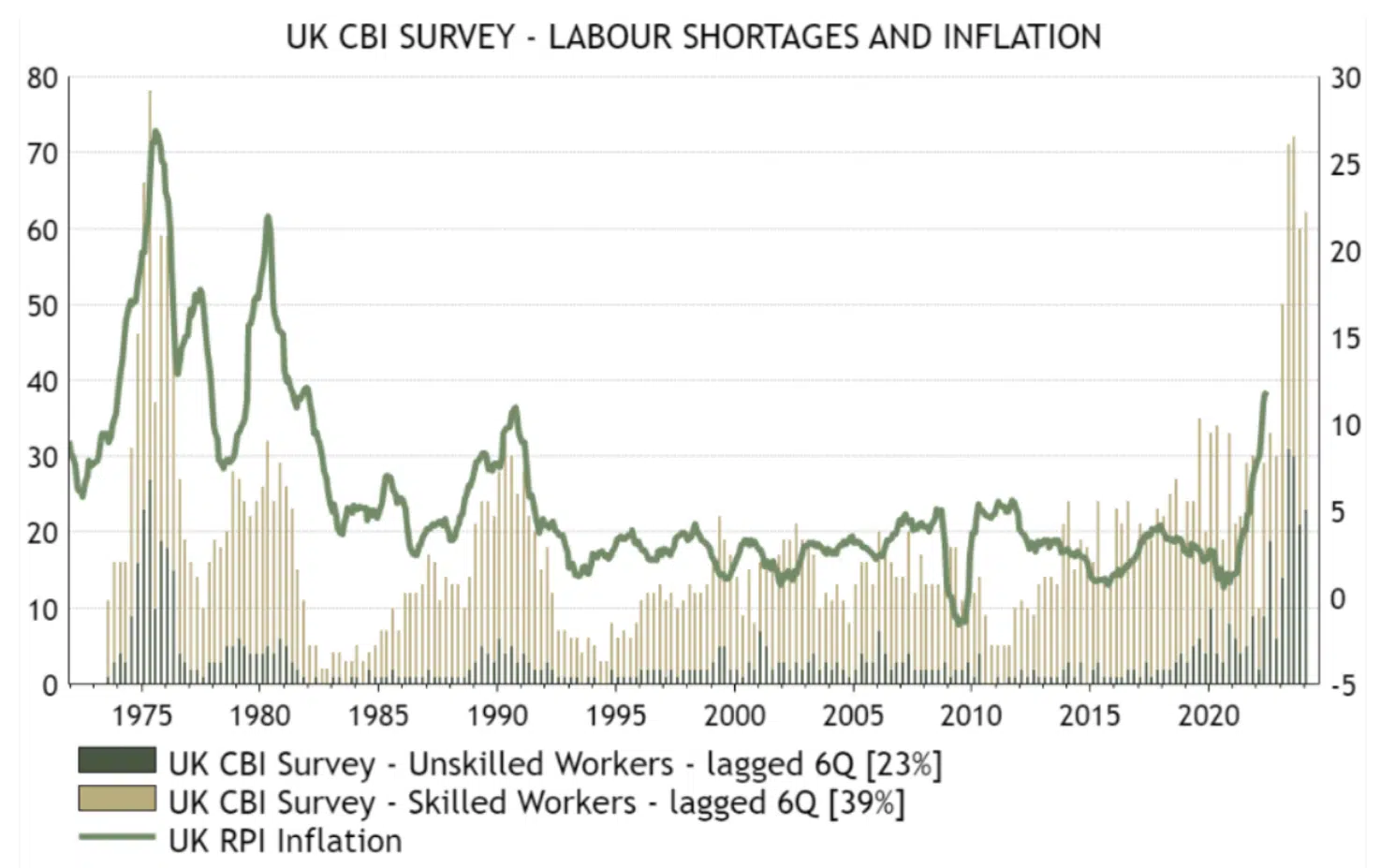

A Tight Labor Market Returns the Upper Hand to American Workers - The always wonderful John Authers put out a recent piece on inflation. Discussing comments out of the UK, he observed, “I cannot remember a central bank of a large, industrialized country being this negative about its own economy.”

A Lucid Stock Discussion on an Amazing Car Company

The High Price of Cool Stuff: An Update on Stocks Valued Over 10x P/S. Lucid Motors Logo: A Symbol of the Future? It’s been a hot stretch of summer for the KCR equity research team. We have, at times, been accused of writing dry and dense material with an intermittently academic tone. Not today. First Friday in August. Let’s talk cars.

