Today’s topic: a large-cap company trading at 11 times earnings, with a ~12% free cash flow yield, and will pay owners a 10% yield in the very near future.[1] Staring at your savings account, stuffed with index funds bloated by supersized tech stocks trading at 30x earnings, one can scarcely believe such discounts exist. Even more remarkable is that the company is 25% cheaper than its peer group — so it is cheap vs. everything.

[2] 10% via share repurchases plus ~3% in dividends – see research on the pages that follow for details.

Get our insights direct to your inbox: SUBSCRIBE

So, what is wrong with it you ask? The lack of “AI mentions” on earnings calls could be the culprit. We don’t know. Don’t care. Just happy the stock is there.

In 2025 the company was busy beating its own forecasts while spending less capital than it had budgeted. Management methodically trimmed its per-unit operating costs every single quarter. This point bears mentioning. Return on invested capital. It matters. A lot.

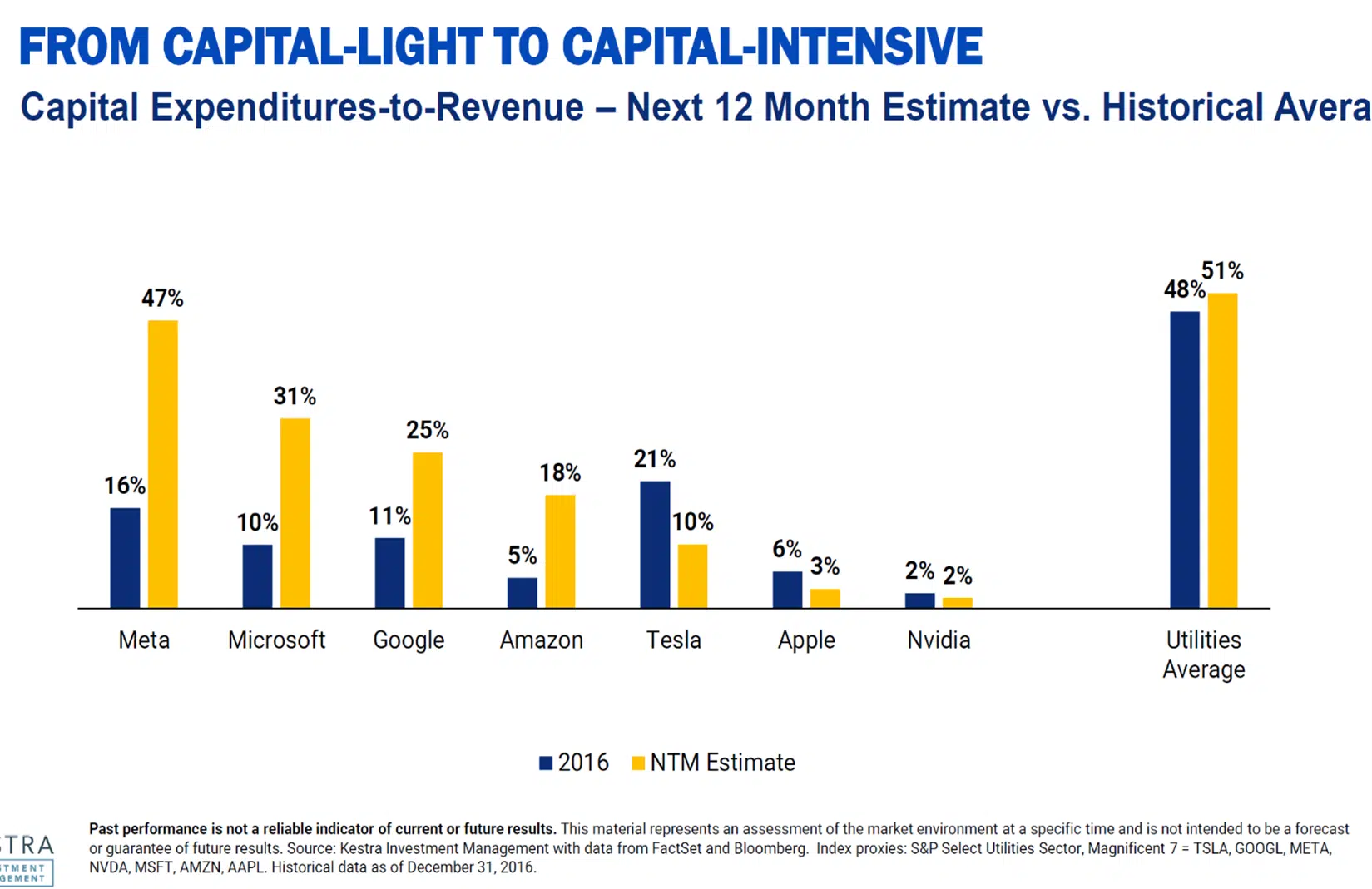

As our friends at Kestra Investment Management show, the explosive growth in spending by big tech is starting to make them look like Utilities. Unfortunately, unlike Utilities, these tech stocks lack even a fraction of the visibility into end demand.