Market Neutral Strategy: Transcript & Video

Economic Cycles and Mean Reversion

In 1999, Warren Buffett gave a rare explanation of why he felt the stock market would generate poor returns for investors over the long haul. He used simple arithmetic to show that elevated valuations and profit margins made equities vulnerable. The piece was 9 pages, over 4,000 words long, and had a single exhibit.

Mean Reversion, Market Prices & Common Sense

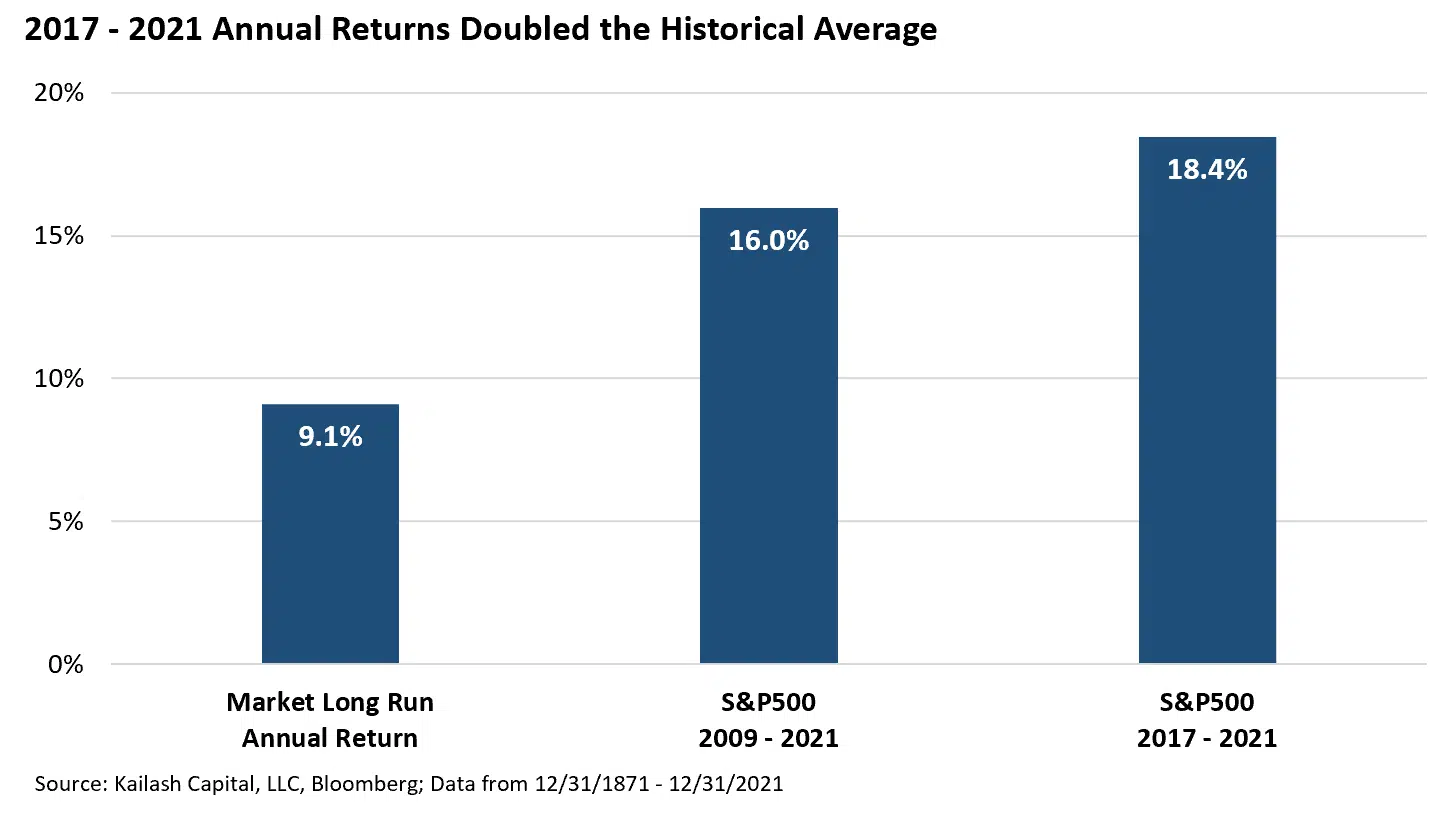

Mean Reversion Made Simple - This paper provides simple context to what are often difficult and highly emotional decisions around money. KCR spent much of 2020 and 2021 producing evidence that the valuations of popular fast growth stocks would lead to their demise. Since the peak in 2021, stock speculation has gone from popular to perilous.

Market Neutral Strategy: Transcript & Video

Large Cap Core Funds: Growth Funds in Hiding?

US Large Cap Core Funds: Historical Weights at Various Levels of Valuations - To summarize, historically, investors in large cap core index funds had the bulk of their money invested in stocks with reasonable valuations with negligible exposure to stocks valued over 10x price to sales.

“Enroned” an Update On High Prices & Low Quality Stocks

The phrase “I got Enroned” has entered the investing lexicon recently. KCR believes the term is slang to describe the losses being incurred by investors in stocks with indefensible valuations and low-quality accounting. This piece updates our January work identifying the stocks most like Enron today.

MO Stock PE Ratio Offers Cash Backed Income

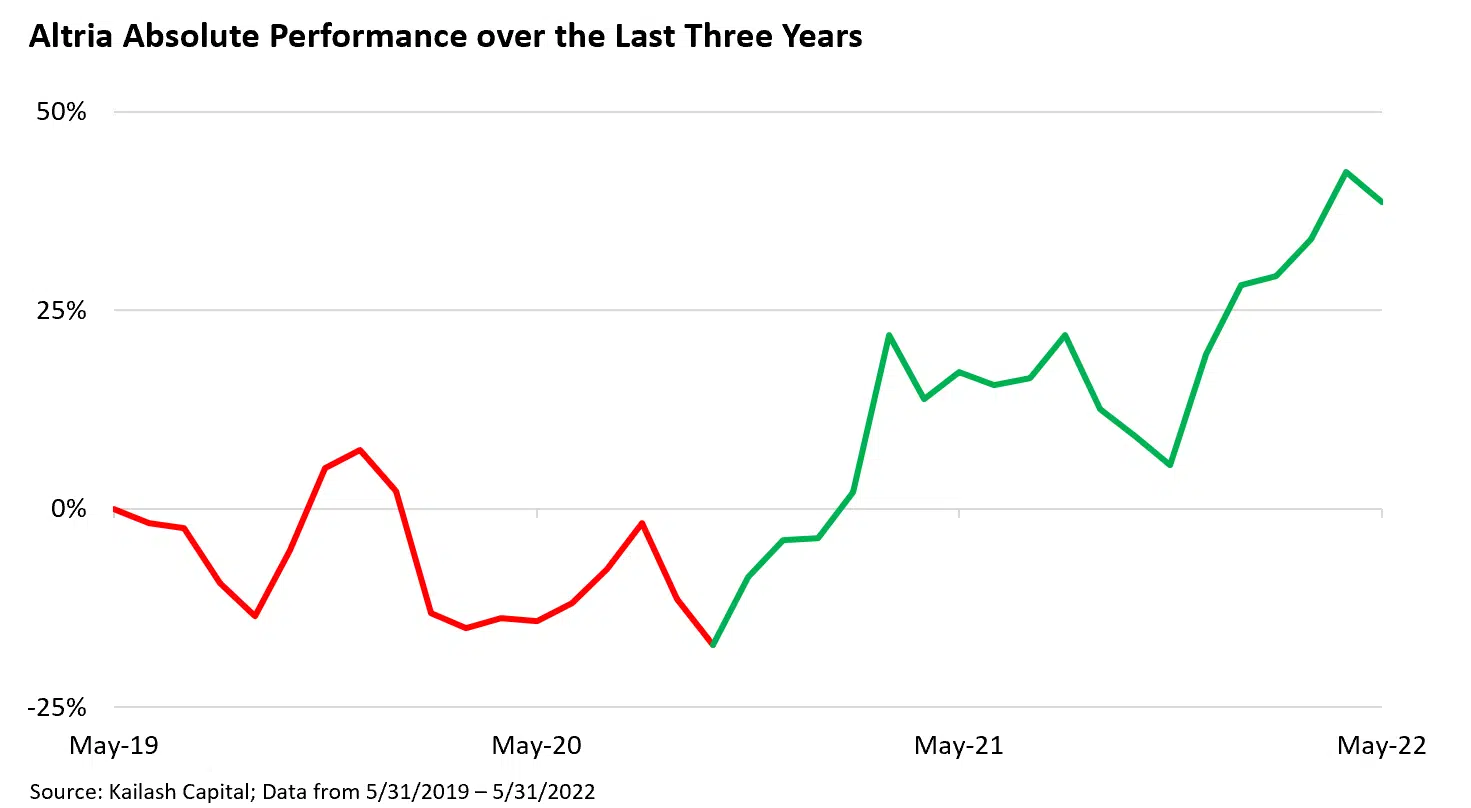

Beginning in March of 2021, KCR’s quantitative research has provided consistent evidence that Staples and Energy stocks present investors with the opportunity to buy companies of high quality for unusually low prices. Subsequent to our evidence-based models’ endorsement, we engaged in a fundamental review of both sectors and the specific stocks our models favored. Steeped in academic research done by...