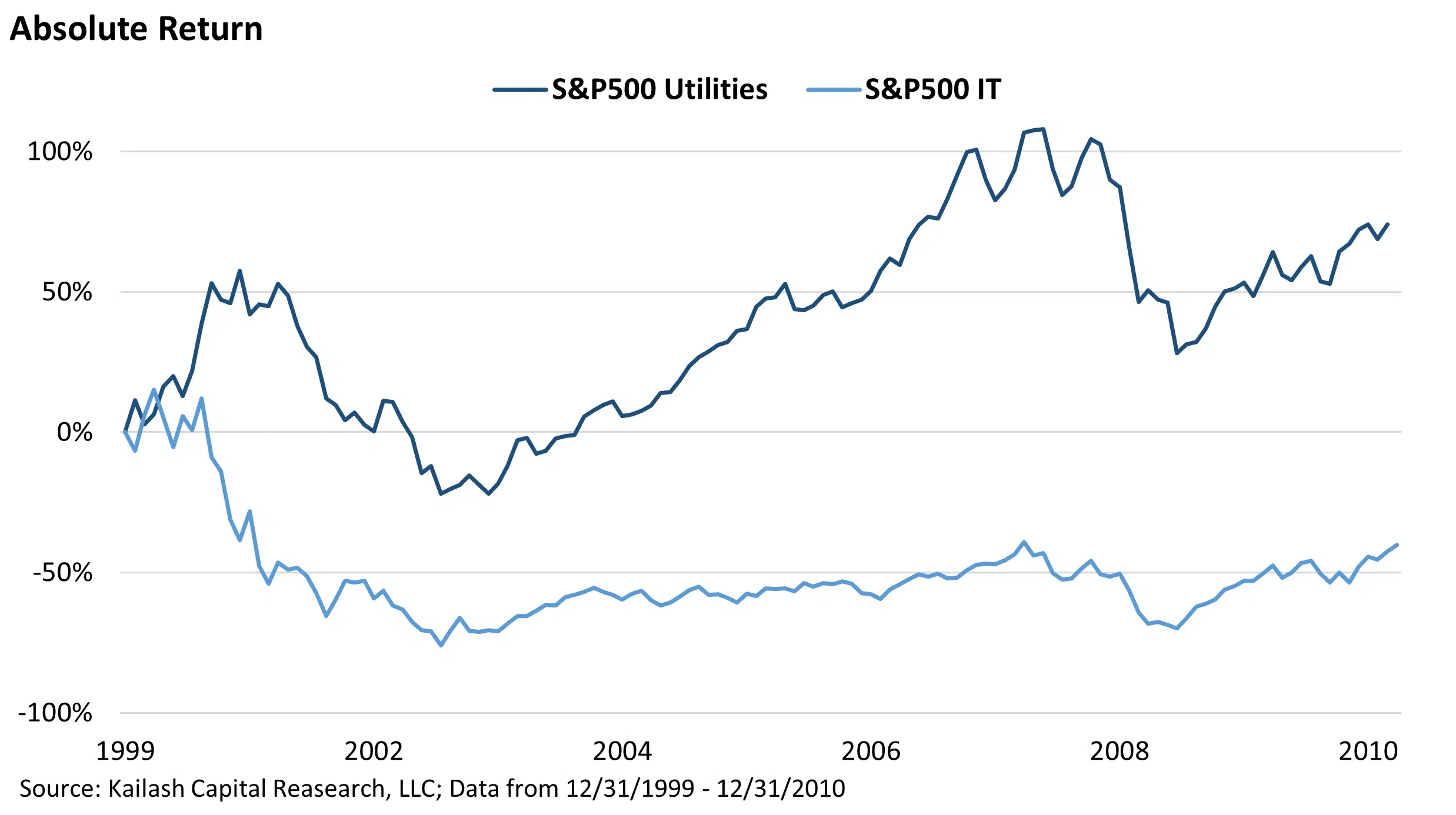

Could big tech be a worse bet over the next decade than boring old Utilities? Again. Don’t know. Don’t care….but last time tech got this expensive, this is what happened:

To us the stock on the following pages reminds us a lot of what tech stocks looked like back in 2010 – 2017. Capital lite. Cheap. Cash-flow rich. Repurchasing piles of cheap stock and paying investors significant dividends along the way.

What makes the setup especially tantalizing is the math on the upside: despite class leading efficiency, productivity, and operating acumen, the company has a collection of powerful internal levers it can pull to create tremendous value the market seems too busy to recognize. Thirty percent upside requires a basic application of algebra.

After writing the note, we were tempted to call the management team and ask the most important question we ever learned to ask about cheap stocks, running higher, with many ways to amplify returns: what can go right?

Please keep reading below for a deep dive into Devon Energy Corporation (DVN).

Disclaimer

The information, data, analyses, and opinions presented herein (a) do not constitute investment advice, (b) are provided solely for informational purposes and therefore are not, individually or collectively, an offer to buy or sell a security, (c) are not warranted to be correct, complete or accurate, and (d) are subject to change without notice. Kailash Capital Research, LLC and its affiliates (collectively, “KCR”) shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced or retransmitted in any manner without the prior written consent of KCR. In preparing the information, data, analyses, and opinions presented herein, KCR has obtained data, statistics, and information from sources it believes to be reliable. KCR, however, does not perform an audit or seek independent verification of any of the data, statistics, and information it receives. KCR and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before engaging in any transaction.

Nothing herein shall limit or restrict the right of affiliates of KCR to perform investment management or advisory services for any other persons or entities. Furthermore, nothing herein shall limit or restrict affiliates of KCR from buying, selling, or trading securities or other investments for their own accounts or for the accounts of their clients. Affiliates of KCR may at any time have, acquire, increase, decrease, or dispose of the securities or other investments referenced in this publication. KCR shall have no obligation to recommend securities or investments in this publication as a result of its affiliates’ investment activities for their own accounts or for the accounts of their clients.

© 2026 Kailash Capital Research, LLC – All rights reserved.

February 20, 2026 |

| Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin

February 20, 2026

Authors: Matthew Malgari, Nathan Przybylo, Dr. Sanjeev Bhojraj and John Durkin