Asset Allocation in Bear Markets

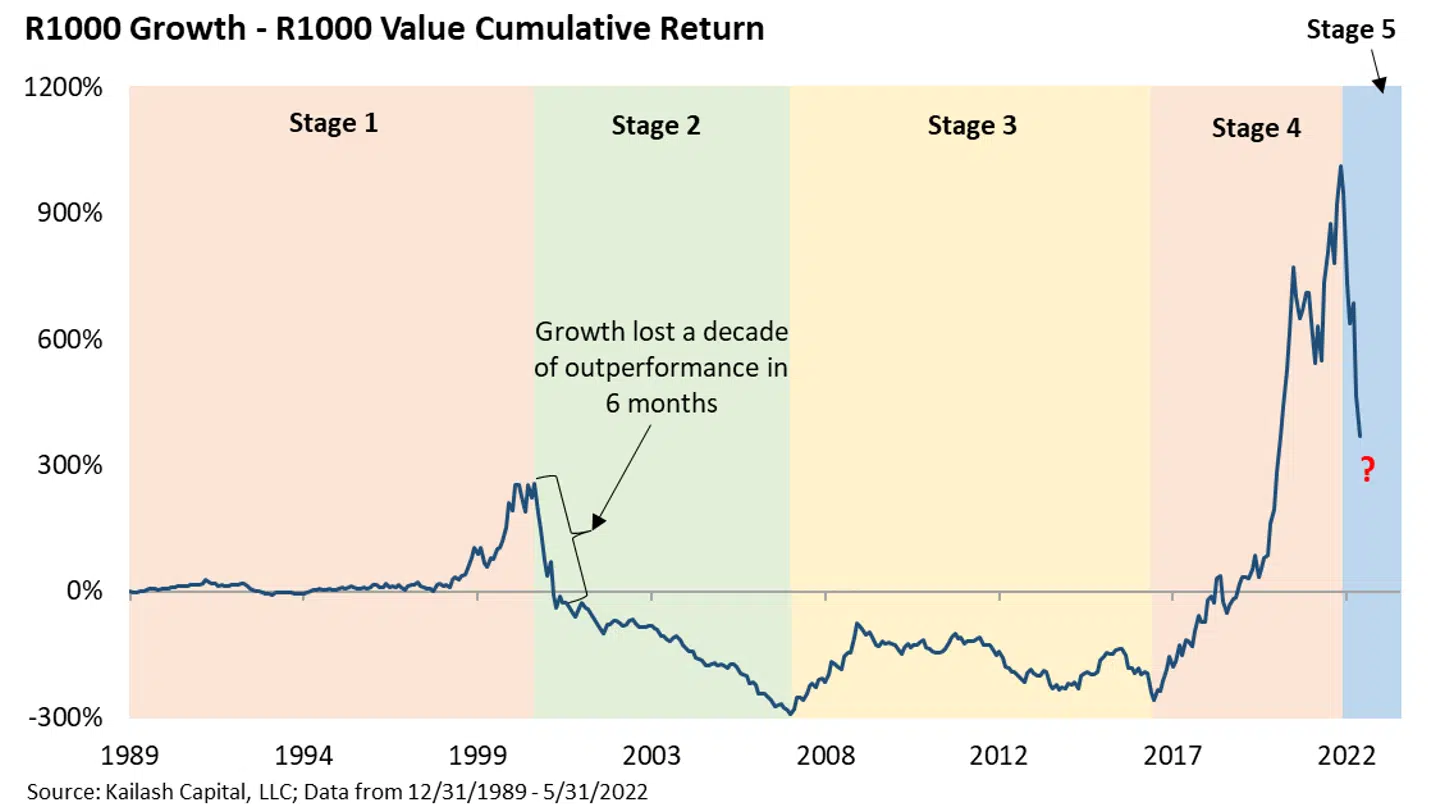

Asset Allocators & The Need for Discipline - The chart below shows the compound return spread from investing in the Russell 1000 Growth Index less an equal investment in the Russell 1000 Value Index.